The Goodyear Tire & Rubber Company (NASDAQ:GT) is one of the world’s largest tire manufacturing companies, selling under Goodyear, Kelly, Dunlop, Fulda, Debica, Sava and various other brands. The company regularly launches innovative products and services to boost sales. Although Goodyear generates worldwide sales, North America is its leading market. It is also expanding in emerging markets to boost profits. Moreover, its capital allocation plan is expected to enhance shareholder value.

However, declining revenues and pricing pressure are concerns. Moreover, economic weakness in Latin America and Brazil are other challenges.

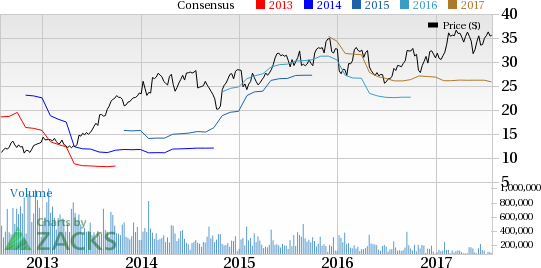

Estimate Trend & Surprise History

Investors should note that the second-quarter earnings estimate for Goodyear have been declining over the past 7 days.

The company delivered positive earnings surprises in each of the last four quarter with an average beat of 9.77%. Investors have been eagerly awaiting Goodyear’s latest earnings report to see whether it delivers an earnings beat in the first quarter as well.

Zacks Rank

Goodyear currently has a Zacks Rank #3 (Hold), but that could change following its earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from the company’s earnings announcement below:

Earnings

Goodyear reported adjusted earnings of 70 cents per share in the second quarter of 2017, missing the Zacks Consensus Estimate of 72 cents. Adjusted earnings were also lower than $1.16 generated in the year-ago quarter.

The Goodyear Tire & Rubber Company Price and EPS Surprise

Revenues

Goodyear logged revenues of $3.69 billion, missing the Zacks Consensus Estimate of $3.75 billion. Moreover, revenues also declined from $3.88 billion recorded year-ago. The decline was partly due to high raw material costs and challenging competitive environment.

Key Stats/Developments to Note

During the reported quarter, Goodyear repurchased 147,000 shares for $5 million under the previously announced $2.1 billion share repurchase program.

The company expects operating income in 2017 to be within the range of $1.6-1.65 billion, as against the previous expectation to be on par with the $2 billion recorded in 2016.

Market Reaction

Goodyear’s shares have decreased 8.63% in pre-market trading so far following the release. It would be interesting to see how the market reacts to the results during the trading session today.

Check back later for our full write up on Goodyear’s earnings report!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Original post