Street Calls of the Week

You've heard it before, one person’s trash is another’s treasure. Some see a pile of junk while others behold the makings of a masterpiece. It's the same way in the markets where you buy when there is blood in the streets. Blood or not, the high-yield debt market is in the midst of a sentiment shift.

Time To Get Out?

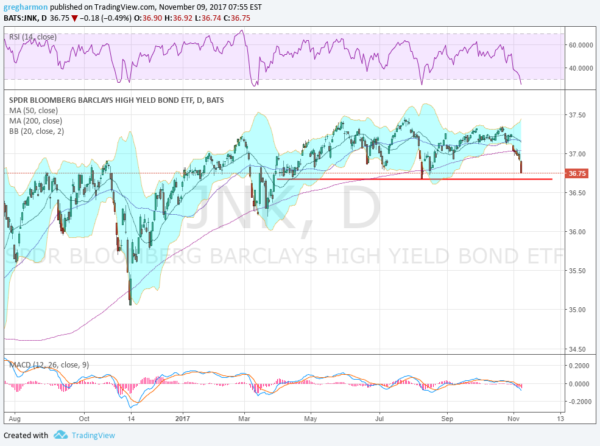

The chart below paints the picture using the high-yield ETF JNK, which has its share of bearish characteristics. First, RSI is in the bearish range while the MACD is falling. The price has also fallen below the 200-day SMA. It previously found a bid at that level, but that's not likely this time. And if that wasn't enough, major bond-market gurus are concerned.

Will it keep falling? Of course, it can.

but there are also signals of a drop in price that is overdone. About that RSI, it is now oversold, like it was in August where it bounced. The price is also well outside of the Bollinger Bands®, often a place where price reverses. There is 6 month support nearby as well. None of these suggest you buy junk yet. You need confirmation of a reversal before that happens. But perhaps it is time to plan what you will create with this pile of trash.