What a week. For the first time in a long time (December 2012) the bulls were not able to defend the line:

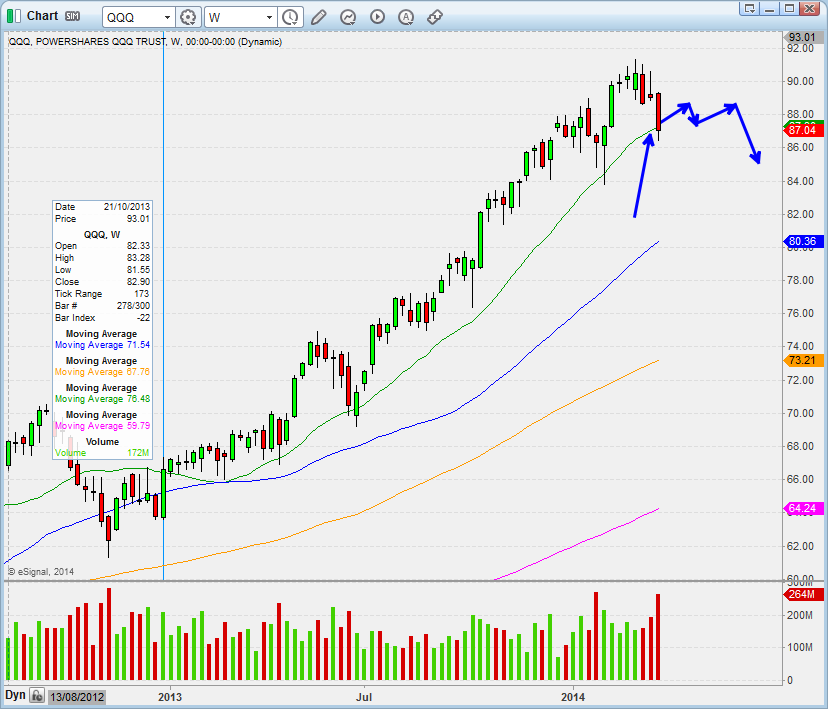

One of the most pertinent signs of the waning power of bulls is how long relief rallies can last — from a few months, to weeks, to days, and now only intraday. PowerShares QQQ ETF (NASDAQ:QQQ) gave a strong beginning reaction this morning only to fade and close at the lows UNDER the 20dma weekly. Goodbye sweet trend, it was nice knowing you.

At some point this coming week we imagine we will go over the line again but the more we test it, the flatter and more irrelevant it becomes. However, do note that the 20dma is ascending so it’s quite possible that we will go above it and go back and forth a few more times, thus flattening it, before breaking it down definitively.

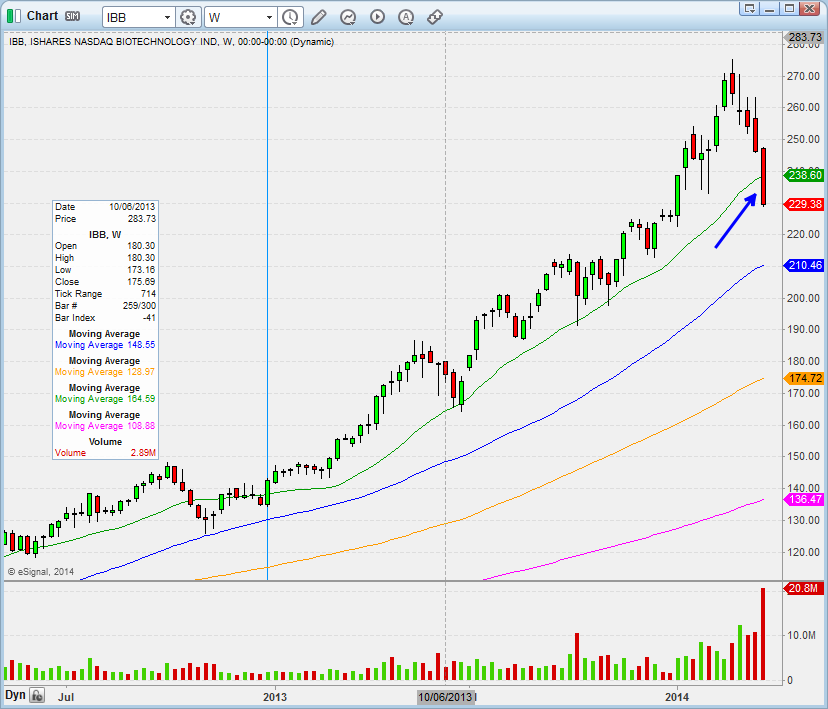

Today’s fade wasn’t a huge surprise as biotech was weak right from the get-go. As we posted at noon with QQQ still at the highs “the iShares Nasdaq Biotech ETF (NASDAQ:IBB) is saying — enjoy the relief rally but I am your truth”.

Big break of the 20dma weekly — look how smooth this trend had been from 2012. RIP weekly 20dma 2012-2014.

The question whether the trend for hot money (momentum darling and biotech) has changed is not on the table anymore — it has. The question now is whether we will keep seeing rotations into commodities, especially oils, or whether the tech correction will pull the rest of the market down with it.

Exxon Mobil (NYSE:XOM) is indicative of where the hot money is rotating into — big bad beautiful breakout here at 96.

And the SPDR Energy Select Sector Fund (ARCA:XLE) is proudly hitting new year highs today as momentum money sags.

What’s our plan? We had a partial QQQ rider that we were stopped out of on the fade and are going home flat. Our mistake was not swinging long XOM yesterday (a breakout that we had been stalking in our newsletter for days) and instead focusing on getting the bounce on QQQ. As we posted on Thursday, we knew the bulls would at least try to bounce it over the weekly 20dma and they did — what was surprising was how short-lived it was.

Going forward, we will be shifting our focus to commodities and see what sets up there while still trading the oversold tech stocks (will do that until it stops working). No oil stock is ever as fun as trading a Musk stock (SolarCity (NASDAQ:SCTY) Tesla (NASDAQ:TSLA) our favorite stocks to trade) but it is what it is — of course the goal of the job is not fun and games but consistently pulling money from the market. And for us the path of least resistance to do that is to follow the trends, even if it is in some old grandpa stocks.

Market is just getting interesting, stay smart and whatever you do, don’t get stubborn.

Disclosure:The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.