The economy is starting to grow again, and that is good for every company in the United States. They all have a tailwind now. This effect is starting to show up in the US Equity Indexes as they begin to move to new higher highs, supplemented with the view that governmental financial issues will become certain at some point soon. Of course there will be winners and losers along the way.

One place to look for winners is in the shipping sector, but maybe not where you would expect. The railroads have good prospects but rarely big price swings, and the trucking industry could have a double benefit if Crude Oil prices continue to decline. But one company already has that double benefit in its future. With the Mississippi River at record low levels, barge traffic is facing concerns. One company, Great Lakes Dredge & Dock Corporation (GLDD) based in Oak Brook, Illinois, is already cashing in on projects up and down the Mississippi.

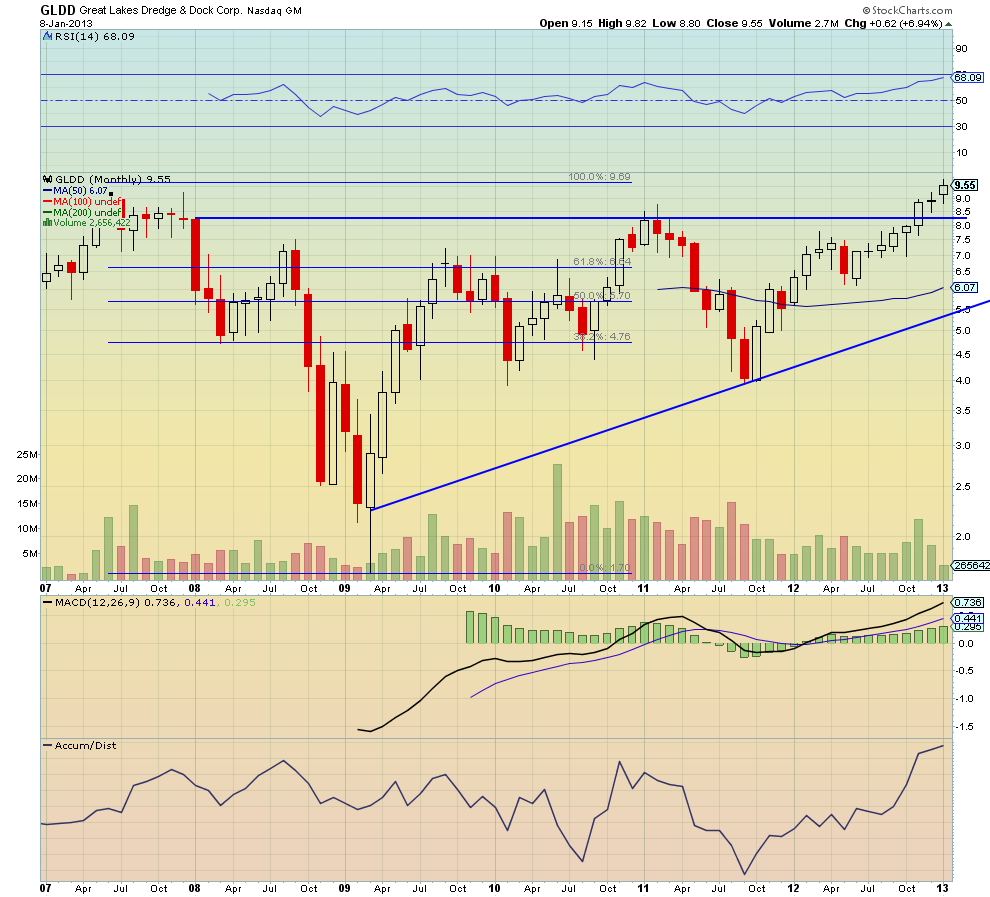

With the added boost of a growing economy and financial clarity with producers looking to ship, there stands to be more need for their services. Some of this has already been reflected in their stock price. You might think that picking this name as the winner in 2013 is crazy with it up over 60% in 2012. But the technicals support a much greater move. Take a look. The daily chart shows a rising channel that is reaching the midline between the Lower Median Line and the Median Line of the Andrew’s Pitchfork.

In the middle, it could be attracted to either Median Line but what is important is that the Pitchfork is running higher with no sense of any impending test of its support lower. The trend is higher. But it is the longer views from the weekly and monthly charts that look even better. The weekly chart below is showing a break above the 4-year long consolidation channel between 4.00 and 8.60. It is natural that as it breaks above this channel that it will consolidate, as it was doing in late December.

The target for the break of the channel is a move to 13.20. Got your attention now? And look at the Relative Strength Index (RSI). This measure of the strength of the move is solidly in bullish territory and rising, supporting a continued move higher. The Moving Average Convergence Divergence histogram (MACD) is also positive and growing adding weight to the bullish case. But the picture gets better.

Moving out to the monthly view shows that it broke an ascending triangle in November and is consolidating that break out in December. The target from the triangle break is a move higher to 14.30. The RSI and MACD on this timeframe also support a move higher. And a quick look at the accumulation/distribution line shows it strong and at highs.

Finally, a glance at the 3-box reversal Point and Figure chart, where time does not matter, shows a price objective of 19.25 on a double top breakout. Will there be a retest of the break out levels between 8.30 and 8.60. It probably will, but the potential for upside is not to be ignored. Oh, and for those of you that do not believe in the voodoo of technical analysis, the few fundamental analysts that follow it are bullish. At least they were a year ago. So it is underfollowed as well. Another plus.

Disclosure: This article was originally written in late December for the Investor Place Best Stocks of 2013 contest. The charts have been updated to show the story is unchanged. I own this stock at the time of this posting.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Great Upside For Great Lakes Dock & Dredge

Published 01/09/2013, 12:15 AM

Updated 05/14/2017, 06:45 AM

Great Upside For Great Lakes Dock & Dredge

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.