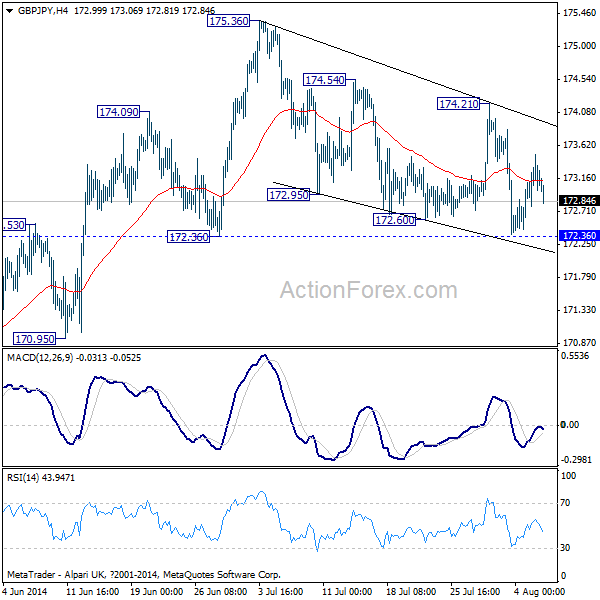

GBP/JPY

Daily Pivots: (S1) 172.82; (P) 173.15; (R1) 173.55;

Intraday bias in the GBP/JPY stays neutral with focus on 172.36 support. Decisive break there will confirm near term reversal and will target 170.95 support and then 169.53 key support level. Meanwhile, above 174.21 will suggest that price actions from 175.36 are mere a consolidation pattern. And that will turn bias back to the upside for 175.36 and above.

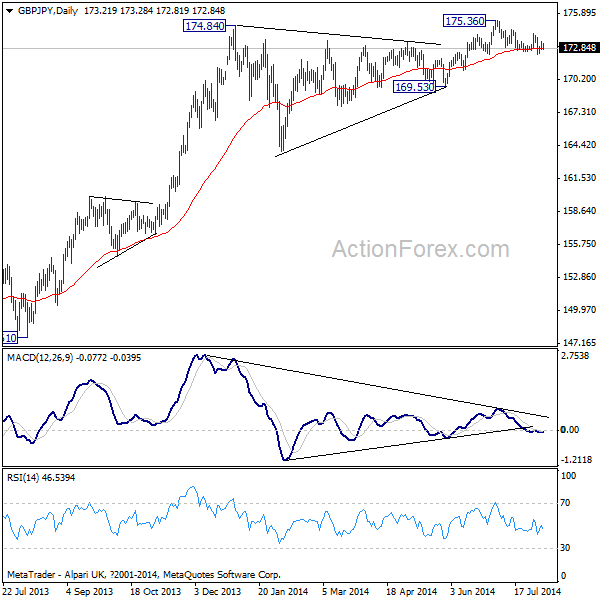

In the bigger picture, the up trend from 116.83 (2011 low) continued to lose upside momentum. This could be seen in bearish divergence condition in daily MACD. And, weekly MACD continued to trend down. There is no clear sign of reversal yet but a medium term top should be near. So, in case of another rise, we'd expect strong resistance below 50% retracement retracement of 251.09 to 116.83 at 183.96 to bring reversal. Meanwhile, sustained break of 169.53 support should confirm medium term topping and turn outlook bearish.

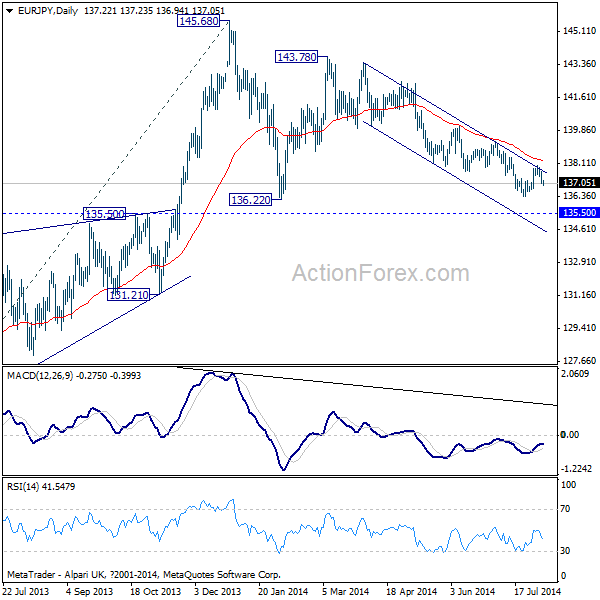

EUR/JPY

Daily Pivots: (S1) 136.96; (P) 137.33; (R1) 137.60;

TheEUR/JPY's break of 137.4 minor support dampened the bullish case of near term reversal and argues that the cross hasn't bottomed yet. Intraday bias is back on the downside for 136.36 support first. Break will put focus on 135.50 key support level. On the upside, above 138.02 resistance will turn bias back to the upside for 139.27 resistance. Break will confirm completion of the choppy fall from 143.78 and will turn near term outlook bullish.

In the bigger picture, loss of upside momentum was seen in bearish divergence condition in weekly MACD. However, the EUR/JPY is so far holding above 135.50 key support. Thus, there is no confirmation of trend reversal yet. Break of 145.68 will extend the up trend from 94.11 towards 76.4% retracement of 169.96 to 94.11 at 152.59 before topping. Meanwhile, break of 135.50 will confirm reversal and target 124.95 support.