This article was written exclusively for Investing.com.

- Soybeans rise above technical resistance level

- Corn approaches $4

- Wheat moves to a six-year high

- Elevated grains prices translate to higher meat prices

- Mother Nature could throw commodities a curveball in 2021

On Friday, Oct. 9, the US Department of Agriculture released its monthly World Agricultural Supply and Demand Estimates (WASDE) report. Producers and consumers consider the USDA’s report as the gold standard for agricultural products. Many make business and hedging decisions based on it.

Soybean, corn, wheat and animal protein prices had already been appreciating over the past weeks and months. The latest WASDE report supported recent gains.

The WASDE spells out changes in crop yields, stockpiles, imports and exports, and consumer demand in the volatile agricultural sector. The weather conditions in the leading growing areas determine supplies each year and can be extremely variable.

A derecho in mid-August weighed on supplies and caused prices to rise. Meanwhile, the demand side of the fundamental equation is ever-increasing. According to the US Census Bureau, each quarter the world adds approximately twenty million people. At the turn of this century, six billion people inhabited the earth. At the end of last week, that number was over 28% higher at 7.69 billion. Each day there are more mouths to feed, meaning that the world must produce more of the agricultural products required for nutrition.

Since 2012, plentiful crops of grains and other agricultural commodities have been sufficient to meet requirements. Because the world will require more products in 2021 than in 2020, and the weather will determine production, we could see lots of price variance and higher prices in agricultural futures markets in the coming months and years. Time will tell if the rally that began over the past months is the start of the significant bullish trend in agricultural commodity prices.

Soybeans rise above a level of technical resistance

As the 2020 harvest continues, the price of nearby soybeans futures rose above its level of technical resistance.

Source: CQG

As the monthly chart shows, soybeans rose to the most recent high of $10.7975 on Oct. 9, surpassing the March 2018 peak of $10.71 per bushel. The next level on the upside stands at the Jun. 2016 apex of $12.0850 from June 2016. At the end of last week, November soybeans were at the $10.50 per bushel level.

Corn approaches $4

While soybeans rose to a new multi-year high, corn did not yet surpass the $4 per bushel. The coarse grain reached a high of $3.9925 on Oct. 12.

Source: CQG

The monthly chart shows that technical resistance in corn futures is at the October 2019 peak of $4.0250. The next level on the upside stands at $4.6425 per bushel, the June 2019 high. Corn was above the $4.00 level at the end of last week.

Wheat moves to a six-year high

The most dramatic technical move in the grain sector over recent weeks came in the CBOT soft red winter wheat futures market.

Source: CQG

On Oct. 16, December CBOT wheat futures reached a high of $6.3075 per bushel, the highest price since 2014.

Technical resistance had been the August 2018 high at $5.93 and at $6.1575 per bushel in June 2015.

Six years ago, CBOT wheat futures rose to $6.77 in December 2014 and $7.35 per bushel in May 2014. Wheat for December delivery on the CBOT was trading at over $6.25 per bushel on Friday, Oct. 16.

Elevated grains translate to higher meat prices

One of the primary determinates of meat prices is feed, and grains are the basis for animal feeds. Soybean meal is one of the direct inputs for raising chickens, cattle and hogs.

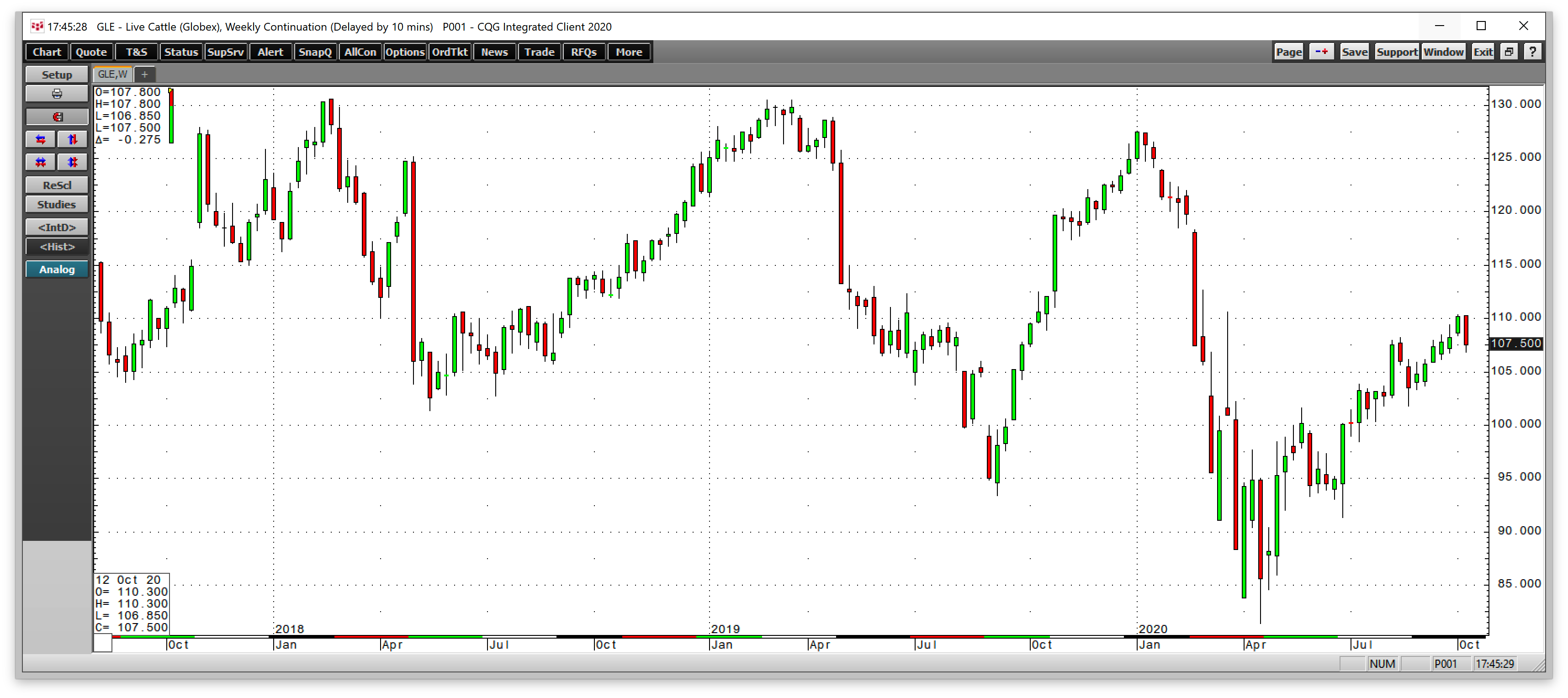

Source: CQG

The weekly chart of live cattle futures shows that the price of beef has been trending higher since reaching a bottom in late April 2020.

Source: CQG

After reaching a bottom at 37 cents per pound in April, the price of nearby lean hog futures has been moving up and was at almost the 70 cents per pound level at the end of last week.

The price of pork fell to the lowest price since 2002 and has recovered. While the global pandemic and issues with the supply chain caused beef and pork prices to move to multi-year lows earlier in 2020, both have recovered. Elevated grain prices increase feed prices for animal protein producers and are a bullish factor for the meats.

Mother Nature could throw the commodities that feed the world a curveball in 2021

Soybeans, corn and wheat prices have all moved into bullish trends over the past months. Soybeans and wheat rose to multi-year highs, while corn is flirting with the $4 level.

The focus will now shift to the 2020/2021 crop year below the equator. However, since the world’s leading producers of the grains and oilseed are in the northern hemisphere, the weather and demand in the planting, growing and harvest seasons in 2021 will determine if a bull market in the grain sector continues.

The last time the markets experienced a significant supply issue was during the 2012 drought, which pushed the prices of corn and soybeans to all-time highs at $8.4375 and $17.9475 per bushel, respectively. In 2012, wheat rose to a high of $9.4725. Even though the grains have experienced significant rallies, there is a lot of room for increased prices.

According to the US Census Bureau, each quarter, the global population increases by approximately twenty million people. Over eight years, that amounts to 640 million more mouths to fill with nutritional requirements. Any supply issues could send prices to higher levels than during the last bull market that took prices to highs in 2012.

Mother Nature determines the weather. She will be the ultimate arbiter of the path of least resistance of grain prices in 2021. Time will tell if the recent rally is just the start of a bull market in the grain sector.