Heads the RBA cuts, tails the RBA stays on hold!

From the 24 Bloomberg economists surveyed, 10 have voted for a cut and the other 14 a hold. That is a true split down the middle and is as close as you’re ever going to get leading into a central bank decision. This is why today’s RBA meeting is so eagerly anticipated by traders.

Before last week, things were relatively smooth sailing for the RBA to keep rates steady. Domestic indicators such as employment and economic growth were strong, while the increase in commodity prices and Chinese demand for the country’s major exports had picked up.

But last week’s headline inflation number changed everything.

“AUD CPI q/q (-0.2% v +0.3% expected and +0.4% previous)”

The traditional indicator that the RBA uses to adjust monetary policy around just dropped for the first time in 7 years! This number is what has turned markets from a unanimous on hold prediction, to a 50/50. Once again, heads they cut, tails they hold.

To highlight the importance that markets have placed on the CPI release, the 30 day cash rate futures market has re-priced since last week from barely a 15% chance they cut, to around a 60% chance after the CPI release… In a week before the meeting…. The same week that Stevens delivered a speech in New York talking down the effectiveness of monetary policy alone in today’s global low interest rate environment. See where I’m going with this?

Stevens is known as a conservative central banker and has stated numerous times that the 2-3% target band for inflation is ‘over the entire cycle’. A cycle that we are reaching extremes of right now. Can you see him and his board panicking? I don’t think I can.

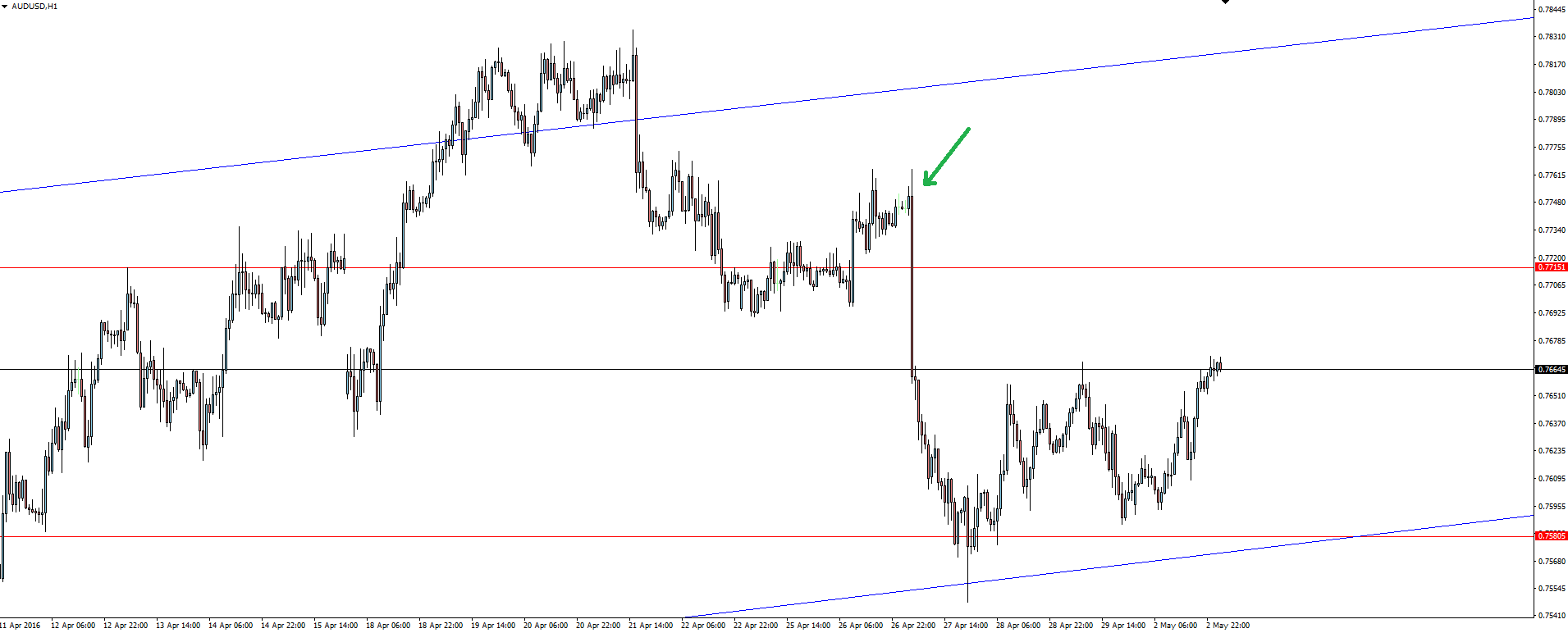

AUD/USD Hourly:

The above 4 hour AUD/USD chart shows the drop that the Aussie experienced following the CPI release. But as you can see, price has retraced half of that drop. This is the forex market reflecting the uncertainty that the market shows around today’s decision and sets up nicely for a rip in either direction.

Scenario trees for this release just feel useless. I asked yesterday whether you’re a trader or punter and the risk of rips in either direction are there.

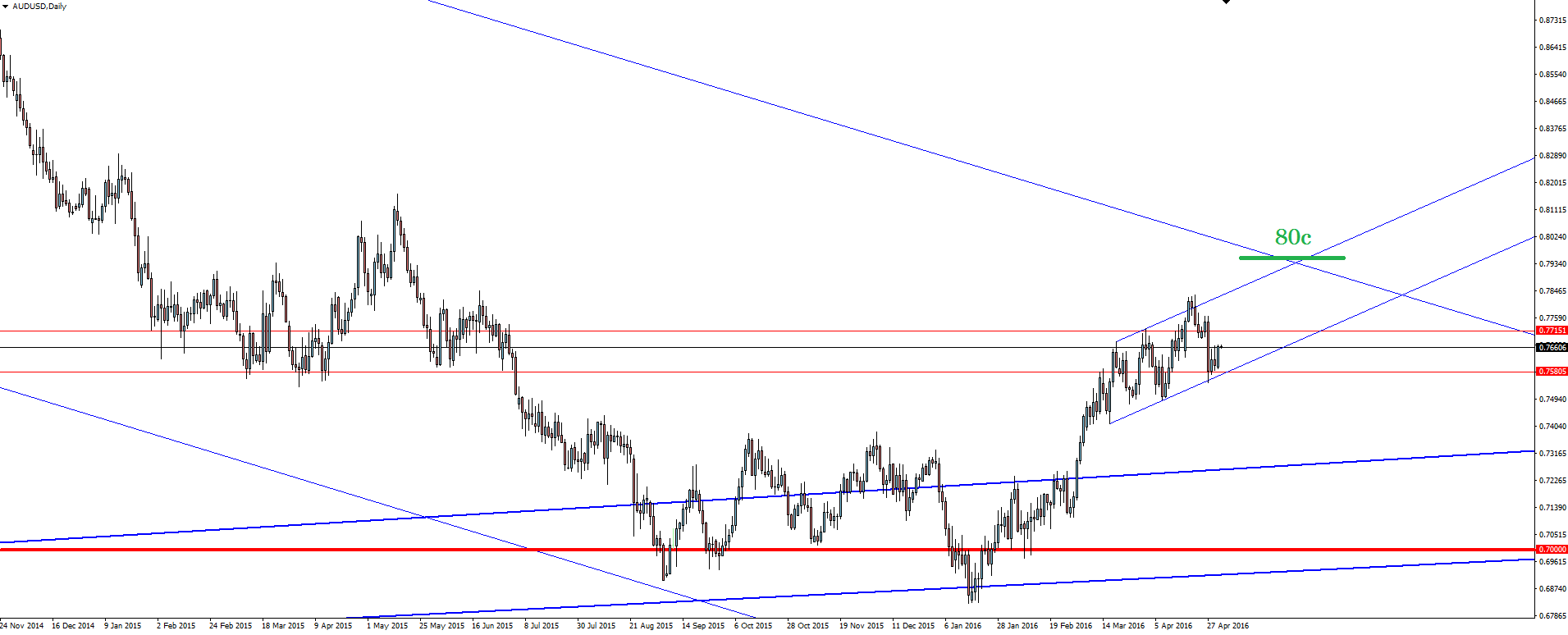

Zooming out into the daily and you can see that the hugely significant psychological level of 80.000 coincides with a confluence of short and long term trend line resistance. Let's for arguments sake say that last week’s CPI came in at expectation. External factors meant that the Aussie was on track to reach this zone anyway.

If the RBA doesn’t cut, the jump upward will most likely be sharp, but the bank wont experience the same pressure of an appreciating AUD because it was heading there anyway. I think this is a hugely significant factor for a conservative central bank and while the initial whip may not be worth trading, I can’t help but feel that current pricing sees the risk to the upside being much greater.

Take that as you will.

Finally, while not traditionally a market mover, tonight’s election campaign federal budget may be slightly different. This isn’t the place to go into Australian politics but be aware that the release is barely a few hours following the RBA decision.

On the Forex Calendar Tuesday

AUD: Building Approvals m/m

CNY: Caixin Manufacturing PMI

AUD: Cash Rate

AUD: RBA Rate Statement

GBP: Manufacturing PMI

AUD: Annual Budget Release

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices, spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, secure Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.