Kenny Construction Company (Kenny), a wholly owned subsidiary of Granite Construction Inc. (NYSE:GVA) , has been awarded a $21-million contract by the Illinois Department of Transportation. The contract work involves the reconstruction and widening of the Van Buren Street Bridge in Chicago, IL.

Per the contract, Kenny will replace the Van Buren Street Bridge over Interstate 90/94 and build a wall at the northwest quadrant of the Jane Byrne Interchange. Its scope of work also includes improvements to the southeast corner of the Elysian Field and relocation of the existing Greektown monument from Quincy Street to the project site.

Construction work is scheduled to begin in August 2017 and close by September 2019. The contract work will be included in Granite Construction’s third-quarter 2017 backlog.

The company’s total contract backlog increased 8.4% to $4.06 billion in second-quarter 2017. Granite Construction intends to focus on the execution of its large project backlog, apart from bidding for, and winning new deals and contracts.

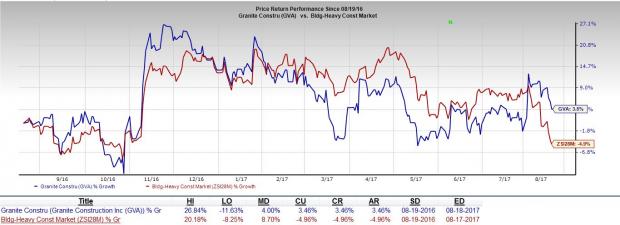

In the last year, Granite Construction has outperformed the industry with respect to price performance. The stock gained around 3.46%, while the industry declined 4.96% in the same time frame.

Granite Construction currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same space include MasTec, Inc. (NYSE:MTZ) , Sterling Construction Company, Inc. (NASDAQ:STRL) and KB Home (NYSE:KBH) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

MasTec has expected long-term growth rate of 14.00%.

Sterling Construction has expected long-term growth rate of 11.00%.

KB Home has expected long-term growth rate of 16.66%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

MasTec, Inc. (MTZ): Free Stock Analysis Report

Granite Construction Incorporated (GVA): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Original post

Zacks Investment Research