Another deadline passed in Greece yesterday without an agreement and the market must once again take another trip on the interminable merry-go-round of broken promises, incompetent politicians and self-serving rumours. The Greek political class are too scared of losing their jobs to vote through the further austerity measures and the EU/ECB/IMF troika won’t play ball until further efficiencies are found, intransigence thy name is Greece.

A meeting between Greek politicians is due today and following some harsh words from both Merkel and Sarkozy as to the lack of progress, the technocratic PM Lucas Papademos may have to crack some heads together to get an agreement. Strike action is planned in Greece today as well; expect Syntagma Square to focus in news broadcasts and trouble to flare.

The market reaction has been limited with the euro gaining against both GBP and USD yesterday. There are 2 possible reasons for this: firstly that all the bad news about a default is priced in and still the euro remains strong or none of the news is priced in and that’s why the euro remains strong. Either way it seems that once a plan is announced it will be to the single currency’s benefit. The fact that another leg of the ECB’s LTRO liquidity plan is due to be launched at the end of the month will also keep the euro supported from a risk point of view. This all fits in with our belief that the euro is not due some massive sell-off anytime soon.

Risky assets have sold off in Asia overnight as the Reserve Bank of Australia decided to keep rates at 4.25% when a vast sway of the market expected a 25bps cut. Aussie dollar has flown as a result and touched a 27yr high against GBP in the immediate aftermath of the decision. Obviously the central bank is happier than most about the progression of the Australian economy, possibly as a result of the strong GDP numbers from China earlier in the year, but the decision has come in for criticism from retailers and exporters already. The market may want to see AUD move to a post-float high versus USD (1.1081) soon, especially if the global risk profile increases to support such a shift.

With a lack of tier 1 data today it will be Greece that keeps investors and traders busy over the course of the European session. Much like yesterday we expect the main pairs (GBPUSD, GBPEUR, EURUSD and USDJPY) to remain trading in their pre-determined ranges with possible euro strength should a positive announcement be forthcoming. We also have bond auctions from the Netherlands and UK at 09.00 and 10.00 GMT respectively.

The only data of note will be this morning’s Industrial Production numbers from Germany. They are expected to remain flat versus the previous month following an unexpected decline in December.

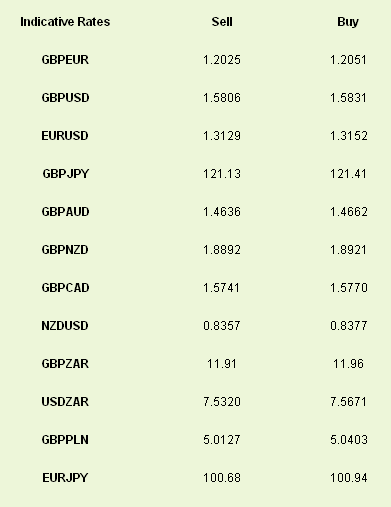

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greek Deal Still a Piece of Mythology

Published 02/07/2012, 06:08 AM

Updated 07/09/2023, 06:31 AM

Greek Deal Still a Piece of Mythology

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.