Greece trap

The lack of a Greek deal is continuing to weigh on the euro as we open up this Monday morning. Talks in Brussels yesterday ended quickly and with little progress made and so focus must now shift to Thursday’s Eurogroup meeting. Pensions remain the sticking point, with a Greek government official saying yesterday that further cuts to pensions will not be accepted. As we reported last week, the IMF does not believe the numbers work without significant changes to the pension system in Greece. That is the ballgame, and with just over a fortnight to go, there is little hope for much of a deal.

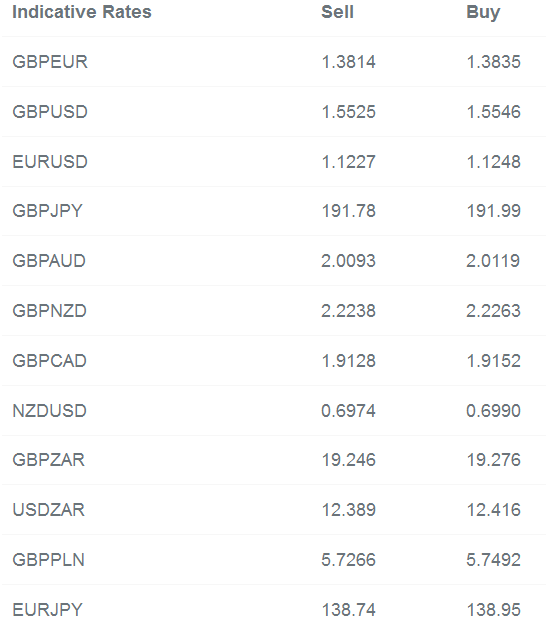

On that basis, we must remain negative on the euro across the board in the short term and the single currency will pitch and yaw more on thoughts and comments on the Greek situation than from a quiet European data calendar. Traders will be looking for progress towards 1.10 in EURUSD and GBPEUR back above 1.40 before long.

Comments from German Finance Minister Wolfgang Schaeuble that he is “ready to accept a Greek exit from the euro” have further helped the single currency lower.

Thank God for Greece though, as without it, I would have little to write about. Summer markets – low liquidity and unpredictable price action – will start in the coming few weeks. For now Greece is the headline act.

Kiwi in the crosshairs

Elsewhere, trends from last week are still very much in force. Fresh off a near 3% decline on a trade weighted basis last week, New Zealand dollar is still in the firing line. Last week’s declines for NZD marked the eighth consecutive week of declines for the currency with speculators lining up to take it only lower.

RBNZ Governor Wheeler signalled last week that another cut may be forthcoming in the coming year and we can see swaps signalling 35bps of further cuts in the next 12 months. On that basis, alongside the resurgence of the USD and the weakness from China we have to be marking NZD lower through the remainder of 2015.

Dollar running higher

For today’s session we have to be looking for additional US dollar strength. Friday’s producer price inflation numbers were solid, and alongside the latest consumer sentiment numbers give further credence to a normalisation of economic conditions in the US in the coming months. We look for today’s industrial production reading to also benefit the dollar.