When you think about it, ultra-low interest rates can be credited with a wide variety of recent occurrences. Real estate became more accessible. Vehicles became more affordable. And higher-yielding stocks and bonds became unavoidable for those who required a return on their life’s savings; that is, CDs and treasuries were not able to provide retirees with a risk-free income stream any longer.

Housing

Yet the Fed’s interest-rate manipulation via quantitative easing (QE) may soon be getting into a scrape with the law of diminishing returns. For example, the headlines have heralded double-digit percentage gains for the prices on single-family residences. However, this ignores the reality that one-third of the properties have been scooped up by investment companies. Similarly, the headline housing starts number for March focuses upon the one million new properties in the pipeline. However, the housing starts break out into a year-over-year increase of 27% for multi-family -- five unit -- buildings and -4.8% for single-family homes. In other words, less single-family homes are being constructed and less will be owned by families as the trend toward renting a four-bedroom in a particular neighborhood appears to be taking root.

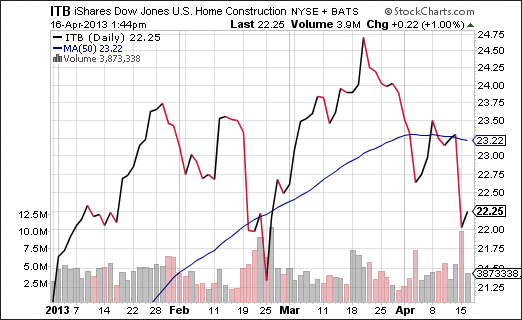

One might be inclined to think that home-builders would still be immensely profitable. After all, wouldn’t the decline in single family residences be offset by the huge increase in multi-family units? However, investors in iShares DJ Home Construction (ITB) and SPDR Homebuilders (XHB) are rethinking the premise. Both exchange-traded funds are well below respective 50-day moving averages.

Autos

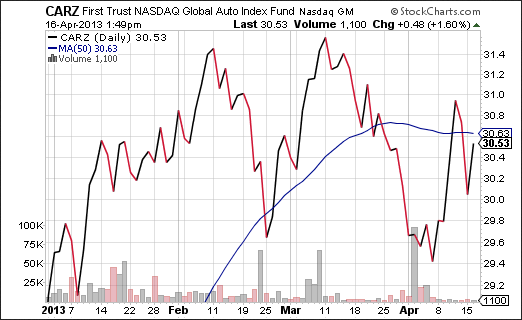

Another beneficiary of low interest rates has been the auto industry. And yet, investor angst has shown up in First Trust Global Auto (CARZ) with the current price below its 50-day trendline.

Brokers

Is it possible that some of the best performers in 2012 -- CARZ, ITB, XHB -- are merely taking a breather? Maybe investors have been locking in profits in light of the current soft patch in the global economic data. Perhaps. Nevertheless, relative weakness is showing up in brokerages as well.

One might expect retail brokerages (e.g., TD Ameritrade, Schwab, E-Trade Financial, etc.) to dance the salsa with ultra-low interest rates propelling stock prices to record highs. Unfortunately, recent indications at retail institutions have shown weakness in trading volume; weak trading activity can hinder profitability and revenue gains. And while the remarkable start to the 2013 year gave iShares DJ Broker Dealer (IAI) a solid shot in the arm, the trend has clearly shifted toward greater caution.

In sum, the ETFs that have benefited the most from ultra-low interest rates have been buckling. Granted, the central banks have made it very difficult for anyone -- consumers, small businesses, large corporations, individual investors -- to ignore ultra-low interest rates. What’s more, investors may not feel like they have viable alternatives than to put money to work in high-yield and/or stocks. That said, there is ample evidence to warrant vigilance as well as some sideline cash for a future buying opportunity.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Great Data Fails To Inspire Homebuilder, Auto And Broker-Dealer ETFs

Published 04/16/2013, 03:21 PM

Great Data Fails To Inspire Homebuilder, Auto And Broker-Dealer ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.