"Within every great crisis, lies a great opportunity"

This statement holds true for this occasion as well, and here are a few assets to pay close attention to after the situation in Greece blows over.

German DAX

Over the last three months, the DAX has dropped a whopping 14% in value, almost completely erasing its meteoric rise in the beginning of the year.

Once a resolution is reached in either direction, the markets will stabilize and the European markets will remain an attractive option for investors, as the ECB has committed to phase one of QE till at least the middle of 2016.

The German markets have taken the biggest hit, and stand the most to gain post Greece.

Swiss Franc

The CHF is the most overvalued currency right now, and is being held up because of the volatility that's taking place in the markets at the moment. The SNB is clearly not comfortable with the current levels of their currency, and are intervening in the forex markets to actively lower the franc.

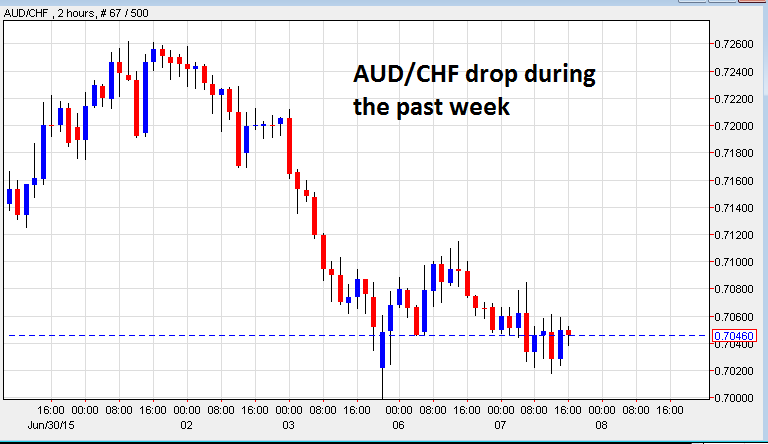

As soon as signs of a resolution in the Eurozone will start being felt, the CHF should start a swift decline, and we will have great buying opportunities on EUR/CHF and AUD/CHF, as investors regain their appetite for riskier currencies.