Several markets live today and this past week.

Soybeans after very near miss of 9.07 buy support we hit 932 resist of last few bull markets hidden trendline. If you bought break new low stop under 9.05 is my take. Meal and bean oil have both hit support by ticks. This very well could be the momentum driven oil share which is oil meal spread.

Coffee- live, under 127 and in falling knife on way to my olive support talked about for weeks in the 124 handle, ask for instructions if looking to buy this market. This feels like this could be a big buy turn if my olive buy catches. The level that hurts the most traders.

Gold- inflation theme in play, 1282-86 high yesterday has been taking out to upside which is why you need buy stop above, either new longs or definitely short cover over 1287.00-ish depending on your risk profile. Big markets, maybe biggest in decades of my trading feel like they are in front of the market. I do not like shorts except;

Meats- Olive sell levels hit today Aug cattle, 127.09 is key, new high stop a must, keep this tight risk, 127.24 is pink line, coded strategy, 129.26 next above, then air upward if bullish.

Aug Cattle- keep an eye on my levels here. This is topish for traders that run fast on losers, 1.00 stop max.

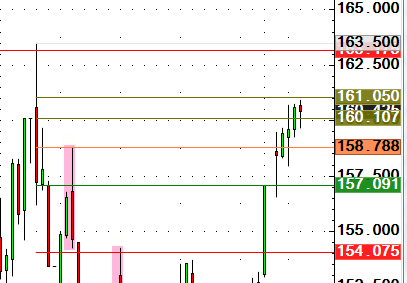

Aug Feeders- live here also. If looking for a top call me for game plan but 161.05 could be the hook line and sinker. Better buy over 163.50 than here, possible debacle top?

Aug Feeder cattle. Mkt is not staying here for long

Gold

Charts are spelled out in right hand column but get some insight and color if trading product

Yesterday high was line and few small sell levels and why you must use a stop always. Inflation idea is out of favor from Wall St. type and one reason why I like.