Meetings between Greek politicians continued over the weekend but no signs of an agreement have been forthcoming. The IMF/EU/ECB troika has asked Greece to come up with further austerity measures by 10am GMT this morning so as to receive the new EUR130bn bailout package that should see the Greeks not default on March 20th. Or at least, not default in a disorderly fashion. The agreement on how much of a haircut the private sector will receive has been pushed away, it seems, as the ECB is not willing to take losses on its holdings and the investors, and a fair few Greeks, want them to.

The euro has slipped somewhat in overnight Asian trade although market conditions have been very thin. GBP/EUR hit a high of 1.2084 before falling back to 1.2058 while EUR/USD got as low as 1.3053 and now finds itself 30pips higher.

Asian equity markets have crept higher overnight however and that slight “risk-on” mentality has made sure that the euro’s losses have not been so bad. Most of the encouragement came from Friday’s superb jobs numbers out of the US that saw 243,000 jobs added in the month of January. The unemployment rate also fell to 8.3%, the lowest in 3 years, and now lower than that of the UK. This will add fuel to the fire that stimulus and not austerity is the way to go.

The US jobs figures were not the only upside data surprise of the day. UK services PMI shot higher to 56.0, against an estimated reading of 53.3. This was definitely unexpected good news (nobody predicted it would get that high) and will eliminate most fears that a double-dip recession is on the cards.

I do not believe that this changes the MPC’s view on further quantitative easing, however, and expect the Bank to add £75bn on Thursday. When the latest pump of cash was injected last October the committee emphasised that it was more as a result of European headwinds than problems with the UK that caused the decision. Now, while a Lehman Brothers type event has been averted courtesy of the ECB’s new lending operation, recession and diminished confidence cannot be spirited away and herein lies the problem. Recession will come to Europe and, as a result, pressure on the UK economy must be alleviated sooner rather than later.

For instant reaction to Thursday’s Bank of England and European Central Bank announcements you can join our webinar on Thursday at 2pm. It is free and we will be looking at what sterling’s prospects are for further gains in the coming months. You can register here

Greece’s travails will be the focus for markets today with unions planning a 24hr strike tomorrow in protest of pay and pensions reform. That being said we anticipate that GBP/EUR and GBP/USD will remain range-bound today.

P.S. Save for some dodgy reffing in the Ireland/Wales game we would have had 3 from 3 in our 6 nations predictions. It is a shame that may be the only England win of the campaign!

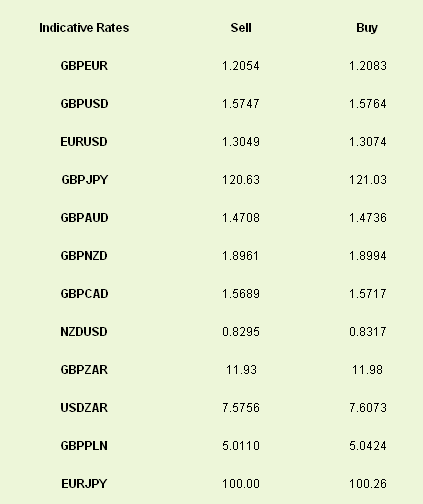

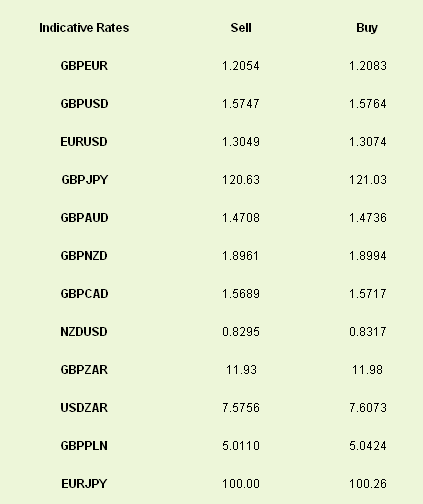

Latest exchange rates at time of writing

The euro has slipped somewhat in overnight Asian trade although market conditions have been very thin. GBP/EUR hit a high of 1.2084 before falling back to 1.2058 while EUR/USD got as low as 1.3053 and now finds itself 30pips higher.

Asian equity markets have crept higher overnight however and that slight “risk-on” mentality has made sure that the euro’s losses have not been so bad. Most of the encouragement came from Friday’s superb jobs numbers out of the US that saw 243,000 jobs added in the month of January. The unemployment rate also fell to 8.3%, the lowest in 3 years, and now lower than that of the UK. This will add fuel to the fire that stimulus and not austerity is the way to go.

The US jobs figures were not the only upside data surprise of the day. UK services PMI shot higher to 56.0, against an estimated reading of 53.3. This was definitely unexpected good news (nobody predicted it would get that high) and will eliminate most fears that a double-dip recession is on the cards.

I do not believe that this changes the MPC’s view on further quantitative easing, however, and expect the Bank to add £75bn on Thursday. When the latest pump of cash was injected last October the committee emphasised that it was more as a result of European headwinds than problems with the UK that caused the decision. Now, while a Lehman Brothers type event has been averted courtesy of the ECB’s new lending operation, recession and diminished confidence cannot be spirited away and herein lies the problem. Recession will come to Europe and, as a result, pressure on the UK economy must be alleviated sooner rather than later.

For instant reaction to Thursday’s Bank of England and European Central Bank announcements you can join our webinar on Thursday at 2pm. It is free and we will be looking at what sterling’s prospects are for further gains in the coming months. You can register here

Greece’s travails will be the focus for markets today with unions planning a 24hr strike tomorrow in protest of pay and pensions reform. That being said we anticipate that GBP/EUR and GBP/USD will remain range-bound today.

P.S. Save for some dodgy reffing in the Ireland/Wales game we would have had 3 from 3 in our 6 nations predictions. It is a shame that may be the only England win of the campaign!

Latest exchange rates at time of writing