• While waiting for the Greek election on 17 June, we are likely to see continued uncertainty and stress in the markets. Things will get worse before they get better.

• Amid this uncertainty, Greek citizens are likely to withdraw more money from banks, which could escalate into a real bank run.

• A major game of chicken has started between the EU and Greek politicians.

• The EU is likely to stand firm on its demands for Greece to deliver austerity while giving just a few concessions. Rhetoric from the left-coalition party Syriza is likely to continue to be fiercely EU-negative as it aims to gather strength.

Election Scenarios

• We are in for a long period of uncertainty but believe that, ultimately, a deal will be struck between the EU/IMF and Greece that keeps Greece in the euro while austerity remains. The alternative is too severe for both the EU and Greece to contemplate.

• We expect the policy response from the ECB to depend on the level of stress and response from political leaders. We do not expect any response besides verbal support this side of the election. In a scenario with widespread contagion, the ECB is likely to announce further -- and possibly longer -- matured LTROs and the Securities Market Program (SMP) might be revived. If the PMIs deteriorate further, we believe a summer cut by the ECB is likely.

Pre-Election:

Greek Bank RunTension in Greece is likely to remain very high in the short term and it could be quite a long period before we know who will form a new government and what their true stance toward the EU will be. The election is scheduled for 17 June, but it will take time after that to form a government.

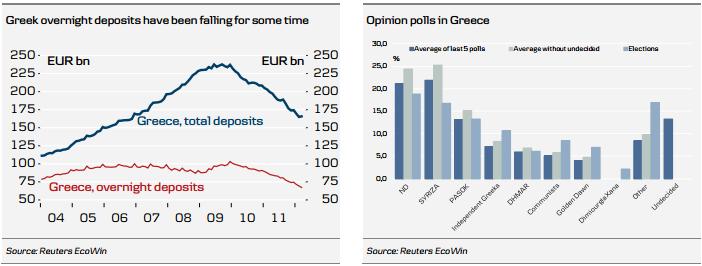

A key risk in the meantime is a rising withdrawal of bank deposits that culminates in a bank run. That a bank run has been frequently mentioned in the press only adds to the risk that it could heighten. The dynamics of a run is exponential. Once you start seeing other people pull money out, you want to do the same and suddenly the slow withdrawal of deposits can quickly escalate into a run.

Unfortunately we have no good, real-time data on bank deposits. The only data we have for is monthly ECB data, which is published on a one-month lag. A figure of EUR700m of withdrawals in one day circulated in the media and came from a transcript of the Greek president’s meeting with party leaders on 14 May. The number was given to the president by central-bank head Geroge Provopoulos and the president apparently used it to underline the seriousness of the situation to party leaders.

Total, deposits in Greece are around EUR165bn. There has been a gradual withdrawal of deposits over the past few years and deposits are 30% below the peak in 2009. However, this has happened in a gradual fasion. The risk is now that it accelerates.

Further Spread Widening In Spain And Italy

The uncertainty surrounding Greece is compounded by negative news about the Spanish banking sector, which has also added upward pressure on Spanish bonds. General contagion has put pressure on Italy as well.

It is hard to see what will turn this around in the short term, as uncertainty about Greece continues. Downgrades of Italian and Spanish banks from Moody’s also fuelled the risk-off.

We thus expect things in Spain and Italy to get worse in the short term and we may see 7% yield levels before long.

Germany To Greece: Stick To The Plan

German Finance Minister Wolfgang Schauble said Wednesday that Greek voters must decide for themselves whether they are willing to accept the terms of the bail-out program. It would not be possible for Greece to stay in the euro and suspend payments to its partners, he said in a radio interview. "Now it is up to Greece to take that decision."

It seems clear that the EU and Germany in particular will make it absolutely clear to Greek voters and politicians that the election will be about whether Greece wants to stay in the euro. If it does, it has to abide by the bail-out program.

On the other hand, we have Syriza, the new popular left-wing coalition party in Greece, standing very strong on a renegotiation of the bail out. Its leader, Alexis Tsipras, said his party would not "betray the hopes and expectations of voters who rejected the bailout."

Hence, we seem to be destined for a major game of chicken with both the EU and Greece standing very firm. Greece is betting on the EU giving in and changing the bailout program, while the EU warns Greece it'll be on its own if it rejects the bailout program. Although it has no legal measures to use to expel Greece, the EU could stop lending money and the ECB could refuse to accept Greek bonds as eligible collateral. That would, in effect, bnkrupt Greece and its banks, a move that would presage the country's euro exit.

Germany Meeting France On Growth Measures

We have seen some division between the German austerity stance and the new French president François Hollande’s focus on growth. However, in times of significant stress, France and Germany have traditionally put disagreements in the background and stood united in the fight for the euro.

We also saw signs of this after the first meeting between German chancellor Angela Merkel and François Hollande. At the press conference they said "growth measures will be considered" and hinted that measures to help Greek growth could be implemented. That's likely to be the message moving forward. Greece could be offered growth measures to support its economy but it will have to live up to the bail-out program.

Post-Election:

The sharp rhetoric is unlikely to change on this side of the election, so uncertainty is likely to be very high. However, what happens after the election? As we see it, there are three scenarios for Greece: positive, negative and very negative.

1. In the positive scenario, the euro-pro and austerity committed parties (mainly ND and PASOK) win increasing public support as we get closer to the election and ultimately win the votes needed (possibly supported by Dimar) to continue implementing the program. This scenario would trigger a relief rally.

2. In the negative scenario, Syriza becomes the main party following the election. Despite its verbal resistance to the EU/IMF program, it is likely to ‘calm down’ on the other side of the election. At the same time, the EU gives in and gives Greece an extra year to reach the program targets and engage insignificant EU-funded investment projects in Greece.

Hence, both Syriza and the political leaders in core countries go out of their way to meet each other. This process would take some time following the election and it would, once again, feel as though we are looking down the abyss. Eventually, the leaders find a solution as the alternative would have severe negative impact on both Greece and the rest of the euro countries. This scenario is likely to result in a long period of market stress but ultimately lead to a relief in global financial markets.

3. In the very negative scenario, the game of chicken between Syriza and the EU/IMF gets out of control and ends with no agreement. The EU/IMF stop support for Greece and the ECB no longer accepts Greek bonds as collateral. Greece effectively has to undergo the fiscal adjustment overnight. There is a severe run on Greek banks. Greece defaults on its remaining public debt. Initially, there is confusion on whether Greece introduces a new currency or just sticks with the euro. The government issues IOUs to pay off public workers.

After some time, the government could consider reintroducing the drachma but, at this stage, any conversation about deposits is close to irrelevant, as the capital flight has been severe. The introduction of a new currency would take some time. This scenario would result in initial market chaos. Also, Spain and Italy are likely to come under pressure. The policy response from both the political leaders and the central banks is likely to be significant. However, there is a risk that this would not be enough to calm investors after the initial mayhem and that we could be in for Lehman-Brothers-like stress in the markets.

We do not expect Greece to leave the euro. Note that there is wide backing among the Greek population (81% in favour in the latest poll) and 54% of the Greek population is in favour of sticking to the EU/IMF program. The most recent polls suggest it is 50-50 between Syriza and ND as to which party will take the election. We do not expect a ‘Grexit’ but acknowledge that the risk is real.

What Would Trigger A Policy Response?

As mentioned above, the political leaders are narrowing in on what form the growth compact should take and we are likely to get some more color on this as soon as Wednesday from the informal EU Summit for heads of states and governments.

We expect the ECB to hold off any further stimuli until the political leaders have delivered their part. However, ultimately, market stress could force an ECB response. Despite the recent increase, we are not there yet. If Spanish and Italian 10-year yields climb above 7% and stress also increases substantially in credit markets, we expect the ECB to announce a new round of LTROs to ensure sufficient liquidity in the system. This

could also help support peripheral sovereign bonds. If this is not enough to calm the market, the maturity could be increased further and the SMP could be revived to support markets in times of severe stress.

A summer rate cut could materialise if the PMIs continue to deteriorate and other leading indicators begin to signal a euro area double dip, which is not our expectation.

China To Give Support To Macro Picture On May Data

On top of the stress about Greece and Spain, markets have recently been weighed down by negative growth data out of China. Data for industrial production and loan flows disappointed sharply in April and raised fears of a hard landing.

However, we feel quite confident that this relates mostly to calendar effects, as there were less working days in April this yea.

Hence, we do not see a change to the still -- as we see it -- favourable macro backdrop. China is expected to show a rebound in the May data as the calendar effect disappears. The U.S. economy is also doing well, with a string of strong releases lately. Even the euro area actually surprised on the upside by steering clear of recession, as GDP was flat in Q1.

While this will not help much in the short run as it will be some time until we get the May data for China, the data is likely to give some support when it is released in mid-June.