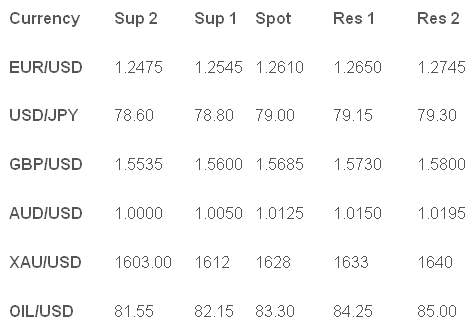

The positive feel for the EUR/USD after the Greek elections failed to hold even the European trading session as Spanish debt continued to trade above the key 7% level. The 7% level is seen a rate that countries can no longer finance government debt at a sustainable pace. The G20 meetings and have offered token amounts to increase the IMF warchest but markets are looking for the ECB to provide real short-term support. Looking ahead, May Housing starts are forecast at 0.72mn vs. 0.717mn previously. Also May Building permits forecast at 0.728mn vs. 0.723mn previously. G20 meetings also continuing today.

The Euro (EUR)

The EUR traded in a 200 pip range from 1.2750 to 1.2550 with the failure of the Spanish bonds to drop back from fresh debt crisis highs. The market is hoping some sort of ECB action will be able to put a more permanent lid on the crisis but the political climate in EU powerhouse Germany is making it hard for fresh ideas to gain traction. Indeed Chancellor Merkel has warned Greece that it will not get easier terms for bailout funds.

The Sterling (GBP)

The British pound was on the backfoot as the EUR/USD losses mounted but the GBD/USD stood up well supported by fresh EUR/GBP selling. EUR/GBP closed just above 0.8000 and a break below may see the cross trade towards 0.7800. The market has been selling for a few months but the support at 0.8000 has proven too solid so far. Looking ahead, May CPI forecast at 0.1% vs. 0.6% previously. Also May Retail Price index forecast at 0.2% vs. 0.7% previously.

The Japanese Yen (JPY)

USD/JPY was dragged lower by heavy EUR/JPY selling and ended under the Y79 level with the chance of QE3 not entirely off the table at Wednesday’s FOMC meeting given the ongoing European debt crisis. No change in FOMC policy may enable the USD/JPY to test Y80.

Australian Dollar (AUD)

The aussie was able to hold onto most of the gains from the Greece election rally in Asia yesterday with traders selling the EUR/AUD rather then selling AUD/USD when the EUR/USD fell so heavily. UPDATE RBA minutes suggest future rate cuts are less likely as local economic data remains strong and the recent cuts were mainly to protect from the European Crisis downside risks.

Oil & Gold (XAU)

Gold held onto gains as well with European Bonds under pressure helping investor demand for alternative investments. OIL/USD was under pressure reversing early gains with the market still unsure on oil demand and direction given the turmoil in Europe. Support was seen at $83 a barrel.

Pairs To Watch

AUD/USD to retest 1.0200 previous key level?

EUR/USD Can the G20 help the euro?

Technical Commentary

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greece Election Rally Reverses Rapidly

Published 06/19/2012, 06:24 AM

Updated 03/09/2019, 08:30 AM

Greece Election Rally Reverses Rapidly

U.S. Dollar Trading (USD)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.