Equities and commodities have fallen this morning following news that eurozone finance ministers have failed to reach agreement on a new bailout deal for Greece. The EURUSD closed at $1.33 yesterday, but is now down to $1.325 in trading this morning.

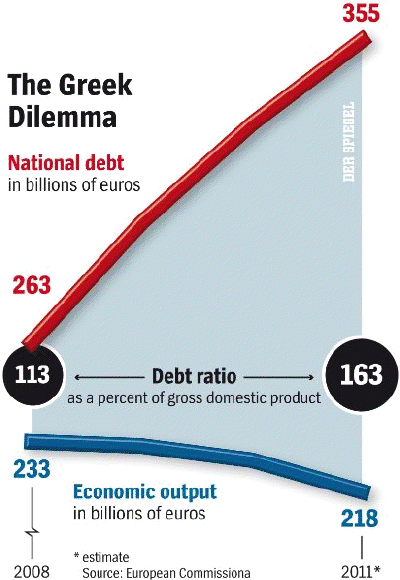

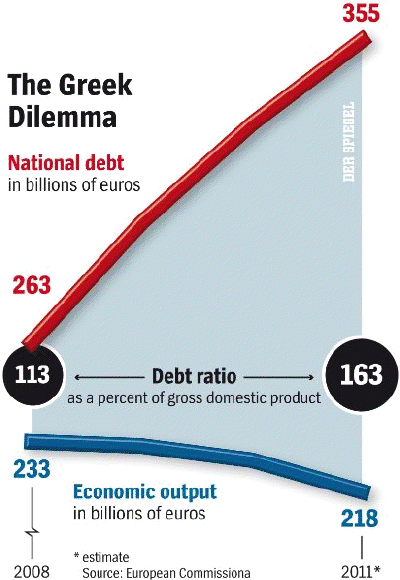

As Reuters reports, Greece’s financial backers are demanding that the Greek government pass a new austerity bill this weekend and identify a further 325 million euros of spending cuts by next Wednesday. Greek workers are on strike today in protest at the austerity measures. The chart below from Der Spiegel sums up the desperation of the Greek situation better than any more words on the subject.

With the dollar rising this morning gold and silver prices have fallen back a little from key chart resistance levels. Gold remains stuck in a trading range between $1,710 and $1,750, with silver trading between $33.25 and $34.25.

Speculation is growing about the size of the next “long-term refinancing operation” (LTRO) from the European Central Bank, scheduled for February 29. Some are predicting that the ECB could lend as much as 1 trillion euros to Europe’s banks. Though this a gross figure that doesn’t account for reductions in shorter-term ECB loans to banks that this operation entails, this could still mean a 350bn euro increase in net ECB open market lending.

On top of this, managers of the world’s biggest bond fund – the PIMCO Total Return Fund – has borrowed a record $88bn in order to buy American mortgage backed securities. As ZeroHedge argues, this is being done in the expectation that the Federal Reserve will shortly announce more quantitative easing – to complement the coming ECB LTRO, and yesterday’s announcement of £50bn more of QE from the Bank of England. This will please the stock markets no end, and is also bullish for precious metals and the wider commodity complex.

"I don't know where the stock market is going, but I will say this, that if it continues higher, this will do more to stimulate the economy than anything we've been talking about today or anything anybody else was talking about."

As Reuters reports, Greece’s financial backers are demanding that the Greek government pass a new austerity bill this weekend and identify a further 325 million euros of spending cuts by next Wednesday. Greek workers are on strike today in protest at the austerity measures. The chart below from Der Spiegel sums up the desperation of the Greek situation better than any more words on the subject.

With the dollar rising this morning gold and silver prices have fallen back a little from key chart resistance levels. Gold remains stuck in a trading range between $1,710 and $1,750, with silver trading between $33.25 and $34.25.

Speculation is growing about the size of the next “long-term refinancing operation” (LTRO) from the European Central Bank, scheduled for February 29. Some are predicting that the ECB could lend as much as 1 trillion euros to Europe’s banks. Though this a gross figure that doesn’t account for reductions in shorter-term ECB loans to banks that this operation entails, this could still mean a 350bn euro increase in net ECB open market lending.

On top of this, managers of the world’s biggest bond fund – the PIMCO Total Return Fund – has borrowed a record $88bn in order to buy American mortgage backed securities. As ZeroHedge argues, this is being done in the expectation that the Federal Reserve will shortly announce more quantitative easing – to complement the coming ECB LTRO, and yesterday’s announcement of £50bn more of QE from the Bank of England. This will please the stock markets no end, and is also bullish for precious metals and the wider commodity complex.

"I don't know where the stock market is going, but I will say this, that if it continues higher, this will do more to stimulate the economy than anything we've been talking about today or anything anybody else was talking about."