GBP/JPY Daily Outlook

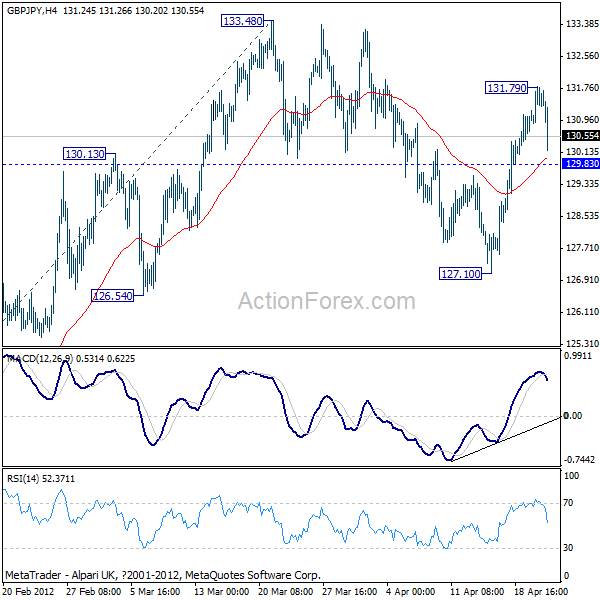

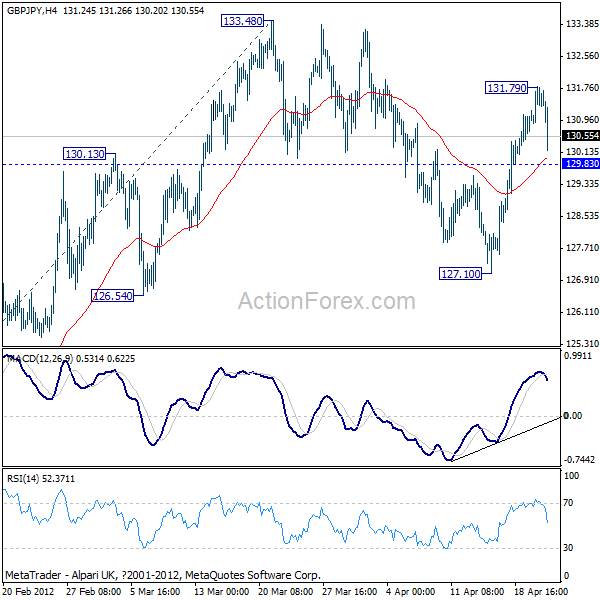

Daily Pivots: (S1) 130.96; (P) 131.37; (R1) 131.90

Today's retreat from 131.79 dragged 4 hours MACD below signal line and turn intraday bias neutral first. At this point, with 129.83 minor support intact, another rise is mildly in favor. Above 131.79 will target 133.48 first. Break will confirm resumption of whole rise from 117.29. Though, below 129.83 will flip bias back to the downside for 127.10 and possibly below to extend the correction from 133.48.

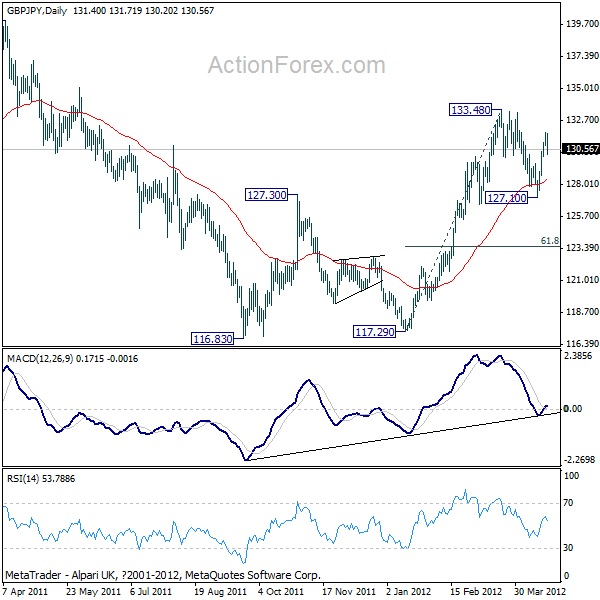

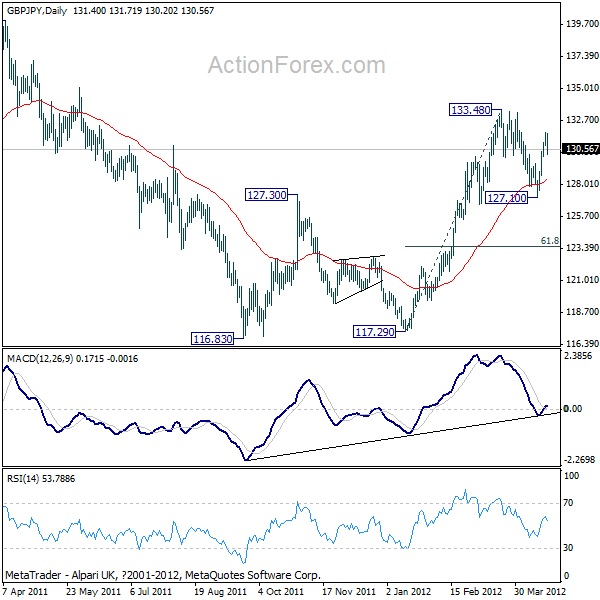

In the bigger picture, with 126.54 support intact, rise from 117.29 should still be in progress. Current development is still in line with the view that choppy decline from 163.05 is finished at 116.83 already. We'd favor further rise to 140.02 key resistance level next. Decisive break there will confirm this bullish case and target 163.05 key resistance next. Nonetheless, another fall and break of 126.54 will put focus back to 116.83 low instead.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

EUR/JPY Daily Outlook

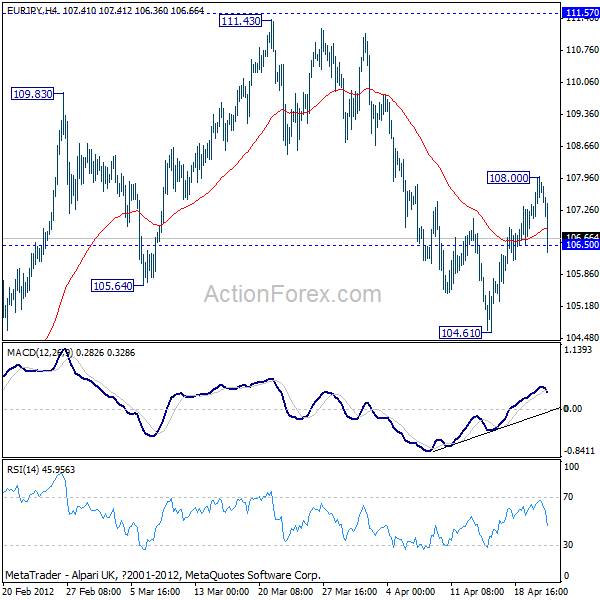

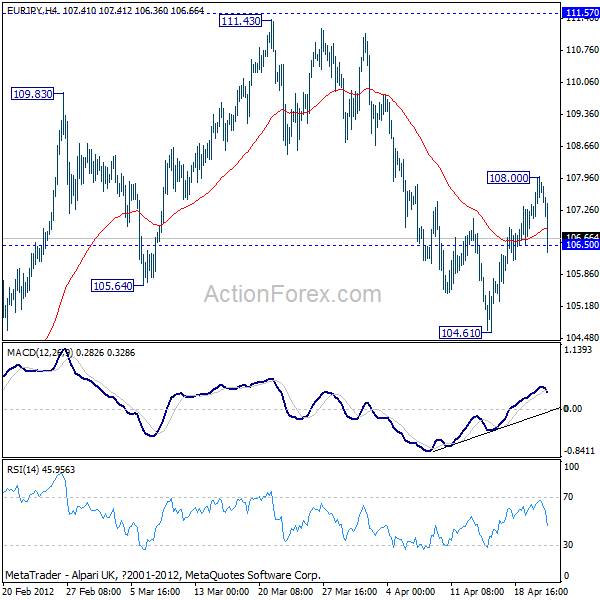

Daily Pivots: (S1) 107.24; (P) 107.61; (R1) 108.13

The break of 106.50 minor support indicates that recovery from 104.61 is possibly completed at 108.00 already. Intra-day bias is flipped back to the downside. After all, price actions from 111.43 are treated as a correction and deeper decline could be seen to 104.61 and below. Above 108.00 will bring another rise towards 111.43. But note again that more consolidative trading is expected below 111.43 in the near term before a break out at latter stage.

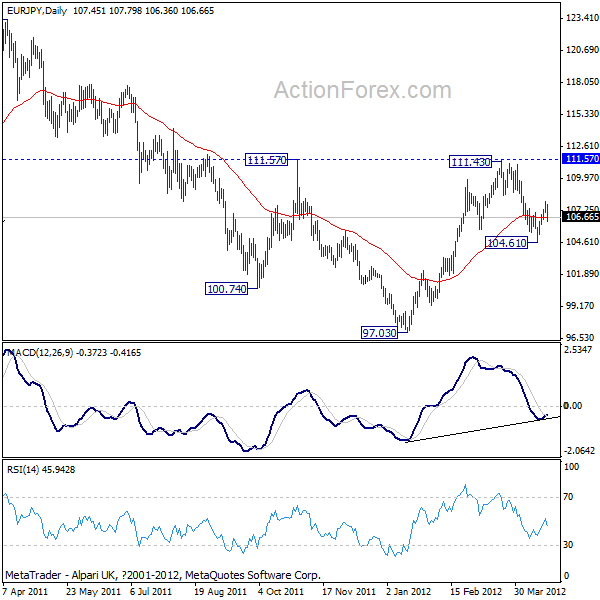

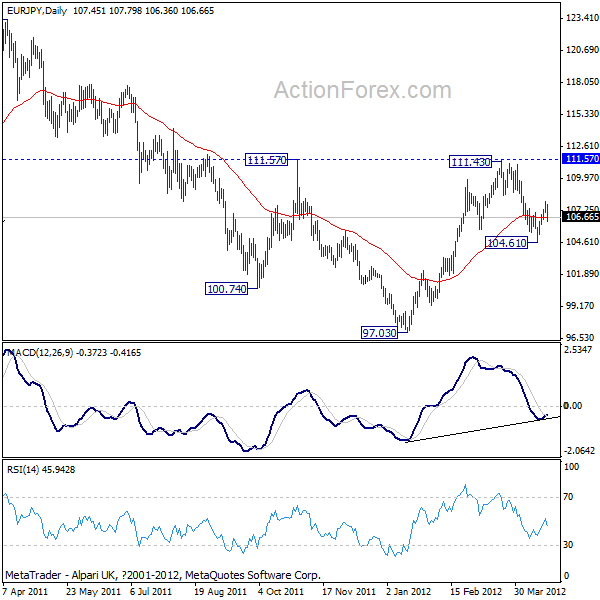

In the bigger picture, the question remains on whether downtrend from 169.96 has completed 97.03 and the picture is unclear. There were loss of medium term downside momentum as seen in convergence condition in weekly MACD. But rebound from 97.03 lacked sustainable strength to break through 111.57 yet. We'll stay neutral first. Note that firstly, while another fall cannot be ruled out yet, the break of 97.03 could be marginal. Meanwhile, sustain trading above 111.57 should raise much odds for the case that EUR/JPY's trend is reversing.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 130.96; (P) 131.37; (R1) 131.90

Today's retreat from 131.79 dragged 4 hours MACD below signal line and turn intraday bias neutral first. At this point, with 129.83 minor support intact, another rise is mildly in favor. Above 131.79 will target 133.48 first. Break will confirm resumption of whole rise from 117.29. Though, below 129.83 will flip bias back to the downside for 127.10 and possibly below to extend the correction from 133.48.

In the bigger picture, with 126.54 support intact, rise from 117.29 should still be in progress. Current development is still in line with the view that choppy decline from 163.05 is finished at 116.83 already. We'd favor further rise to 140.02 key resistance level next. Decisive break there will confirm this bullish case and target 163.05 key resistance next. Nonetheless, another fall and break of 126.54 will put focus back to 116.83 low instead.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 107.24; (P) 107.61; (R1) 108.13

The break of 106.50 minor support indicates that recovery from 104.61 is possibly completed at 108.00 already. Intra-day bias is flipped back to the downside. After all, price actions from 111.43 are treated as a correction and deeper decline could be seen to 104.61 and below. Above 108.00 will bring another rise towards 111.43. But note again that more consolidative trading is expected below 111.43 in the near term before a break out at latter stage.

In the bigger picture, the question remains on whether downtrend from 169.96 has completed 97.03 and the picture is unclear. There were loss of medium term downside momentum as seen in convergence condition in weekly MACD. But rebound from 97.03 lacked sustainable strength to break through 111.57 yet. We'll stay neutral first. Note that firstly, while another fall cannot be ruled out yet, the break of 97.03 could be marginal. Meanwhile, sustain trading above 111.57 should raise much odds for the case that EUR/JPY's trend is reversing.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />