The weekend was full of fast-moving news regarding Greece. Some of the news was good and some was not so hopeful. As the weekend went on and the Eurozone continued to play hard ball, it was clear Greece recognized they had to blink first or completely go belly up. The Eurozone leaders knew they had somewhat of the upper hand and refused to blink. Good for them. Bad behavior should never be rewarded. The people of Greece were held hostage to that bad behavior. It’s not hard to feel bad for them, but in the end, they were also without much of a good choice. It's not etched in stone yet, but it appears Greece sees no alternative but to accept what the Eurozone is offering. If that is the case, then we can close the books on a wild few weeks of volatility based on every piece of news that comes our way.

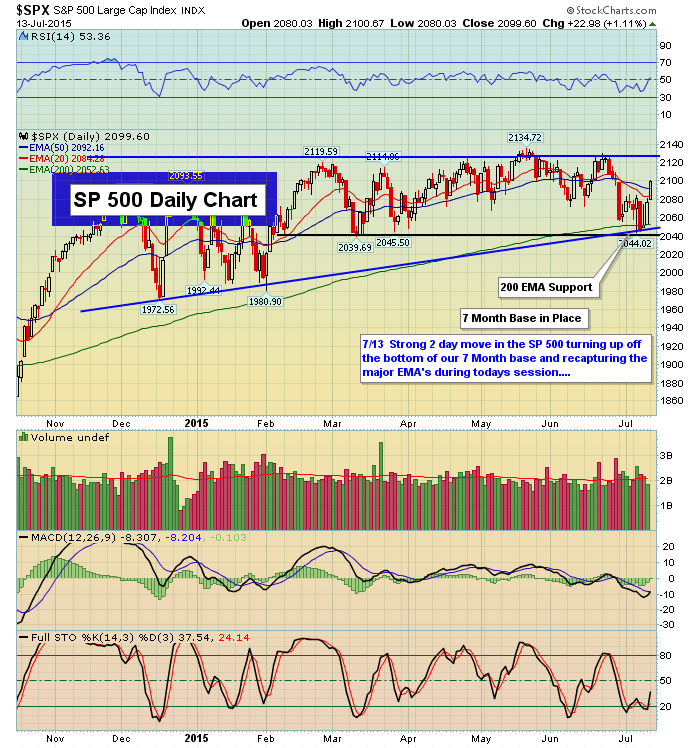

Unfortunately, all of this nonsense did nothing to break us up and out or down and out. Hard to believe we're still in the range between 2040 at the bottom and 2134 at the top. There were so many moments during this crisis when it appeared the market was done. There’s no way it would survive holding above 2040. No different than when we were at the top near 2134. It seemed a lock we'd break out. So the Greece situation is, hopefully, settled, and we're still between 2040 and 2134. Buckle up for the ride to nowhere until, of course, we are already there. Both levels seem so unbreakable right now. I don't know what will help the market make a move out of the range, but, for now, even Greece couldn't get it done, when the news was either bad or good. Take a breath and adjust. Buying weakness is still the only way, it seems.

Maybe what's next is the earnings season. It's here, and things get rocking this week as the banks and many of the key financial stocks get our attention. Wells Fargo & Company (NYSE:WFC) and JPMorgan Chase & Co. (NYSE:JPM) come in on Tuesday, along with Citigroup Inc. (NYSE:C) and the Goldman Sachs Group, Inc. (NYSE:GS) on Thursday, just to name a few of those key leaders to which the market will be totally attentive. The market wants the best news from these stocks. They have held up well, and will need to say all the right things, if they are to continue their overall bullish behavior. You get the feeling the market won't tolerate anything on the warning side of the ledger.

Sometimes the market forgives, but since even a settlement in Greece didn't break us out, it appears the market will reward the good but also hurt the bad. It's a “show me” market, and that's really the way it should be. In super-bull mode, we see everything rise, even if the worst news comes out. Not the case these days. Bad reports are getting sold hard. But, as I've said, good ones are being rewarded. Russian roulette time on the earnings front. Within the next two weeks, we'll hear from most of the big leaders from just about every important sector of the market. If and when that's over, and we're still in the range, it's likely that things will remain that way for another month or two at least. Earnings is the next “hoped for” catalyst to break the range one way or the other. Here's to hoping.

Look folks, I know this is incredibly boring. No moves that matter. Again, however, buying unwound sixty-minute charts are really the best way to play. I'd still avoid shorting for the most part, since the trend is still more on the bullish side, even though we go nowhere since the long-term trend has been up, and only a strong close 2040 breaks that reality. If we're in, and the market breaks 2040, you'll need to get out. Until that time arrives, you are best to stick with the long side of the trade, at least for the most part. I would completely, but do what feels right to you.

Sometimes after a strong move, the market can take many months off as it tries hard to bring about some pessimism, which would help the next move upward become a reality. There's no written law about how long the market needs to move laterally. It may be simply a matter of however long it takes to unwind froth. With two readings on two separate days of the put-call over 1.40, there is definitely some real pessimism occurring. That's a positive, and gives the bulls more hope. But again, you know the real story here. 2134 and 2040 or bust. Keep it light, and if you have the patience, buy weakness.