There is to be no coalition deal in Greece according to the nation’s politicians and Greece will now head for a second round of elections in mid-June. We’re not sure who believed there would ever be a coalition deal, but someone must have been threatening to do so because EUR took another clobbering when no deal was found.

We know from recent polling that around 70% of Greeks wish to stay in the Eurozone although this seems to be lazy polling. I’m sure they want to stay in the Eurozone but nobody has asked the crucial question; ‘at what cost?’ The promise of no more austerity has been broken to the Greek people; they can have the euro but does the pain match the reward? That’s the question that they should be asking on June 10th. Needless to say, pressure on global financial markets will only increase in the meantime.

Where this euro bounces back is anybody’s guess, we’ve been looking for a squeeze on the those short the euro for nearly 3 big figures in EURUSD and it has not been forthcoming. We are less than 0.5% away from the lows seen in January before we saw that bounce back following the French sovereign downgrade.

One side effect of this EURUSD slump has been to see GBPUSD through 1.60 in 4 weeks. The relationship behind dollar moves is now back to that “flight to safety” dynamic and further bad news from the Eurozone, or indeed anywhere, will see further flows into the greenback. The magnitude of the GBPUSD move is obviously less than that of the move in EURUSD and hence we are seeing fresh 3.5yr highs in GBPEUR this morning.

Similar pressures are being seen in the bond markets with Spain’s 10yr bond now over 6.5% and Italy’s above 6% both for the first time since December and the first LTRO liquidity operation from the ECB that calmed everybody’s nerves. We are getting close to the levels that the ECB decided to buy Italian debt through its SMP program in order to depress yields; some will be betting that they bite that bullet again in order to give the periphery some breathing space.

Amidst all this, we have the Bank of England’s quarterly inflation report which is set to show us that inflation is likely to remain high and growth low. This comes only a week after the Bank decided to halt the asset purchase program; extraordinary measures to keep the UK economy going. We may find out today that growth may have to take a back seat in the coming months to fighting inflation although if the Bank of England believes that Greece is bound for the abyss then we will see a bumper increase in QE. They start speaking at 10.30.

Before that, in this economic day of woe, we have UK unemployment at 09.30 with the unemployment rate scheduled to increase to 8.4%.

Today is definitely a day for the tin hat.

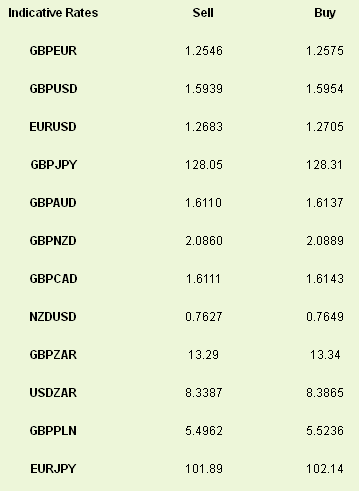

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greece To Go Back To Polls, EUR/USD Hammers Lower

Published 05/16/2012, 07:49 AM

Updated 07/09/2023, 06:31 AM

Greece To Go Back To Polls, EUR/USD Hammers Lower

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.