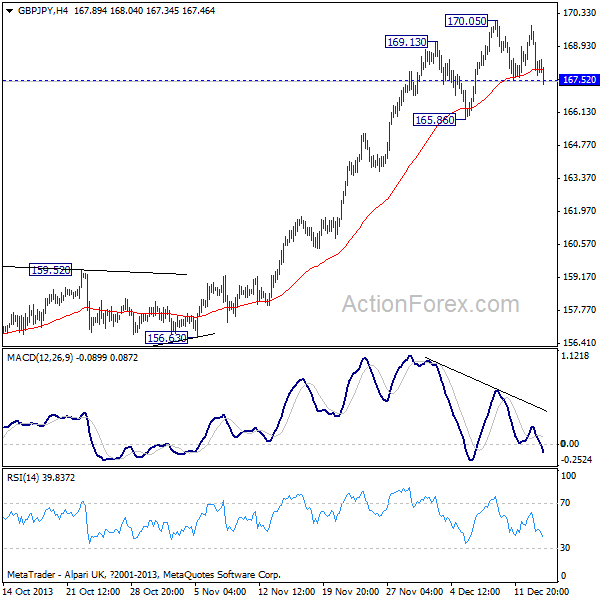

GBP/JPY Daily Outlook

Daily Pivots: (S1) 167.30; (P) 168.56; (R1) 169.41;

The GBP/JPY dips lower in Asian session today and the break of 167.52 minor support indicate that a near term top is formed at 170.05, on bearish divergence condition in 4 hours MACD. Intraday bias is back on the downside for 165.86 support. Break will target 55 days EMA (now at 162.05). But strong support would be seen above 159.98 to bring rebound. On the upside, decisive break of 170.05 is needed to confirm rally resumption. Otherwise, we'd expect corrective trading to extend.

In the bigger picture, break of 159.98 resistance turned support is needed to indicate medium term topping. Otherwise, outlook will stay cautiously bullish. Sustained break of 38.2% retracement of 251.09 to 116.83 at 168.11 will pave the way to 50% retracement at 183.96 and above. GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600">

GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600"> GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

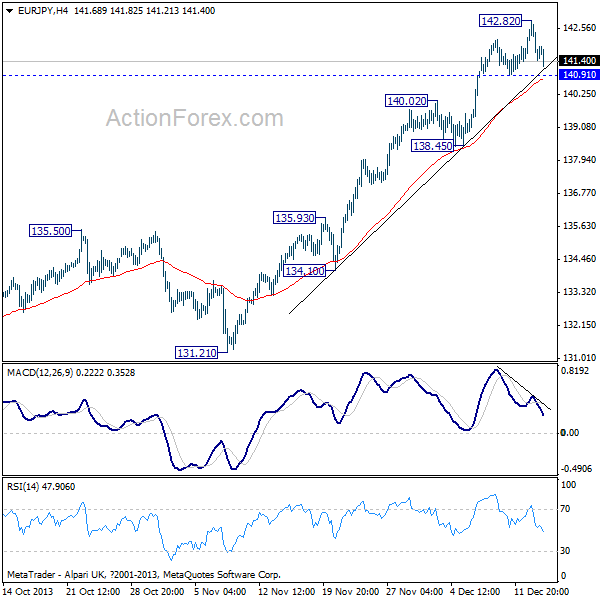

EUR/JPY Daily Outlook

Daily Pivots: (S1) 141.20; (P) 142.01; (R1) 142.61;

Intraday bias in the EUR/JPY remains neutral for the moment with focus on 140.91 minor support. A break there will indicate short term topping. In that case, intraday bias will be turned to the downside for pull back to to 138.45/140.02 support zone first. Meanwhile, sustained break of the channel resistance (now at 142.60) will pave the way to next long term fibonacci level at 152.59.

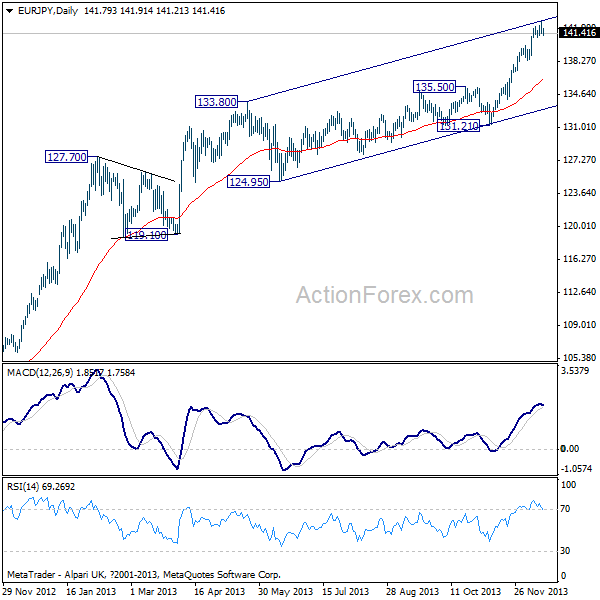

In the bigger picture, medium term up trend from 94.11 is still in progress and the EUR/JPY seems to be regaining upside momentum again. Sustained break of 61.8% retracement of 169.96 to 94.11 at 140.98 should now pave the way to 76.4% retracement at 152.59. Break of 135.50 resistance turned support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish.  EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600">

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600"> EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" width="600" height="600">

EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" width="600" height="600">