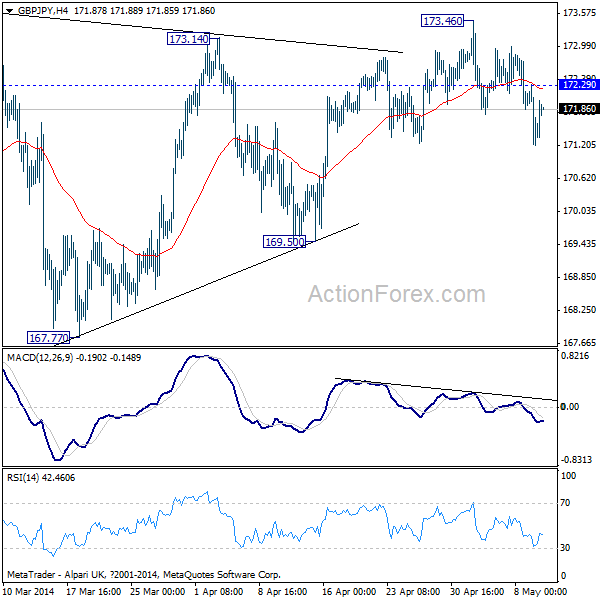

GBP/JPY

Daily Pivots: (S1) 171.03; (P) 171.66; (R1) 172.11;

Intraday bias in the GBP/JPY remains mildly on the downside in spite of recovery in Asian session. The current development suggests that consolidation from 174.84 could be starting the third leg. Deeper fall should be seen to 169.50 support. Break will confirm this bearish case and target 167.77 and below. On the upside, above 172.29 minor resistance will mix up the near term outlook again and turn bias neutral first.

In the bigger picture, the up trend from 116.83 (2011 low) might still extend to above 174.84. Nonetheless, upside momentum is rather unconvincing as seen in weekly MACD. Thus, even in that case, we'd expect strong resistance from 50% retracement retracement of 251.09 to 116.83 at 183.96 to limit upside. Meanwhile, sustained break of 163.87 support should confirm medium term topping at 174.84 and bring deeper correction to 147.61/156.77 support zone next.

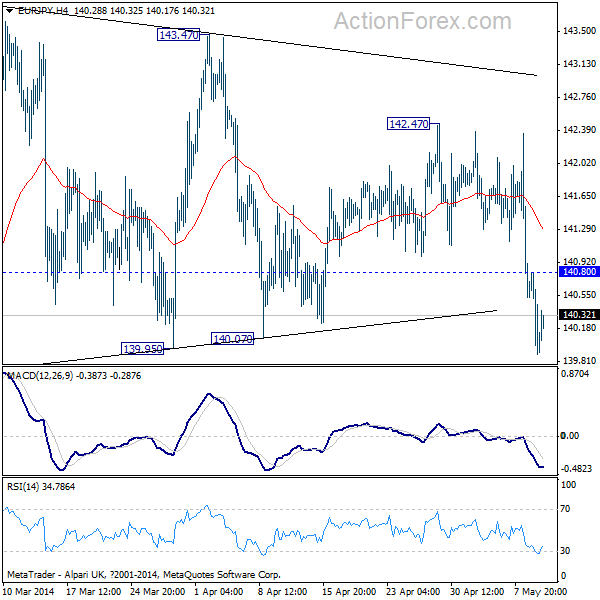

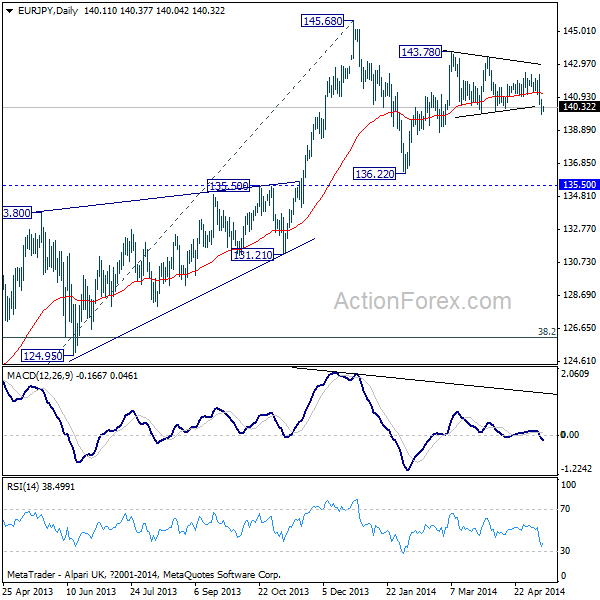

EUR/JPY

Daily Pivots: (S1) 139.68; (P) 140.24; (R1) 140.60;

Intraday bias in the EUR/JPY remains on the downside despite recovery in Asian session. The current development revived the case that rebound from 136.22 has completed at 143.78 already. Also, the consolidation pattern from 145.68 is starting the third leg. Deeper fall would be seen back to 136.22 support. On the upside, above 140.80 minor resistance will turn bias neutral and bring recovery first before staging another decline.

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in daily and weekly MACD. However, EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.