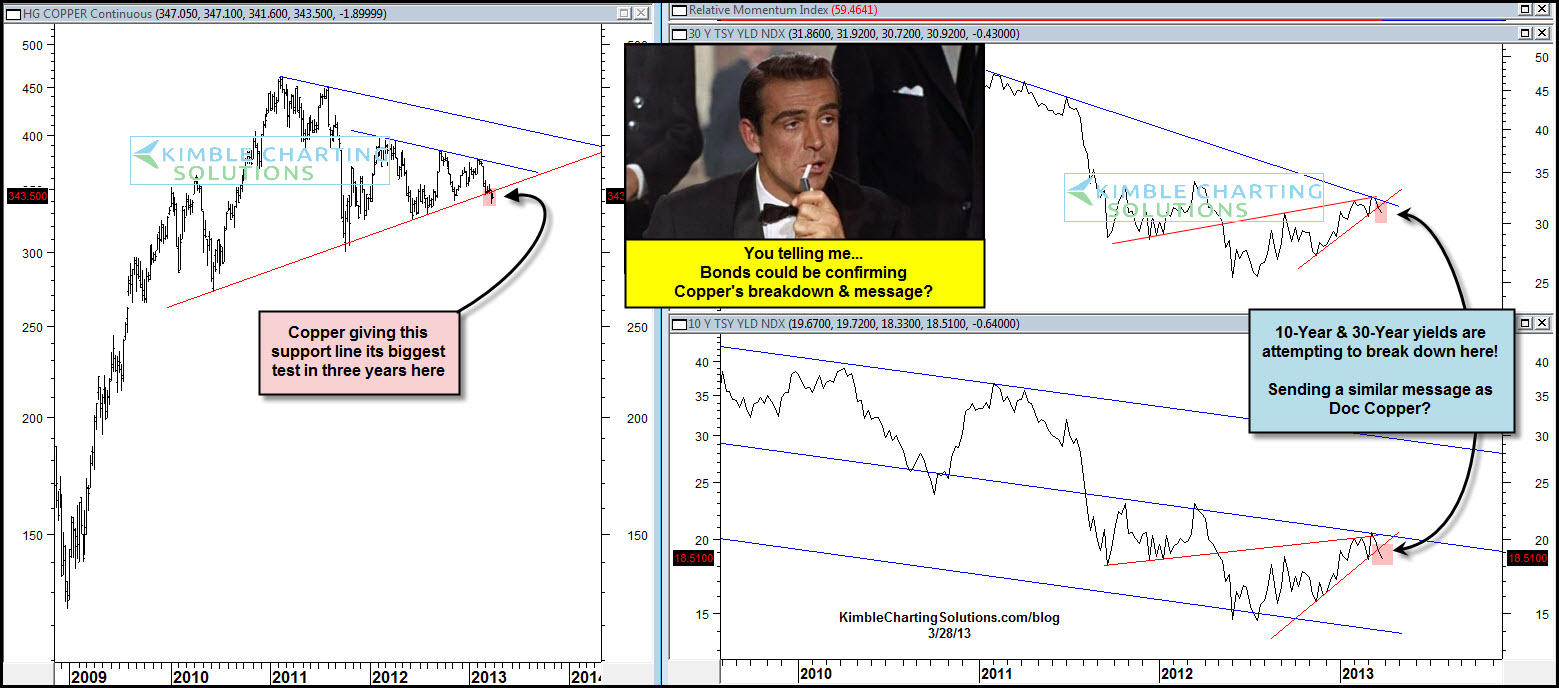

Many view Copper as a quality leading indicator for the global economy. The weakness of late has Copper in the upper left giving a multi-year support line its biggest test in three years. Do we have a breakdown at hand and a macro message of slowness taking place??? Some would say yes.

Government Bond traders are very keen to see global growth or the lack of. The yields on the 10-year and 30-year bonds are attempting to break support of bearish rising wedges.

A breakdown in yields would confirm the signal coming from Copper!

Who loves Government Bonds these days? The sentiment chart (left inset) reflecting bond sentiment was shared with Sector/Commodity Sentiment Extreme members a couple of weeks ago.

The chart reflects that bond bullish sentiment levels are reaching levels seldom seen over the past 7 years! I inverted yields in this chart, reflecting a breakout in price in both the 10-year and 30-year bonds.

Do Doc. Copper and Government bonds know something about the economy that the stock market (SPY) is not aware of? Stay tuned, this could get interesting...