It is quite clear that a euro in Germany is not the same as a euro in Greece or Cyprus or even France. This disturbs many people who believe that having a single currency for such diverse countries does not make sense. Moreover, the exchange rate needed for less competitive countries within the eurozone is lower than in the more competitive parts.

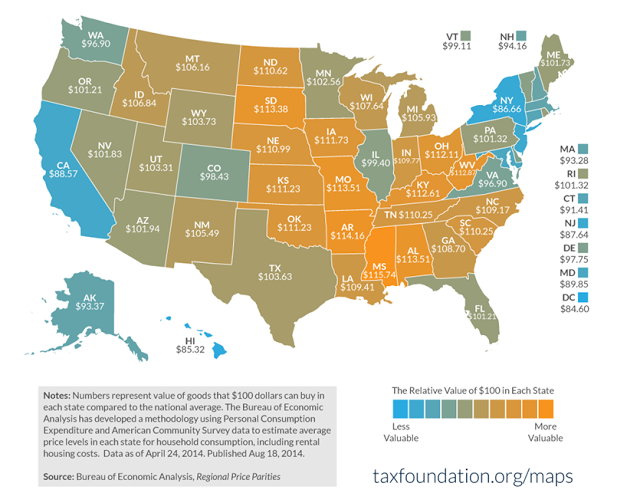

This Great Graphic from the Tax Foundation (Alan Cole, Lyman Stone, and Richard Borean) shows a similar situation in the U.S. The data is from last year. A dollar purchases a third more in Mississippi than in New York while the Arkansas dollar's purchasing power is 29% greater than California's.

The Tax Foundation notes that states with high incomes tend to have high price levels. Both are correlated with stronger levels of economic activity. There are some exceptions to this generalization. It notes that North Dakota has high incomes but not high prices (yet).

The Tax Foundation's point is that there are profound policy implications for this disparity in prices. Taxes are calculated on nominal income. The average New York resident pays considerably more taxes than the average person from Mississippi. However, the resident in Mississippi has greater purchasing power than the New Yorker, meaning that they pay lower taxes and their remaining dollars buy a larger basket of goods than residents from New York.

There are obviously implications as well on means-tested federal welfare programs. Those in high-cost areas may be outside the range eligible for transfer payments despite still being poor. Similarly, some in lower-price states may qualify for assistance even though -- when adjusted for PPP -- they may be wealthier than nominal levels suggest.

The fact that the U.S. is more transparent in fiscal transfers than Europe is not the relevant issue here. As the Tax Foundation notes, the fiscal transfer themselves are based on nominal measures, not real. The existence of fiscal transfers does not directly impact the disparity of purchasing power in the United States.