The currency markets were seen mostly ranging yesterday as investors digested the prospects of a rate hike. The lack of any major catalyst saw the markets remain muted ahead of today's ADP payrolls which could shed light on the upcoming official payrolls data on Friday. The U.S. trade balance figures showed the trade deficit rising to a 5-year high in January, accelerating from December's high deficitfigures. It did little to ease the bullish sentiment in the U.S. dollar.

Economists are expecting to see private sector hiring add 184k jobs for February, which is lower than the surprise 246k jobs posted in January. Regardless, the bar for disappointment is quite high, and thus any knee-jerk reaction to a surprisingly bad jobs report is more likely to be faded.

Elsewhere, Germany's industrial production numbers are up ahead while Switzerland's monthly inflation is expected to rise 0.2%.

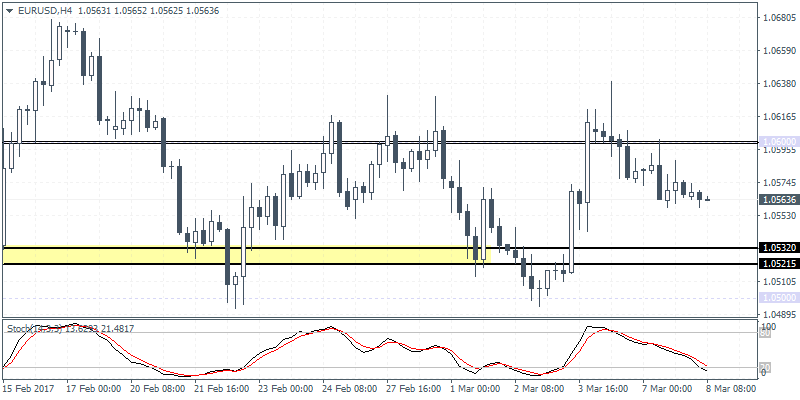

EUR/USD intra-day analysis

EUR/USD (1.0563) was seen retracing the gains made from last Friday with price action likely to test 1.0551 sometime today. Establishing support here could put the bias balanced on both sides, with the scope of a rally that could see 1.0700 being tested while a breach of 1.0551 could trigger a move to 1.0500 at the minimum. EUR/USD is unlikely to make any major moves today ahead of tomorrow's ECB meeting. No changes are expected from the central bank, but the markets are expecting a hint of hawkishness from the central bank.

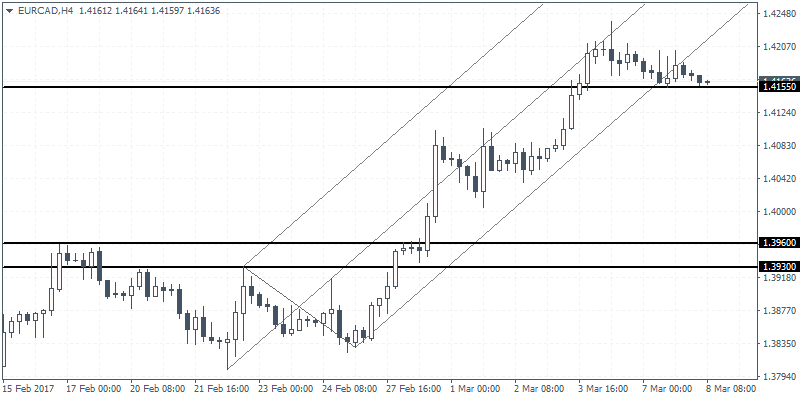

EUR/CAD intra-day analysis

EUR/CAD (1.4163) was bearish yesterday coming off the doji from Monday's session. The apparent weakness in price action comes after the past weeks saw EUR/CAD post steady gains, which pushed the single currency to a two-month high near 1.4229. Technical support is seen at 1.3960 which was breached a few weeks ago, and theprice hasn't retested this level just as yet. Temporary support is seen at 1.4155 which offered a minor bounce to prices. Watch for a break down below 1.4155 which could signal further downside in EUR/CAD towards 1.3960 - 1.3930 support level.

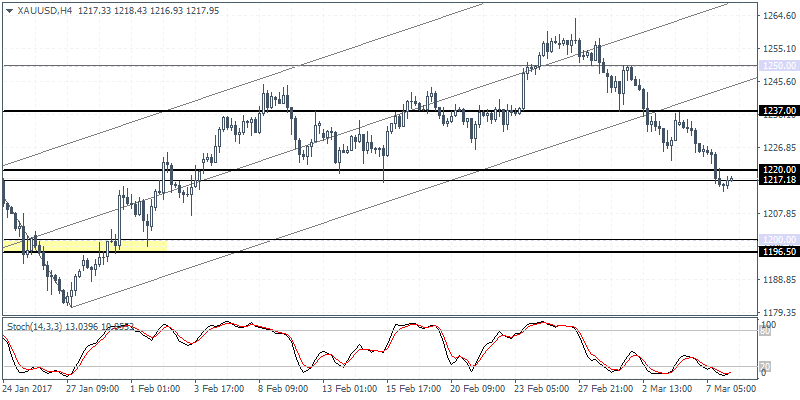

XAU/USD intra-day analysis

XAU/USD (1.2237) Gold prices are attempting to post a recovery following the doji pattern that appeared on the 4-hour time frame near the support, just a few points off 1217 support level. A follow through here could see some moderate bounce that could keep gold prices range bound within 1237 and 1220 - 1217 support level. Ideally, price action could be seen retesting back to the 1237 level where resistance could be established ahead of a dropback to the 1220 - 1217 region.