GBP/JPY Daily Outlook

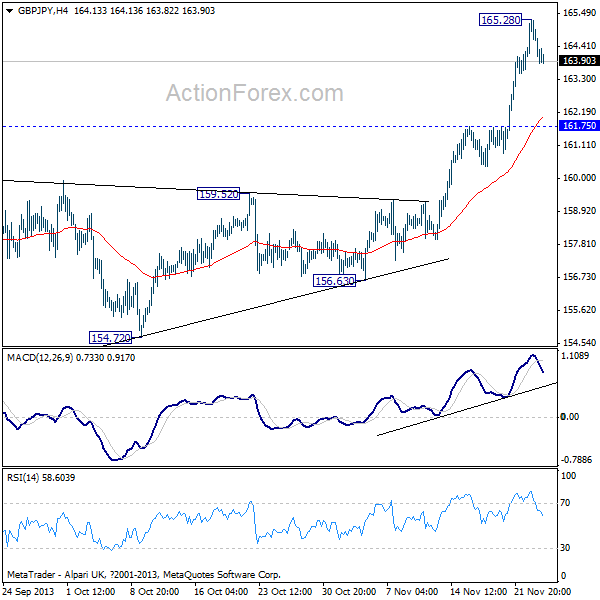

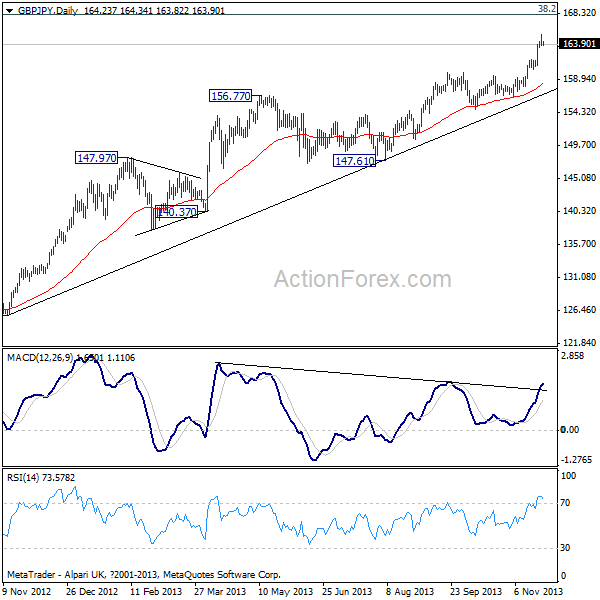

Daily Pivots: (S1) 163.62; (P) 164.44; (R1) 165.08;

A temporary top is formed at 165.28 in the GBP/JPY and intraday bias is turned neutral first. Some consolidations would be seen but downside should be contained by 161.75 resistance turned support and bring another rally. Above 165.28 will target 168.11 long term fibonacci level next.

In the bigger picture, there is no clear sign of topping and indeed, the cross might be building upside momentum again. We'd be cautious on resistance from 38.2% retracement of 251.09 to 116.83 at 168.11 to bring medium term topping. But, a sustained break there will pave the way to 50% retracement at 183.96 and above. GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" height="600" width="600" />

GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" height="600" width="600" /> GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" height="600" width="600" />

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" height="600" width="600" />

EUR/JPY Daily Outlook

Daily Pivots: (S1) 136.97; (P) 137.47; (R1) 137.94;

A temporary top is in place in the EUR/JPY at 137.98 after hitting channel resistance and intraday bias is turned neutral first. Some consolidations could be seen. But as long as 135.93 minor support holds, another rally remains mildly in favor. Above 137.98 will target 139.21 key resistance next. Though, break of 135.93 will turn bias back to the downside for lower channel support.

In the bigger picture, at this point, we'd still expect strong resistance from 139.21 and 61.8% retracement of 169.96 to 94.11 at 140.98 to complete the rally from 94.11 and form a medium term top. Break of 131.21 support will bring correction back to 124.95 and below. Though, the uptrend from 94.11 should resume after completing the anticipated correction. EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" height="600" width="600" />

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" height="600" width="600" /> EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" height="600" width="600" />

EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" height="600" width="600" />