Greenback Rallies Versus Safe Haven Currencies

The U.S. dollar gained against the safe haven currencies, and climbed against the euro during the early hours on Monday as risk appetite remained subdued due to the fact that the sell-off of currencies from the emerging markets continued for a second week. Investors are concerned that a slowdown for China’s economy may influence the Federal Reserve’s decision to cut stimulus even further. Analysts anticipate that the U.S. dollar may still appeal to speculators this week, especially as the central bank begins its two-day policy meeting. Economists are forecasting that the economy may post a drop of 1.4 percent in growth for the last quarter of 2014 while personal consumption may reveal a decline. However, all eyes will be on the FOMC, and the last statements Mr. Ben Bernanke will issue before Janet Yellen takes over as the head of the Federal Reserve. Gold Prices retreated from a nine-week-high on Monday as the markets showed slight stability following the big sell-off in equities and currencies from the emerging markets. Futures for delivery in April surged to $1,279.20 a troy ounce on the Comex.

The euro traded lower against the U.S. dollar as speculators anticipate that the Federal Reserve could announce another $10 billion cut in the monthly bond purchases. But the shared currency managed to rally against the yen following positive data on German Business Confidence. The european Central Bank indicated that the overnight interest rates rose above the ECB’s key cash rate, despite the fact that policy makers stated that the time was not right to trim stimulus. Officials are scheduled to meet in Frankfurt on February 6th at which time they plan to discuss whether the current tight financial conditions could warrant a chance in policy. Mario Draghi, the President of the central bank, spoke to business leaders and politicians at the european Economic Forum in Davos, Switzerland; in his comments he suggested that policy makers will only act if they notice an unwarranted hike in the money-market rates, since they can have a negative impact on expenses for corporations and private households. The British pound came close to a 2½ year-high in anticipation of this week’s news which is expected to show another quarter of growth for the U.K.’s economy. The Swiss Franc advanced against the U.S. dollar as the sell-off in the emerging markets benefitted harbor currencies.

The yen extended a hike subsequent to a drop in Asian Index Futures. But its gains were capped by an announcement revealing that the country’s Trade Deficit widened to a record high, another factor that contributed to a 2.51 percent fall on the Nikkei. According to Bank of Japan officials, the increase in trade shortfall was prompted by the slowdown in exports and a drop in competitiveness among Japanese businesses.

Lastly, in the South Pacific, the Australian dollar retreated from a three-year low against the U.S. monetary unit but remained sensitive to worries over the outlook for China’s economy. Trading specialists anticipate that the Aussie could continue to trade to the downside, especially after China issued weak data on Manufacturing. New Zealand’s dollar on the other hand climbed versus the greenback on the likelihood that the Reserve Bank may raise the interest rate.

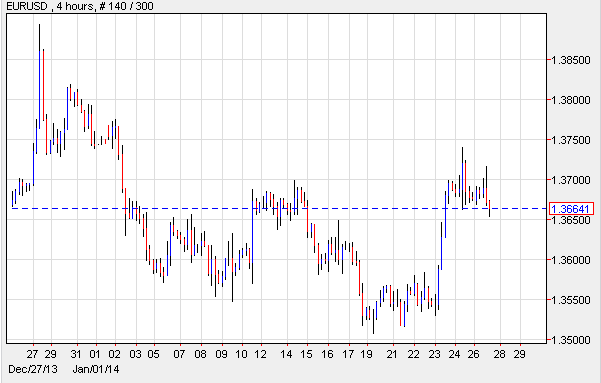

EUR/USD: German Business Confidence Up

The EUR/USD slipped to a session low as the markets anticipate another reduction in the Federal Reserve’s stimulus program. Meanwhile in the E.U., the head of the region’s Finance Ministers, Jeroen Dijsselbloem, indicated that the E.U.’s economic recovery is not sensitive to influences by a slowdown in the emerging markets. On the data front, the German IFO Institute announced that Business Confidence rallied to 110.6, beating forecasts for a surge to 110. The EUR/USD pair was supported by an optimistic outlook led by positive metrics out of the region’s biggest economy.

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

EUR/USD 4 Hour Chart" title="EUR/USD 4 Hour Chart" width="474" height="242">

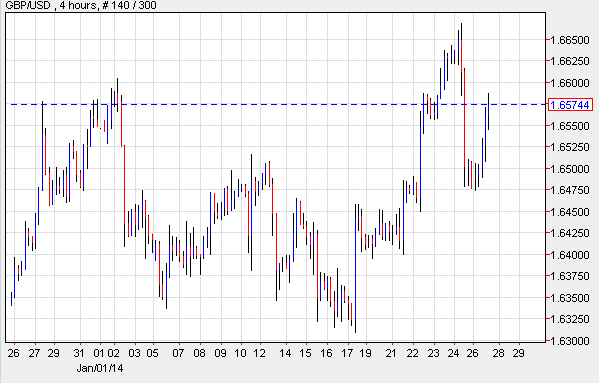

GBP/USD: Great Expectations For GDP

The GBP/USD advanced aggressively over the past few days, especially after the U.K. reported a drop in the rate of unemployment; and it’s expected to continue advancing this week as analysts predict the economy will show another quarter of positive growth. Recent data has confirmed that the country remains on the road to recovery while consumer confidence is up, a fact represented by Retail Sales figures which posted the best results in close to ten years. Analysts believe the GBP/USD may benefit from speculation over Fed tapering and could continue to advance.

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

GBP/USD 4 Hour Chart" title="GBP/USD 4 Hour Chart" width="474" height="242">

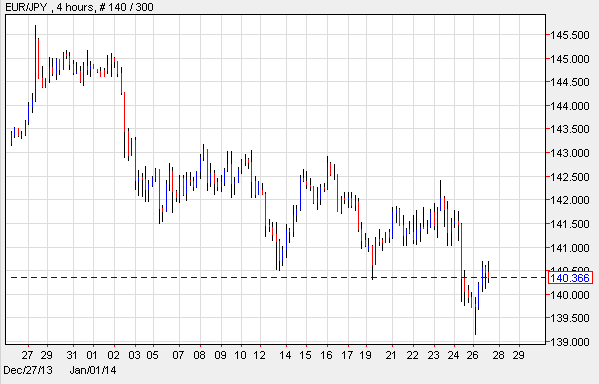

EUR/JPY: German Confidence Boosts Currency

The EUR/JPY advanced following the release of positive data which showed that Business Confidence in Germany surged to a 2½ year high, confirming that the economy has picked up momentum. The Index, which is based on a survey of 7,000 business executives, posted a hike from 109.5 to 110.6. Data out of Japan disappointed investors when it revealed that the Trade Deficit widened due to increasing energy costs. The reports also indicated that imports went up 24.7 percent, while exports dropped from 18.4 to 15.3 percent. The Trade Deficit went to a record 11.5 trillion yen, close to double what it posted in 2012. The yen recouped some of its decline after european stocks dropped to a one-month low on news that the emerging markets are still experiencing a big sell-off of assets, thereby creating greater demand for haven currencies.

EUR/JPY 4 Hour Chart" title="EUR/JPY 4 Hour Chart" width="474" height="242">

EUR/JPY 4 Hour Chart" title="EUR/JPY 4 Hour Chart" width="474" height="242">

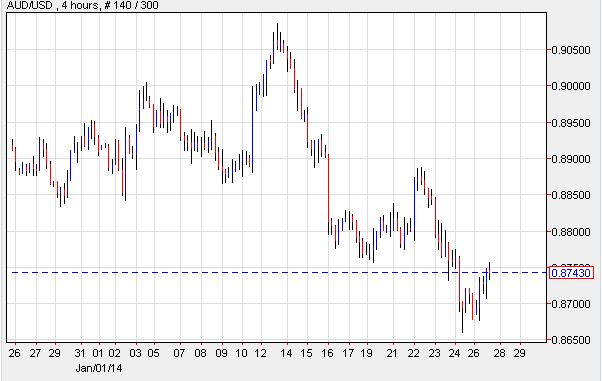

AUD/USD: Aussie Headed For 0.80

On Friday, the AUD/USD slumped to the downside by 0.57 percent following comments by one of the board members of the Reserve Bank who intimated that the Aussie needs to weaken further so that the economy can recoup as the mining industry slows down. The AUD/USD pair is expected to remain sensitive to economic data due out this week on Business Sentiment, but it could continue to drop on concerns over the turmoil in the emerging markets.

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

AUD/USD 4 Hour Chart" title="AUD/USD 4 Hour Chart" width="474" height="242">

Daily Outlook: Today’s economic calendar shows that the U.K. will report on GDP. The U.S. will issue data on Core Durable Goods Orders and Durable Goods Orders, as well as on CB Consumer Confidence and the S &P/CS HPI Composite.