The Goodyear Tire & Rubber Company (NASDAQ:GT) plans to launch its fleet services business model for shared mobility providers with an aim to advance urban fleet operations.

Along with STRATIM, the company will initiate an advanced superior tire maintenance program for vehicles. STRATIM is a startup offering technology platform to track, monitor and oversee fleet maintenance for around 10,000 vehicles, which operate under about 50 mobility services in 25 markets across North America.

Armed with Goodyear's artificial intelligence technology, this pilot program will help STRATIM’s clients foresee the need to replace or service tires, which in turn would advance their overall fleet management ability and maximize the fleet uptime.

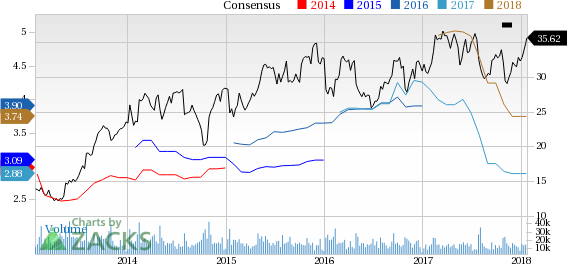

The Goodyear Tire & Rubber Company Price and Consensus

Vehicle maintenance and its operating uptime are the two significant parameters for mobility service providers and Goodyear’s predictive analytics as well as its fleet solutions will help all mobility service providers achieve this benchmark.

Further, the company forecasts mobile fleet solutions to be an emerging market for passenger vehicles and also seeks to offer this upcoming market with its network of tire and service locations. While at the same time, it wishes to continue serving its traditional customers.

Goodyear regularly unveils innovative products and services to boost sales. Last September, it showcased a non-pneumatic or airless turf tire for passenger and commercial vehicles, particularly for fleet applications. This new tire technology is in line with the company’s strategy to develop maintenance-free technologies.

Price Performance

Shares of Goodyear have gained 5% in the last three months, outperforming the 4% rise of the industry it belongs to.

Zacks Rank & Key Picks

Goodyear has a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are Oshkosh Corporation (NYSE:OSK) , Lear Corporation (NYSE:LEA) and Allison Transmission Holding, Inc. (NYSE:ALSN) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Oshkosh has an expected long-term growth rate of 14.5%. Shares of the company have gained 7.9% in the last three months.

Lear has an expected long-term growth rate of 7.1%. In the last three months, shares of the company have climbed 10.40%.

Allison Transmission has an expected long-term growth rate of 10%. Shares of the company have increased 11.8% in the last three months.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Lear Corporation (LEA): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Original post