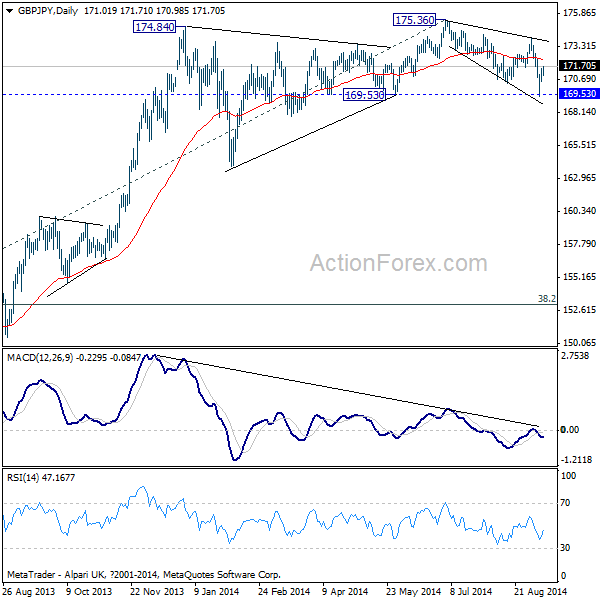

GBP/JPY

Daily Pivots: (S1) 170.52; (P) 171.02; (R1) 171.52;

The breach of 171.67 minor resistance suggested that the GBP/JPY has defended 169.53 key support successfully. Intraday bias is turned back to the upside or 173.95 resistance first. Break will target a test on 175.36 high. Meanwhile again, break of 169.53 will carry larger bearish implication and will extend the fall from 175.36.

In the bigger picture, the up trend from 116.83 (2011 low) continued to lose upside momentum. This could be seen in bearish divergence condition in daily MACD. And, weekly MACD continued to trend down. Sustained break of 169.53 support should confirm medium term topping at 1175.36 and turn outlook bearish for 38.2% retracement of 116.83 to 175.36 at 153.00. Before that, another rally cannot be ruled out. But in that case, we'd expect strong resistance below 50% retracement retracement of 251.09 to 116.83 at 183.96 to bring reversal.

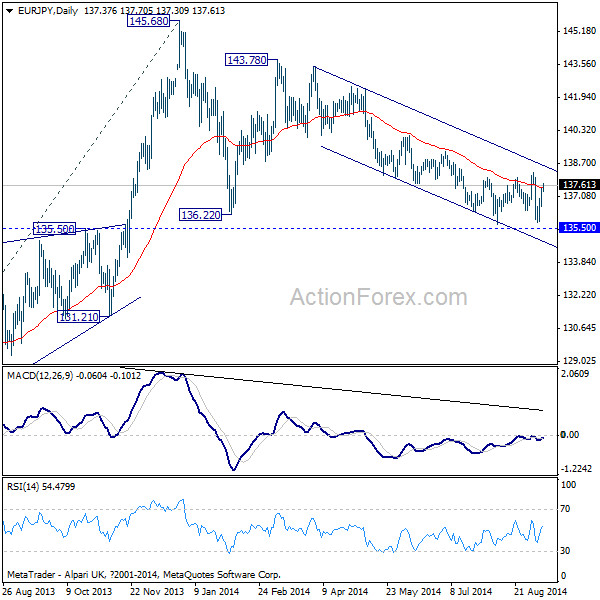

EUR/JPY

Daily Pivots: (S1) 136.84; (P) 137.17; (R1) 137.73;

Intraday bias in the EUR/JPY remains neutral for the moment. Focus stays on 135.50 key support level. Decisive break there will carry larger bearish implication and would target 131.21 support next. On the upside, break of 138.27 will indicate near term reversal instead and will bring stronger rebound back towards 139.27 resistance.

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in weekly MACD. However, EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.