It had all gone quiet on the Greek front for a couple of days and with UK GDP and the Fed meeting on Wednesday it would have been easy to forget the debt negotiations going on Greece. Rumours that a deal had been struck between authorities and hedge funds invested in Greek debt kept the euro elevated yesterday although the rumours do strike us as a bit fishy.

The rumours came from a Greek newspaper that the private investors are willing to take a lower interest rate of 3.75 per cent on the bond they will receive in exchange for their existing holdings. The one proviso that nobody is really willing to talk about however is that while thousands of investors will be taking a 70% haircut on its Greek debt holdings, one of the largest holders (the ECB) says it doesn’t want to, and expects to be repaid in full. From this, two things are obvious; firstly some bonds are more equal than others and secondly, this is by no means resolved. We would expect risk to trade lower through today’s session.

With the spotlight still on Europe the situation in Portugal is getting a lot of headlines in market circles, elsewhere there has not been a peep. Bond yields on Portuguese debt on a 10yr term are starting to rise towards the 15% level. Now they were at this level in August but the situation between then and now is drastically different due to the ECB’s liquidity operations. If a country is unable to fund itself close to sustainable levels with the LTRO in force then it really is in trouble. A second bailout is looking rather inevitable at the moment.

Today will be very much like a non-farm Friday with trade likely quiet until the US GDP reading for the 4th quarter. It is expected to grow at 3% on an annualised basis (0.75% on a QoQ basis). There is a broad split in the market as to whether a good GDP number would help or hurt the US dollar. We think that risk would remain bid and therefore a good figure is likely to hurt dollar through the afternoon session. The release is due at 13.30 and we are sub-consensus in expecting a number of 2.8%.

Consumer confidence from the University of Michigan is also due at 14.55 and we expect it to continue its 5 month run of improving sentiment.

So, GBP/EUR is likely to remain in the 1.1930 to 1.2030 range that it has been operating in for the past couple of days while GBPUSD looks overstretched at current prices and we are looking for it trade back into the 1.55s over the coming sessions.

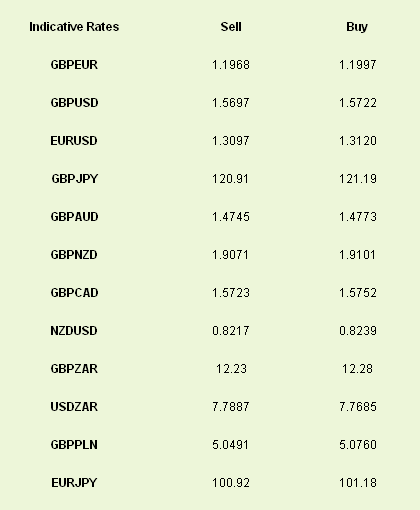

Latest exchange rates at time of writing

The rumours came from a Greek newspaper that the private investors are willing to take a lower interest rate of 3.75 per cent on the bond they will receive in exchange for their existing holdings. The one proviso that nobody is really willing to talk about however is that while thousands of investors will be taking a 70% haircut on its Greek debt holdings, one of the largest holders (the ECB) says it doesn’t want to, and expects to be repaid in full. From this, two things are obvious; firstly some bonds are more equal than others and secondly, this is by no means resolved. We would expect risk to trade lower through today’s session.

With the spotlight still on Europe the situation in Portugal is getting a lot of headlines in market circles, elsewhere there has not been a peep. Bond yields on Portuguese debt on a 10yr term are starting to rise towards the 15% level. Now they were at this level in August but the situation between then and now is drastically different due to the ECB’s liquidity operations. If a country is unable to fund itself close to sustainable levels with the LTRO in force then it really is in trouble. A second bailout is looking rather inevitable at the moment.

Today will be very much like a non-farm Friday with trade likely quiet until the US GDP reading for the 4th quarter. It is expected to grow at 3% on an annualised basis (0.75% on a QoQ basis). There is a broad split in the market as to whether a good GDP number would help or hurt the US dollar. We think that risk would remain bid and therefore a good figure is likely to hurt dollar through the afternoon session. The release is due at 13.30 and we are sub-consensus in expecting a number of 2.8%.

Consumer confidence from the University of Michigan is also due at 14.55 and we expect it to continue its 5 month run of improving sentiment.

So, GBP/EUR is likely to remain in the 1.1930 to 1.2030 range that it has been operating in for the past couple of days while GBPUSD looks overstretched at current prices and we are looking for it trade back into the 1.55s over the coming sessions.

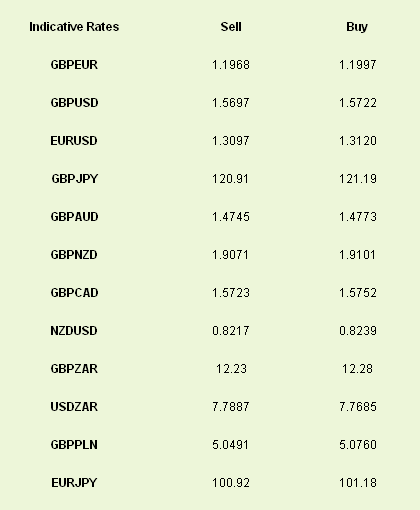

Latest exchange rates at time of writing