GBP/JPY Daily Outlook

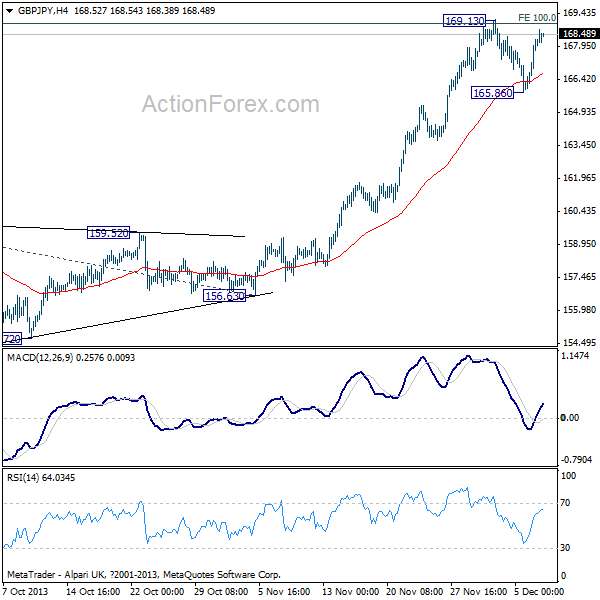

Daily Pivots: (S1) 166.65; (P) 167.45; (R1) 168.90;

Intraday bias in the GBP/JPY remains mildly on the upside for 169.13 near term resistance. Break will resume the larger rally and would target 161.8% projection of 147.61 to 159.98 from 156.63 at 173.72. Nonetheless, failure to break through 169.13, followed by break of 165.86 will bring another decline to extend the consolidation from 169.13.

In the bigger picture, there is no clear sign of topping and indeed, the cross might be building upside momentum again. We'd be cautious on resistance from 38.2% retracement of 251.09 to 116.83 at 168.11 to bring medium term topping. But sustained break there will pave the way to 50% retracement at 183.96 and above. GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600" />

GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600" /> GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600" />

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600" />

EUR/JPY Daily Outlook

Daily Pivots: (S1) 139.57; (P) 140.30; (R1) 141.67; More...

The EUR/JPY edges higher to 141.55 so far today as recent rally continues. Intraday bias stays on the upside and current rise would target 61.8% projection of 134.10 to 140.02 from 138.45 at 142.10 next. On the downside, break of 138.45 support is needed to signal near term topping. Otherwise, outlook will stay cautiously bullish now.

In the bigger picture, medium term up trend from 94.11 is still in progress and the EUR/JPY seems to be regaining upside momentum again. Sustained break of 61.8% retracement of 169.96 to 94.11 at 140.98 will pave the way to 76.4% retracement at 152.59. Meanwhile strong bounce off from 140.98 will bring pull back to 124.95 support and possibly below before staging another up trend.