It’s a critical week for the U.S. dollar: key economic data is on tap this week as well as Wednesday’s FOMC meeting. The U.S. dollar index has crossed below its 55-day moving average for only the second time since February.

The U.S. dollar is on the defensive after failing to take out the key 1.3000 level against the euro last week, despite very ugly German data and the increasing anticipation of a rate cut from the ECB this Thursday. The market is probably fretting that the FOMC won’t change its tune, as US data has been disappointing. Another headwind for the US dollar has come from the remarkable comeback in commodities and equities after all of the recent nervousness.

With the dollar index crossing below the 55-day moving average today - which it has done on one day since early February - it is readily apparent that this is a key pivot week for the greenback. There are plenty of event risks peppered through the week besides Wednesday’s FOMC meeting, as we have the ISM manufacturing on Wednesday, the ISM non-manufacturing on Friday and the April employment report up on Friday as well. Will we get another dissenting voice from the FOMC statement, or any broadening in concerns about the effects of the Fed’s QE on asset markets and the “reach for yield”?

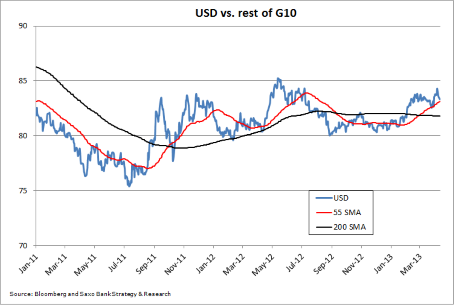

Chart: USD vs. rest of G-10

This is a chart of the USD versus an evenly weighted basket of the rest of the G10 currencies (note that it is NOT the "Dollar Index" or DXY, which is very heavily weighted toward the EUR/USD). The USD is clearly at a near term crossroads here. After sprinting to new highs for the year and since mid-2012, the currency has stumbled and it must pick up the pieces here to get back in rally mode, or it will face a further bout of weakening.

SEK

Sweden’s Retail Sales were very weak in March. The market tried to sell SEK on this, but then the release of the Riksbank minutes had the SEK back higher again. Last Tuesday’s sharp weakening in the SEK on the back of weak employment data has now been unwound. I’m still looking for SEK to weaken again, but there is still some room for consolidation before the bear case is threatened, starting with the critical 8.50 level in the EUR/SEK, which is also right near the 200-day moving average.

Looking ahead

Watch out for data out of Japan tonight. Besides the FOMC meeting this week, we have the ECB meeting, which probably has more potential for actual developments than what we should expect from the FOMC. One widely circulated idea is that the ECB could take a page from the BoE’s playbook, and start some kind of funding for lending scheme. This may be greeted with enthusiasm, and pull the EUR/USD up to test the 1.3200 area if the FOMC doesn’t trigger a USD rally.

Elsewhere, the GBP/USD rally is defying gravity after the strong GDP data last week further squeezed what must be some of the last remaining GBP/USD shorts (although the IMM Data from the US futures market suggests that the market has been unwilling to give up its short positioning), and is busy challenging the bear case if we don’t get a strong reversal soon from the pair. If we end the week above the 1.5410 level broken last week, it may be back to the drawing board on the outlook from here.

The USD/JPY is the other pair to watch, as are JPY crosses in general: 96.75 is an interesting USD/JPY level, as this was the previous high before the attempt to test 100.00 below there. The price action could pick up pace, as we would likely see weak hands who put on longs above the old high flushed out of the market. The Ichimoku daily cloud won’t come in below 94.50 if the JPY gets up to mischief this week.

Stay careful out there.

Economic Data Highlights

- Spain Mar. Adjusted Retail Sales fell -8.9% YoY as expected and vs. -7.6% in Feb.

- Spain Apr. Preliminary CPI out at +1.4% YoY vs. +2.1% expected and vs. +2.4% in Mar.

- Sweden Mar. Retail Sales out at -0.4% MoM and +1.8% YoY vs. +0.2%/+2.3% expected, respectively, and vs. +3.4% YoY in Feb.

- Euro Zone Apr. Economic, Industrial, Consumer Confidence Surveys (0900)

- US Mar. Personal Income and Spending (1230)

- US Mar. PCE Deflator/Core (1230)

- US Mar. Pending Home Sales (1400)

- US Apr. Dallas Fed Manufacturing Activity (1430)

- New Zealand Mar. Building Permits (2245)

- UK Apr. GfK Consumer Confidence (2301)

- Japan Apr. Markit/JMMA Manufacturing PMI (2315)

- Japan Mar. Overall Household Spending (2330)

- Japan Mar. Jobless Rate (2350)

- Japan Mar. Industrial Production (2350)

- Japan Mar. Retail Trade (2350)

- New Zealand Apr. ANZ Business Confidence / Activity Outlook (0100)

- Japan Mar. Housing Starts (0500)