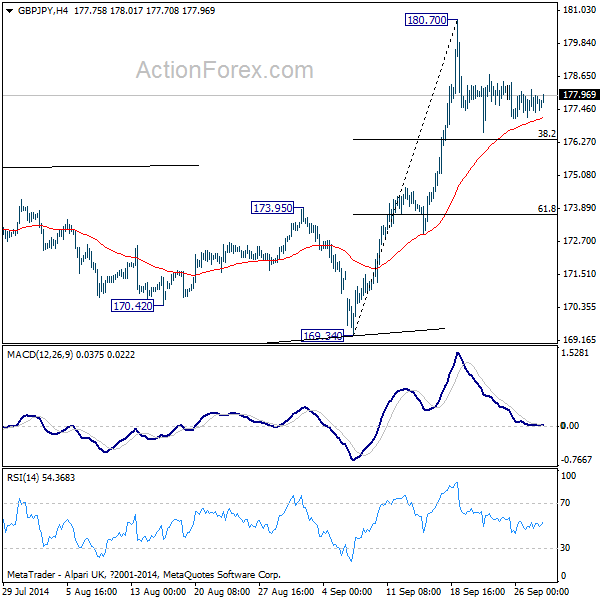

GBP/JPY

Daily Pivots: (S1) 177.30; (P) 177.74; (R1) 178.25;

Intraday bias in GBP/JPY remains neutral as consolidation from 180.70 continues. Downside of consolidation would be contained by 38.2% retracement of 169.34 to 180.70 at 176.36 and bring another rise. Above 180.70 will target next long term fibonacci level at 183.96. Though, firm break of 176.36 will target 61.8% retracement 173.67 and below.

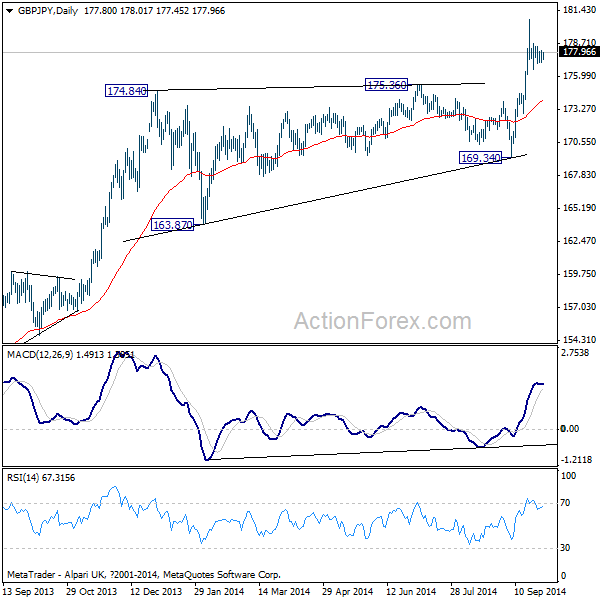

In the bigger picture, the strong break of 175.36 confirmed larger up trend from 116.83 low has resumed. Current rise would now extend to 50% retracement retracement of 251.09 to 116.83 at 183.96. Current acceleration suggests that such fibonacci level would be taken out and GBP/JPY would target 61.8% retracement at 199.80. Meanwhile, outlook will stay bullish as long as 169.34 support holds, in case of deep pull back.

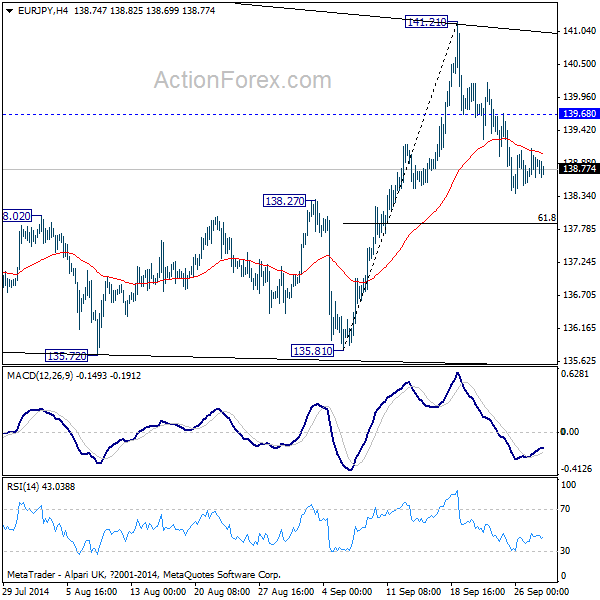

EUR/JPY

Daily Pivots: (S1) 138.61; (P) 138.87; (R1) 139.16;

As noted before, EUR/JPY's actions from 145.68 are probably developing into a triangle pattern with fall from 141.21 as the last wave. Deeper decline is mildly in favor to 135.72. But we'd expect strong support above 135.50 key level to bring reversal. On the upside, above 139.68 minor resistance will turn bias back to the upside for retreating 141.21 resistance. Break of 141.21 will target 143.78/145.68 resistance zone.

In the bigger picture, the strong rebound from 55 weeks EMA, with 135.50 support intact, suggests that the up trend from 94.11 long term bottom is still in progress. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59. On the downside, again, sustained break of 135.50 key support level will confirm medium term reversal and would target 124.95 support and below.