Investing.com’s stocks of the week

The market themes of a strong USD and confusion over the prospects for Greece are doing battle as we open up this morning with the dollar in the driving seat. The latest leg of strength for the greenback has come following a speech from Dallas Federal Reserve President, which attempted to pressure Janet Yellen and the rest of the US Federal Reserve into raising rates. Speaking at a university in Texas, Mr Fisher stated that the US was risking another recession if interest rates are held at these ultra-low levels for too long given the improvements in the US jobs market.

US yields have been on the back foot and the dollar like a rocket ship as market participants have upped their bets that interest rates in the US are only set to run higher sometime this year. Combine that with an investor’s innate desire for a yield on an asset and compare that to what is going on with other central banks and the reason for USD outperformance is as clear as the nose on my face.

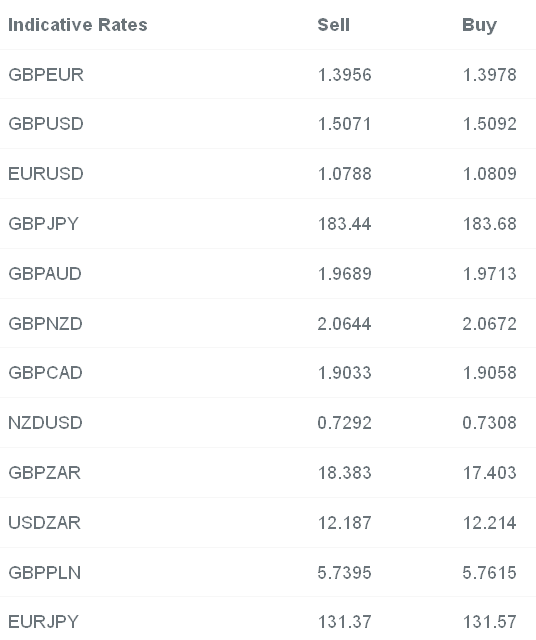

The weakness of the euro is exacerbating this situation, of course. Yesterday, I wrote that I foresaw sterling breaking below the 1.50 mark in GBP/USD before the 1.40 level in GBP/EUR gave way. This morning I am not too sure. Let’s hope my thoughts on today’s racing at Cheltenham do a little better!

Overnight, GBP/EUR has cracked as high as 1.3979 following further ructions between Greek and wider European officials. Greece is set to resume talks with its creditors tomorrow after being warned yesterday that it has done nothing but drag its feet. The temperature was raised further by an unnamed European official being quoted as saying that Greece had funding to last it one, two or three weeks although it was difficult to be precise.

Comments from some Greek politicians continue to stir the pot at home and add fuel to what is already a tinderbox. I still maintain that we are a long way away from anything that looks like Greece leaving the eurozone. Firstly, there is little desire within the eurozone to get rid of Greece. Merkel does not want to be remembered as the Chancellor who presided over the end of the eurozone whilst 70% of Greeks want to keep the euro.

In the short term, however, we are looking at a liquidity crisis. EUR500m worth of funds from the European Central Bank last week have already been used up and little more seems available unless Syriza wake up and start playing ball in Brussels.

Overnight, Chinese inflation numbers have rebounded handily from their recent nadir, though there is little chance that this will be sustained. While some of the increase may be as a result of the recent monetary policy loosening by the People’s Bank of China, I believe it to be more as a result of the Lunar New Year seeing retailers increasing food and transport costs as people headed home to celebrate.

With everything going on in Greece you would think that the euro was the weakest currency overnight yesterday. You would be wrong. NZD collapsed yesterday following a threat to poison baby formula produced by three of the country’s largest dairy companies. Given milk and dairy products make up 29% of New Zealand exports, any stop here will drastically hurt output numbers. Initial tests seem to suggest that there has been no contamination however. NZD is down 0.90% overnight.