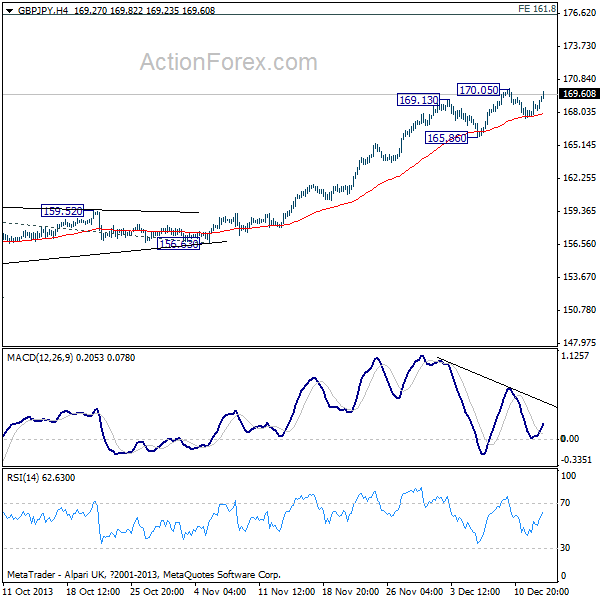

GBP/JPY Daily Outlook

Daily Pivots: (S1) 168.06; (P) 168.56; (R1) 169.50;

The GBP/JPY drew some support from 4 hours 55 EMA again and recovered. But, it's staying below 170.05 temporary top so far and intraday bias stays neutral first. Near term outlook will remain bullish as long as 165.86 support holds. Above 170.05 will target 161.8% projection of 147.61 to 159.98 from 156.63 at 173.72 next. However, break of 165.85 will indicate short term topping, on bearish divergence condition in 4 hours MACD and bring deeper pull back to 55 days EMA (now at 161.79).

In the bigger picture, there is no clear sign of topping and indeed, the cross might be building upside momentum again. We'd be cautious on resistance from 38.2% retracement of 251.09 to 116.83 at 168.11 to bring medium term topping. But sustained break there will pave the way to 50% retracement at 183.96 and above. GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600">

GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600"> GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

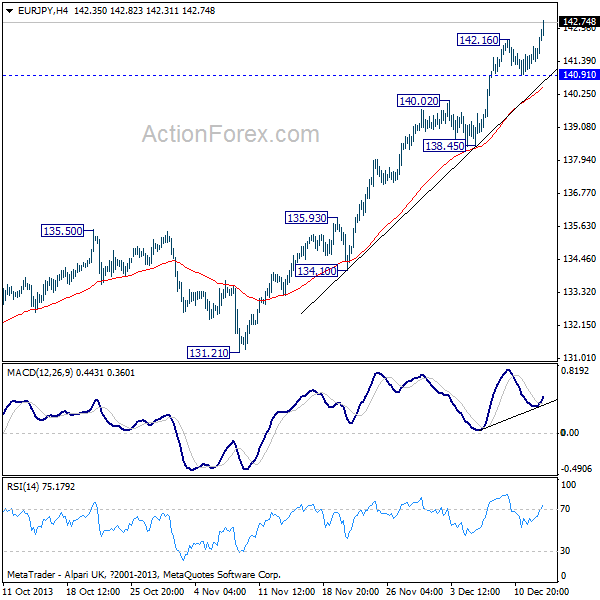

EUR/JPY Daily Outlook

Daily Pivots: (S1) 141.45; (P) 141.84; (R1) 142.54;

The EUR/JPY's rally resumed after brief consolidations and reaches as high as 142.82 so far. Intraday bias remains on the upside. Sustained break of the channel resistance (now at 142.60) will pave the way to next long term fibonacci level at 152.59. On the downside, break of 140.91 is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, medium term up trend from 94.11 is still in progress and the EUR/JPY seems to be regaining upside momentum again. Sustained break of 61.8% retracement of 169.96 to 94.11 at 140.98 should now pave the way to 76.4% retracement at 152.59.  EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600">

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600"> EUR/JPY" width="600" height="600">

EUR/JPY" width="600" height="600">