History was made last week, when Greece and its euro zone partners made a deal on the country’s debt. Under the agreement, Greece has been granted a 10-year debt maturity extension and will not have to make any debt payments until 2032. While both sides see the deal as a win, some think it simply puts off the inevitable and passes the country’s burdens on to its future generations. However, 2032 looks like a distant future now and the stock market seems to be willing to take advantage of that time.

Three years ago, on July 4th 2015, we wrote an article about the Athens General – Greece’s benchmark stock exchange index, saying that it “should start rising, despite all the problems Greece has to take care of.” Our positive outlook was inspired by the chart below. Take a look.

The monthly chart of the Athens General Index made the entire drop since its all-time high of 6355 in 1999 visible. From an Elliott Wave point of view, it looked like a gigantic simple A-B-C zigzag correction, whose wave 5 of C needed to make one last low before the uptrend resumes.

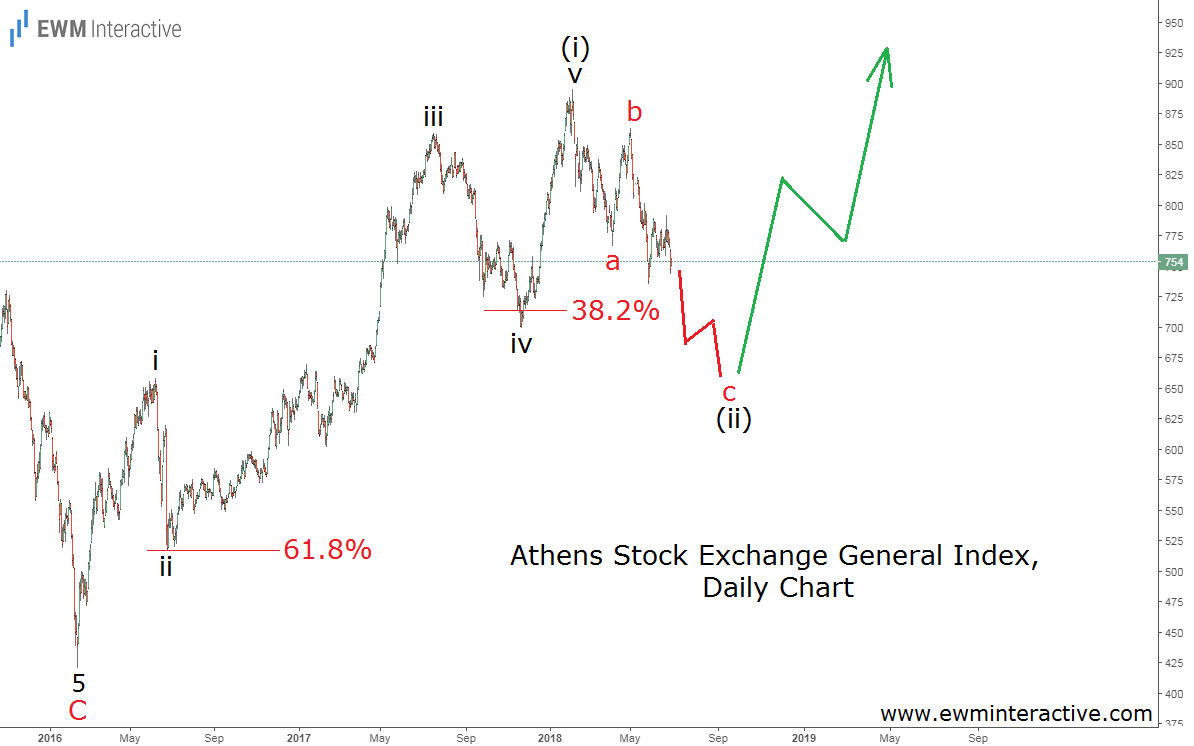

In February 2016, the index dropped to a new low of 421. By January 2018, the Athens General was already in the vicinity of 900. That 112%-recovery may be exciting, but its structure is a lot more interesting to us, because it confirms that the first step of a larger bull market has already been made. The next chart explains.

The daily chart visualizes the recovery from 421 to 896. It is undoubtedly a five-wave impulse, marked i-ii-iii-iv-v. Note that both corrective waves – ii and iv – have retraced the previous impulsive waves to their natural Fibonacci targets of 61.8% and 38.2%, respectively.

According to the theory, impulses develop in the direction of the larger trend. Given that the bigger picture suggests the huge three-wave correction since 1999 is finally over, this pattern tells us that once wave (ii) is complete, the bulls should return and lift the Athens General above the 1000 mark again.

Telling what will happen on Greece’s political and economic stage by 2032 is next to impossible, but 421 looks like a very significant low and at least the country’s general stock market should do well.