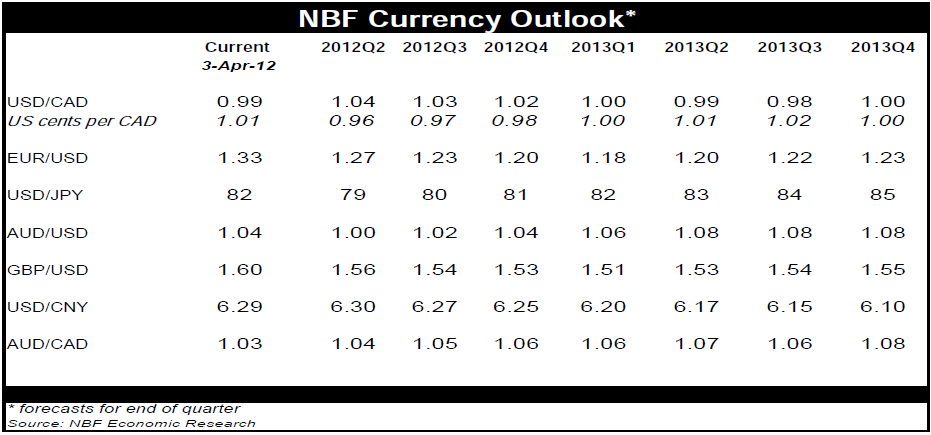

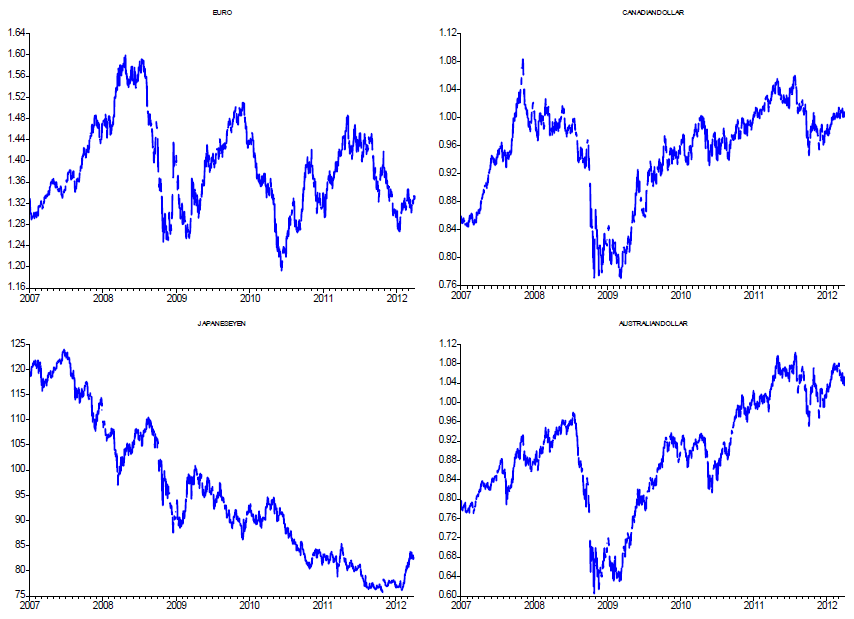

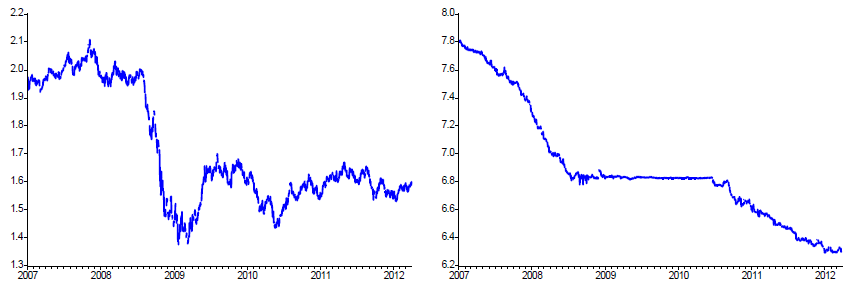

• The euro is holding firm for now, with liquidity injections by the ECB and a tentative agreement on an enlarged bailout fund helping to boost confidence. But investors may be grasping at straws and underestimating the gravity of the situation in Europe. The eurozone recession is likely to worsen over the near term and political uncertainty will grow with forthcoming elections and referendums, putting into question the effectiveness of any bailout fund.

• After being hammered in Q1, the US dollar seems well placed for a rebound. The US economy is on a clear uptrend and the likelihood of further liquidity injections is diminishing. Moreover, thanks to the European economic situation, the likely return of safe haven flows should keep the greenback well bid over the next few quarters.

• The Canadian dollar is benefiting from the ramp up in oil prices and a slightly less dovish central bank. While we remain CAD bulls over the longer term, we anticipate a near-term retreat for the loonie (and other commodity currencies) as concerns about global growth make a comeback.

Grasping At Straws

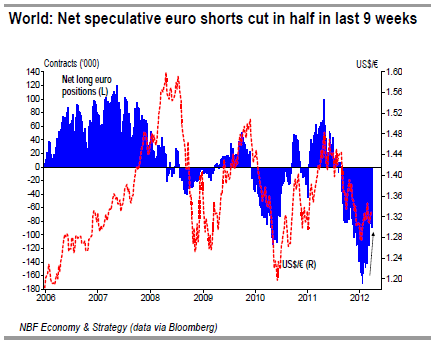

Investors seem to be grasping at straws when it comes to European economic news. Most recently, it was the German IFO that brought cheers (of course, temporarily). The increase of a sovereign bailout fund to a reported €800 bn also brings new hope. So much so, that even speculators are cutting their short positions and helping lift the euro in the process.

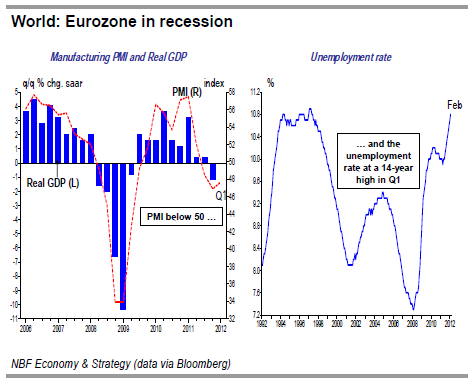

But, in our view, the worst is not over in Europe. Our end-of-year euro target at 1.20 USD/EUR reflects such caution. Note that several of the individual eurozone economies were already in a recession in Q4, and the zone as a whole is likely to contract for a second consecutive quarter in Q1 if the manufacturing PMI is any guide. Even economic powerhouses like France and Germany printed sub-50 PMI’s in Q1. The fact that the zone’s unemployment rate was at a 14-year high in February is just a reflection of worsening economic conditions.

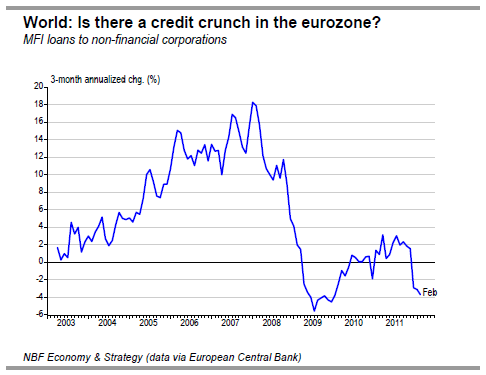

Looking ahead to the current quarter, i.e. Q2, the prospects aren’t any better, particularly with the threat of a credit crunch. The €1 trillion LTRO injections haven’t led to increased lending activity given that the bulk of the cash is stuck in ECB vaults as deposits and is therefore not flowing to the real economy. February data indeed shows loans by financial institutions to non-financial corporations are contracting almost 4% on a 3-month annualized basis. This development does not argue for a quick rebound in economic activity or a labour market recovery.

And while the LTRO provided liquidity to banks, it did nothing to address their solvency problems. With mounting losses on their books, some banks are on shaky ground. Bank insolvencies (and bailouts by their respective governments) cannot be ruled out, particularly if economic conditions worsen further.

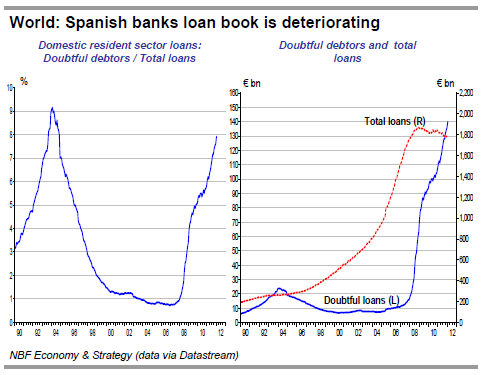

Spain is a case in point. With an unemployment rate above 23% and an ongoing real estate meltdown, Spanish banks are seeing a rising percentage of doubtful debtors on their loan books. The sovereign debt crisis also remains far from contained. Spain just announced that its debt to GDP ratio will climb to 80% this year, a ten-point rise from last year. So much for the wonders of austerity! Adding to Europe’s economic and banking problems, is political uncertainty with the forthcoming elections in France and Greece, and a referendum in Ireland at the end of May. The implementation of the recently crafted fiscal compact depends on the outcome of those.

Moreover, despite the so-called agreement by European Finance ministers on a €800 bn sovereign bailout fund, implementation is likely to be as tricky as ever. Germany isn’t enthusiastic about raising the bailout fund to such levels, and even if it forces itself to play ball, €800 bn won’t be enough to bail out the likes of Italy or Spain. Comes a point, markets will realize that the eurozone’s future hinges not on the size of bailout funds, but rather on the ability of its policymakers to pass significant structural reforms and generate economic growth. And that takes time. US dollar down in Q1, but not out “Risk on” ruled supreme in Q1, with global stock markets generally seeing strong gains. And not surprisingly, the US dollar underperformed all major currencies besides the yen. But don’t bury the greenback just yet.

As we pointed out earlier, the European economic picture should darken in coming months. Moreover, concerns about China could grow further over the near to medium term. We are not anticipating a hard landing for the world’s second largest economy, expecting authorities there to make use of the significant monetary and fiscal policy room at their disposal. That said, a hit to exports (thanks to weak European demand), coupled by a moderation in domestic construction should limit China’s GDP growth to around 7.5% this year, the first sub-8% reading since 1999.

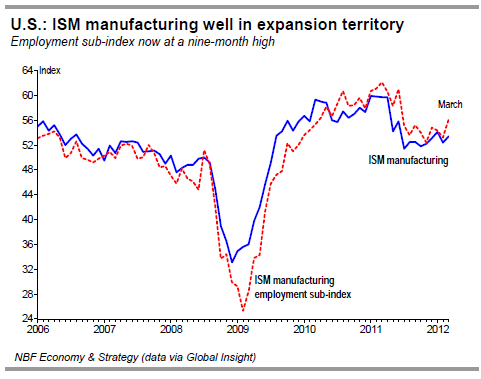

With growing concerns about global growth, and the euro falling back to earth, perceived safe havens such as the US dollar should benefit. And investors may flock to US assets not just for their relative safety, but also for their appeal, given a much sounder economic backdrop on this side of the Atlantic. Employment creation is gathering speed and the manufacturing sector in particular seems to have regained its vigour. Indeed, momentum from the end of last year carried over into 2012, if the ISM manufacturing index is any guide. So much so that US growth is tracking a respectable annualized pace of around 2% in Q1, on top on Q4’s healthy 3% print.

The 18% increase in gasoline prices this year is, of course, concerning. But if, as we expect, pump prices moderate and the labour market picks up speed, consumption spending should hold firm. The better economic prospects and a stubbornly above-target PCE deflator do not support further easing by the Fed at this point. With the odds of QE3 diminishing, expect the US dollar to find some support, particularly against currencies whose central banks seem more inclined to inject further liquidity.

Canadian Dollar Rebound

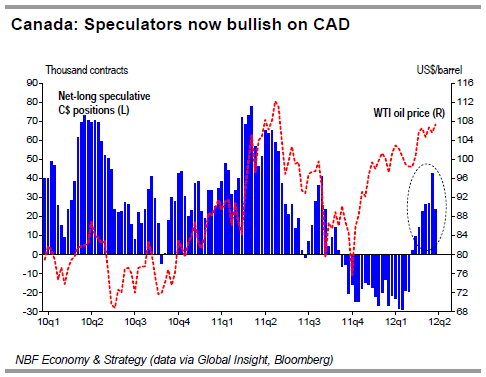

While the Canadian dollar failed to gain traction in Q4 despite soaring oil prices, it behaved much differently in the first quarter of 2012, more than making up for lost ground in the prior quarter. The ramp up of net speculative long positions certainly helped boost the loonie in the quarter.

Also supportive of the loonie are the pared-down expectations of rate cuts by the Bank of Canada. The latter has indeed sounded less dovish in its recent communications with the public. In its March interest rate statement, the BoC saw firmer inflation than what had previously been anticipated. Moreover, for the first time, the Bank explicitly mentioned in its statement that household debt is the “biggest domestic risk”. Unless there is a global recession, it’s hard to see the BoC enhancing such domestic risks with looser policies.

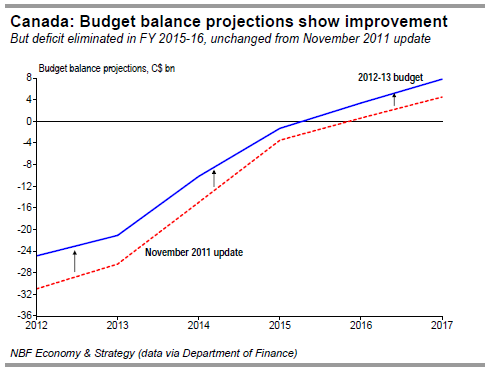

Another piece of good news for the economy and hence the Canadian dollar was the Federal budget which showed somewhat fewer cuts to spending than expected. An improved economic outlook coupled with savings from attrition and modest cuts mean that Canada is well on track to eliminate its budget deficit by 2016 without materially harming growth in the process. The improved fiscal position certainly reinforces Canada’s AAA status.

That said, while we remain CAD bulls over the longer term, we anticipate a near-term retreat for the loonie (and other commodity currencies) as concerns about global growth make a comeback.

Annex

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Grasping At Straws: A Tentative Agreement On An Enlarged Bailout Fund Helps To Boost Confidence

Published 04/05/2012, 04:20 AM

Updated 05/14/2017, 06:45 AM

Grasping At Straws: A Tentative Agreement On An Enlarged Bailout Fund Helps To Boost Confidence

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.