I’ve started a new series of screens on my blog: the best-yielding large cap stocks from foreign countries with cheap price ratios.

The results from Asia and Latin America were inspirational for me but when I look deeper at the results, I realize that I could not build a deeper relationship to them. They are too far away from my research and their products and services are really unknown for me.

Today we come back to the core industrialized countries by screening stocks from the United Kingdom with an U.S. listing. A full list of the best yielding stocks from the FTSE can also be found in my weekly published E-Book, Dividend Weekly.

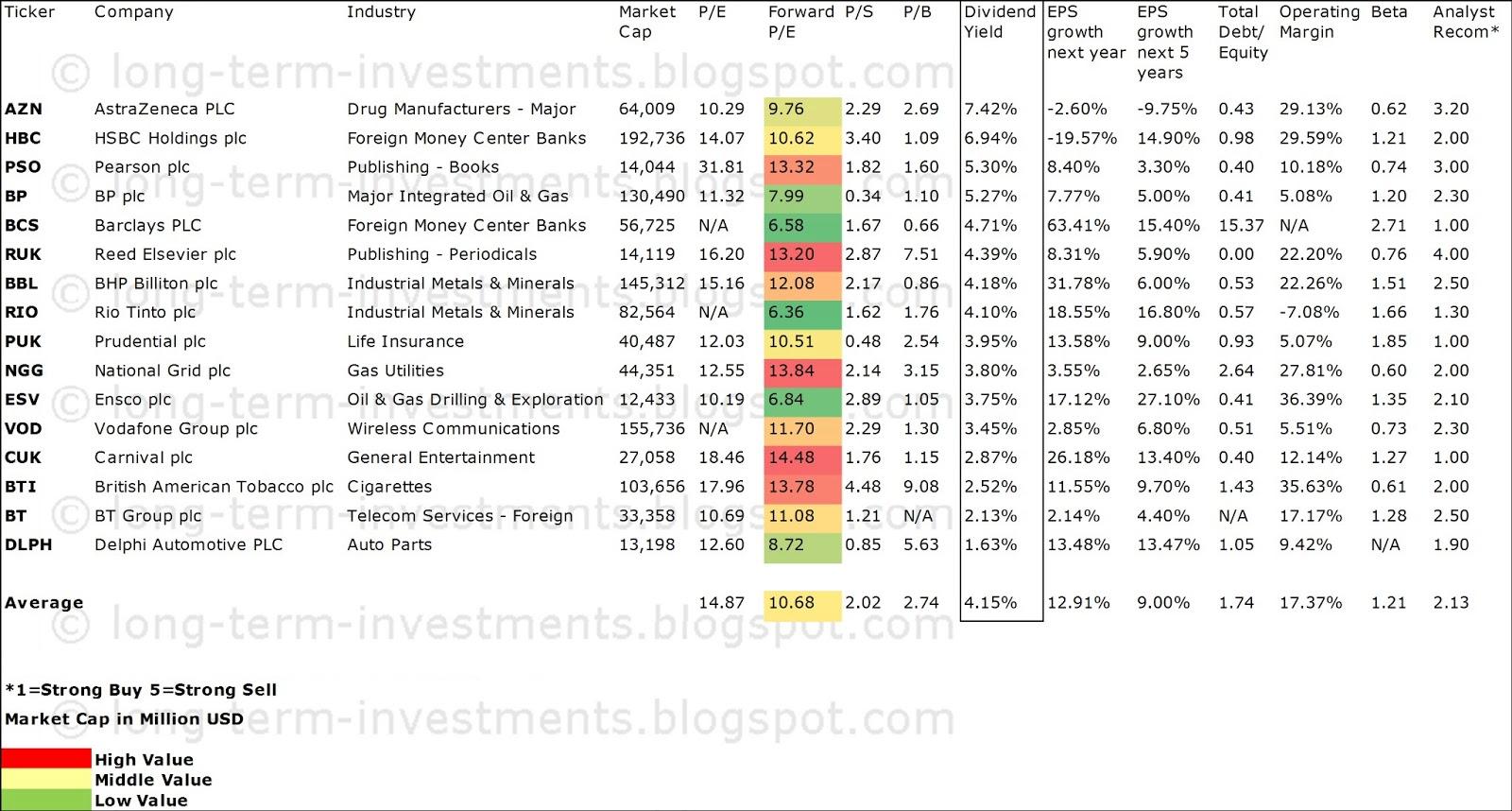

My criteria are still the same: A market capitalization over USD 10 billion with a low forward P/E of less than 15. Finally, the dividend yield should be positive. In total, 16 of 38 U.K. stocks fulfilled these criteria. Thirteen companies have a current buy or better rating.

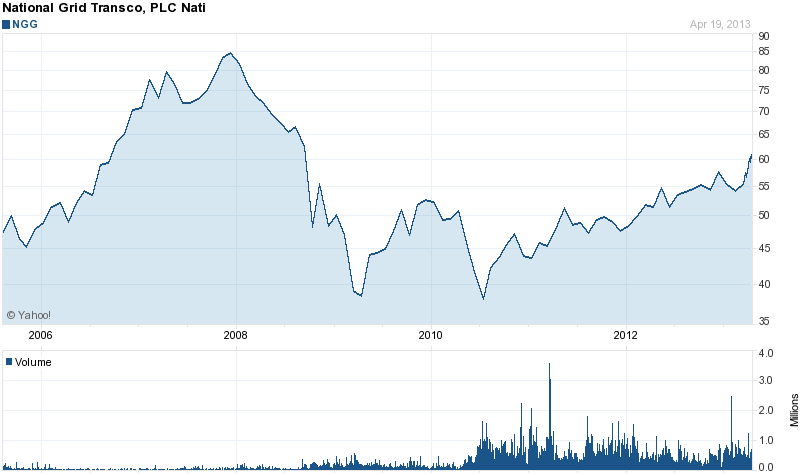

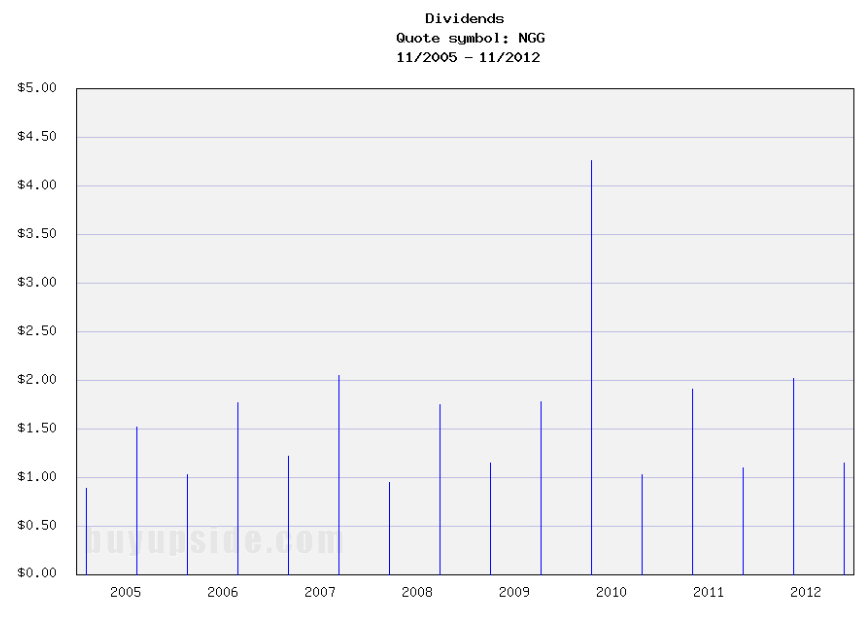

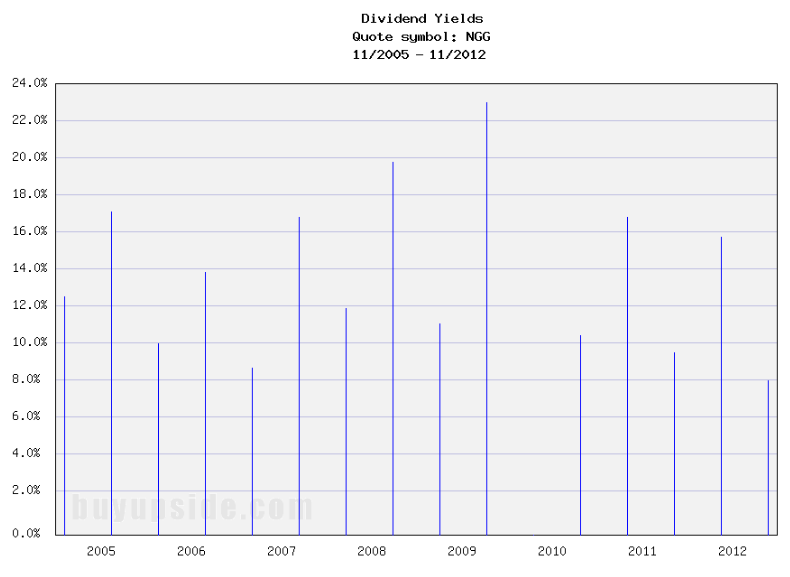

National Grid (NGG) has a market capitalization of $44.02 billion. The company employs 25,645 people, generates revenue of $21.066 billion and has a net income of $3.103 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $7.220 billion. The EBITDA margin is 34.28 percent (the operating margin is 25.08 percent and the net profit margin 14.73 percent).

- Financial Analysis: The total debt represents 48.64 percent of the company’s assets and the total debt in relation to the equity amounts to 249.22 percent. Due to the financial situation, a return on equity of 22.25 percent was realized. Twelve trailing months earnings per share reached a value of $4.82. Last fiscal year, the company paid $2.99 in the form of dividends to shareholders.

- Market Valuation: Here are the price ratios of the company: The P/E ratio is 12.56, the P/S ratio is 2.11 and the P/B ratio is finally 3.18. The dividend yield amounts to 5.23 percent and the beta ratio has a value of 0.60.

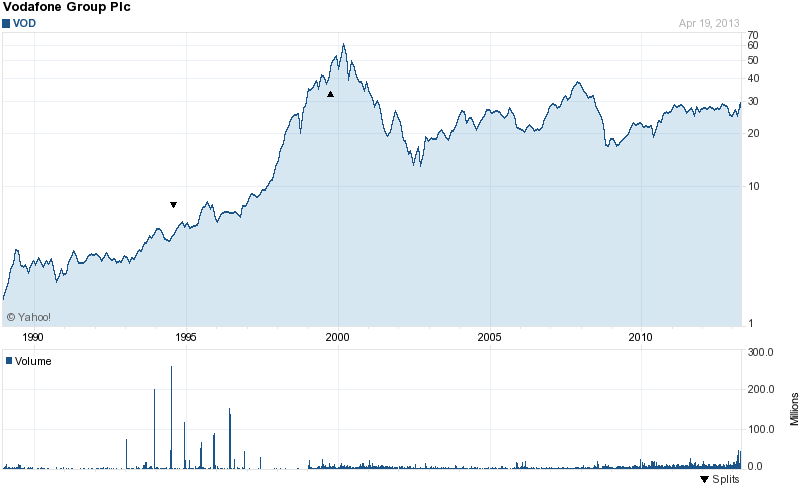

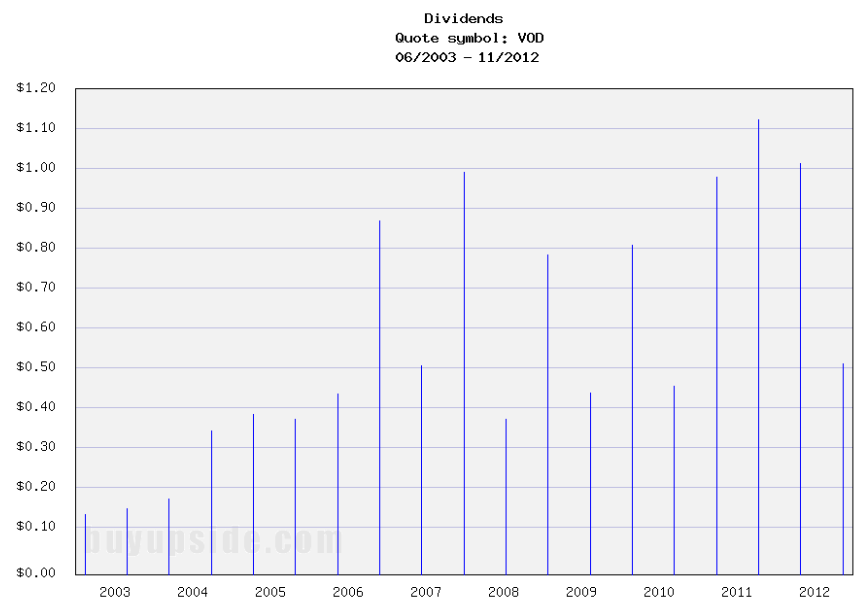

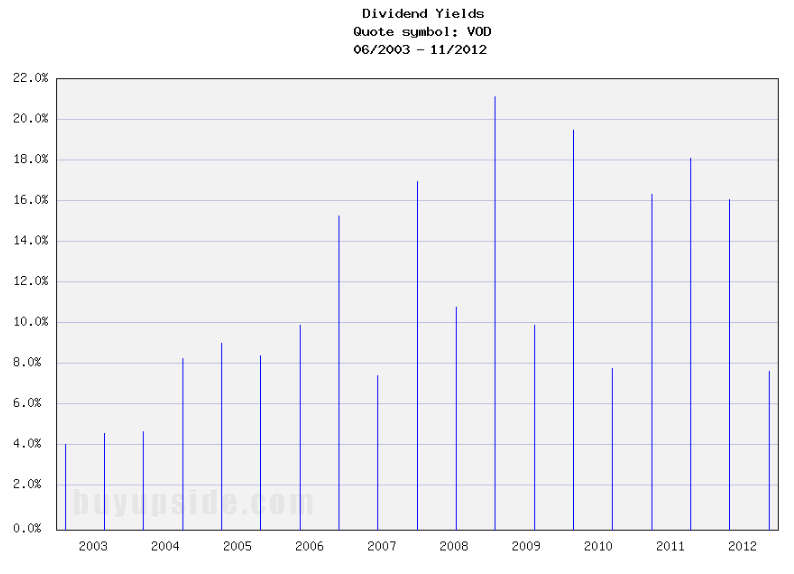

Vodafone Group (VOD)

has a market capitalization of $145.53 billion. The company employs 86,373 people, generates revenue of $70.692 billion and has a net income of $10.665 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $15.790 billion. The EBITDA margin is 22.34 percent (the operating margin is 24.10 percent and the net profit margin 15.09 percent).

- Financial Analysis: The total debt represents 24.80 percent of the company’s assets and the total debt in relation to the equity amounts to 45.00 percent. Due to the financial situation, a return on equity of 8.46 percent was realized. Twelve trailing months earnings per share reached a value of $-0.53. Last fiscal year, the company paid $1.45 in the form of dividends to shareholders.

- Market Valuation: Here are the price ratios of the company: The P/E ratio is not calculable, the P/S ratio is 2.04 and the P/B ratio is finally 1.25. The dividend yield amounts to 5.17 percent and the beta ratio has a value of 0.73.

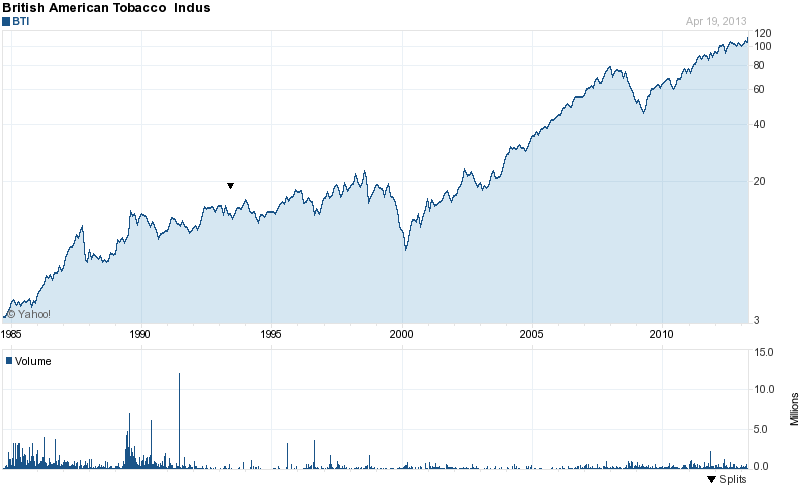

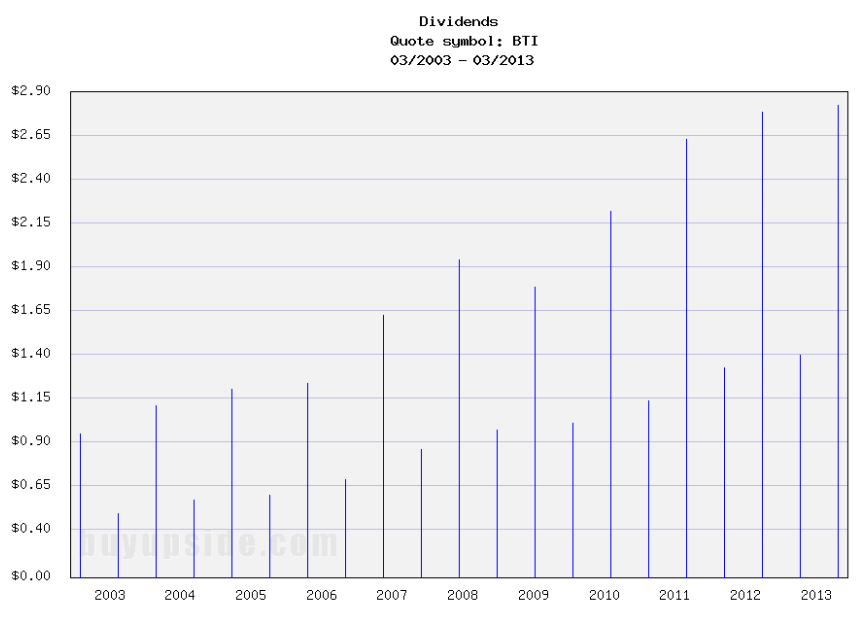

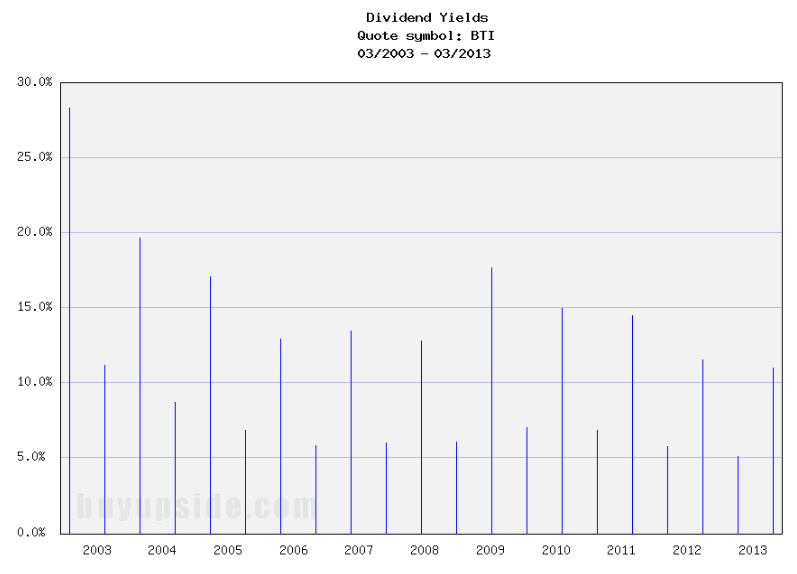

British American Tobacco (BTI)

has a market capitalization of $103.91 billion. The company employs 87,485 people, generates revenue of $23.134 billion and has a net income of $6.277 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $8.947 billion. The EBITDA margin is 38.68 percent (the operating margin is 35.63 percent and the net profit margin 27.14 percent).

- Financial Analysis: The total debt represents 39.22 percent of the company’s assets and the total debt in relation to the equity amounts to 143.46 percent. Due to the financial situation, a return on equity of 49.12 percent was realized. Twelve trailing months earnings per share reached a value of $6.00. Last fiscal year, the company paid $4.11 in the form of dividends to shareholders.

- Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.95, the P/S ratio is 4.48 and the P/B ratio is finally 9.14. The dividend yield amounts to 3.88 percent and the beta ratio has a value of 0.61.

Take a closer look at the full list of the cheapest UK dividend stocks. The average P/E ratio amounts to 14.87 and forward P/E ratio is 10.68. The dividend yield has a value of 4.15 percent. Price to book ratio is 2.74 and price to sales ratio 2.02. The operating margin amounts to 17.37 percent and the beta ratio is 1.21. Stocks from the list have an average debt to equity ratio of 1.74.

Here is the full table with some fundamentals (TTM)

Related stock ticker symbols:

AZN, HBC, PSO, BP, BCS, RUK, BBL, RIO, PUK, NGG, ESV, VOD, CUK, BTI,

BT, DLPH

I am long AZN, BTI. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.