Investing in the stock market can be quite stressful, especially during periods of volatility…but investing doesn’t have to be nerve-racking. Investing legend T. Rowe Price captured the beneficial sentiments of growth investing beautifully when he stated the following:

“The growth stock theory of investing requires patience, but is less stressful than trading, generally has less risk, and reduces brokerage commissions and income taxes.”

What I’ve learned over my investing career is that fretting over such things as downgrades, management changes, macroeconomic data, earnings misses, geopolitical headlines, and other irrelevant transitory factors leads to more heartache than gains. If you listen to a dozen so-called pundits, talking heads, journalists, or bloggers, what you quickly realize is that all you are often left with a dozen different opinions. Opinions don’t matter…the facts do.

Finding Multi-Baggers: The Power of Compounding

Rather than succumbing to knee-jerk reactions from the worries of the day, great long-term investors realize the benefits of compounding. We know T. Rowe Price appreciated this principle because he agreed with Nobel Prize winning physicist Albert Einstein’s view that “compounding interest” should be considered the “8th wonder of the world”.

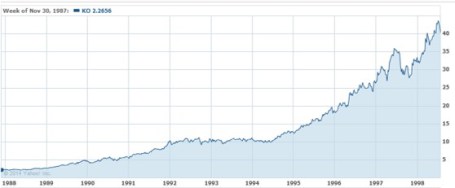

People generally refer to Warren Buffett as a “Value” investor, but in fact, despite the Ben Graham moniker, Buffett has owned some of the greatest growth stocks of all-time. For example, Coca Cola Company (NYSE:KO) achieved roughly a 20x return from 1988 – 1998, as shown below:

Source: Yahoo! Finance

If you look at other charts of Buffett’s long-term holdings, such as Wells Fargo & Company (NYSE:WFC), American Express Company (NYSE:AXP) and Procter & Gamble – Gillette (NYSE:PG), the incredible compounded gains are just as astounding.

In recent decades, there is no question that stocks have benefited from P/E expansion. P/E ratios, or the average price paid for stocks, has increased from the early 1980s as long-term interest rates have declined from the high-teens to the low single-digits, but the real lifeblood for any stock is earnings growth. As growth investor extraordinaire Peter Lynch once said:

“People may bet on hourly wiggles of the market but it’s the earnings that waggle the wiggle long term.”

As Lynch also pointed out, it only takes the identification of a few great multi-bagger stocks every decade to compile a tremendous track record, while simultaneously hiding many sins:

“Fortunately the long-range profits earned from really good common stocks should more than balance the losses from a normal percentage of such mistakes.”

The Scarcity of Growth

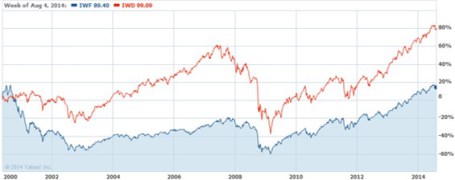

Ever since the technology bubble burst in 2000, Growth stocks have felt the pain. Since that period, the Russell 1000 Value index (NYSE:IWD) has almost doubled in value and outperformed the Russell 1000 Growth index (NYSE:IWF) by more than +60% (see chart below):

Source: Yahoo! Finance

Although the R1KG index has yet to breach its previous year 2000 highs, ever since the onset of the Great Financial Crisis (end of 2007), the R1KG index has been on the comeback trail. Now, the Russell 1000 Growth index has outperformed its Value sister index by an impressive +25% (see chart below):

Source: Yahoo! Finance

Why such a disparity? Well, in a PIMCO “New Normal & New Neutral” world where global growth forecasts are being cut by the IMF and a paltry advance of 1.7% in U.S. GDP is expected, investors are on a feverish hunt for growth. U.S. investors are myopically focused on our 2.34% 10-Year Treasury yield, but if you look around the rest of the globe, many yields are at multi-hundred year lows. Consider 10-Year yields in Germany sit at 0.96%; Japan 10-Year at 0.50%; Ireland 10-Year at 1.98%; and Hong Kong 10-Year at 1.94% as a few examples. This scarcity of growth has led to outperformance in Growth stocks and this trend should continue until we see a clear sustainable acceleration in global growth.

If we dig a little deeper, you can see the 25% premium in the R1KG P/E ratio of 20.8x vs. 16.7x for the R1KV is well deserved. Historical 5-year earnings growth for the R1KG has been +52% higher than R1KV (17.8% vs. 11.7%, respectively). Going forward, the superior earnings performance is expected to continue. Long-term growth for the R1KG index is expected to be around 55% higher than the R1KV index (14% vs 9%).

In this 24/7, Facebook, Twitter society we live in, investing has never been more challenging with the avalanche of daily news. The ultra-low interest rates and lethargic global recovery hasn’t made my life at Sidoxia any easier. But one thing that is clear is that the investment tide is not lifting all Growth and Value stocks at the same pace. The benefits of long-term Growth investing are clear, and in an environment plagued by a scarcity of growth, it is becoming more important than ever when reviewing your investment portfolios to ask yourself, “Got Growth?”

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in KO/PG (non-discretionary accounts) and certain exchange traded fund positions, but at the time of publishing SCM had no direct position in TWTR, FB, WFC, AXP, IWF, IWD or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.