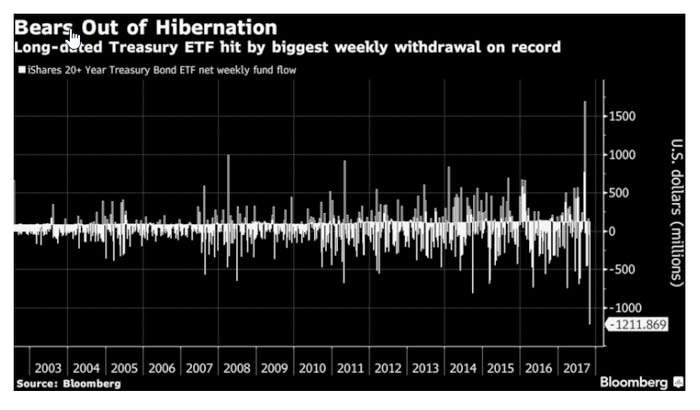

Money managers pulled $1.2 billion from the iShares 20+ Year Treasury Bond (NASDAQ:TLT) last week, the most on record, and the second-largest withdrawal among U.S.-listed exchange-traded funds across asset classes.

In what I view as a strong contrarian indicator, Long Treasury ETF Posts Record Outflow in Duration Rotation.

Some investors are paring exposure to longer-maturity U.S. debt as the Federal Reserve moves closer to normalizing borrowing conditions in the midst of a leadership transition.

The iShares iBoxx $ Investment Grade Corporate Bond ETF was hit by $460 million of outflows last week, its fourth-biggest withdrawal of the year. The $38.6 billion fund has an effective duration of 8.8 years, meaning it’s acutely vulnerable to price swings spurred by interest-rate changes.

By contrast, shorter-maturity Treasury and corporate funds saw inflows last week, including the SPDR Bloomberg Barclays (LON:BARC) Short Term High Yield ETF, the iShares 0-5 Year Invest Grade Corporate Bond (NASDAQ:SLQD) product and SPDR’s 1-3 Month Treasury Bill fund.

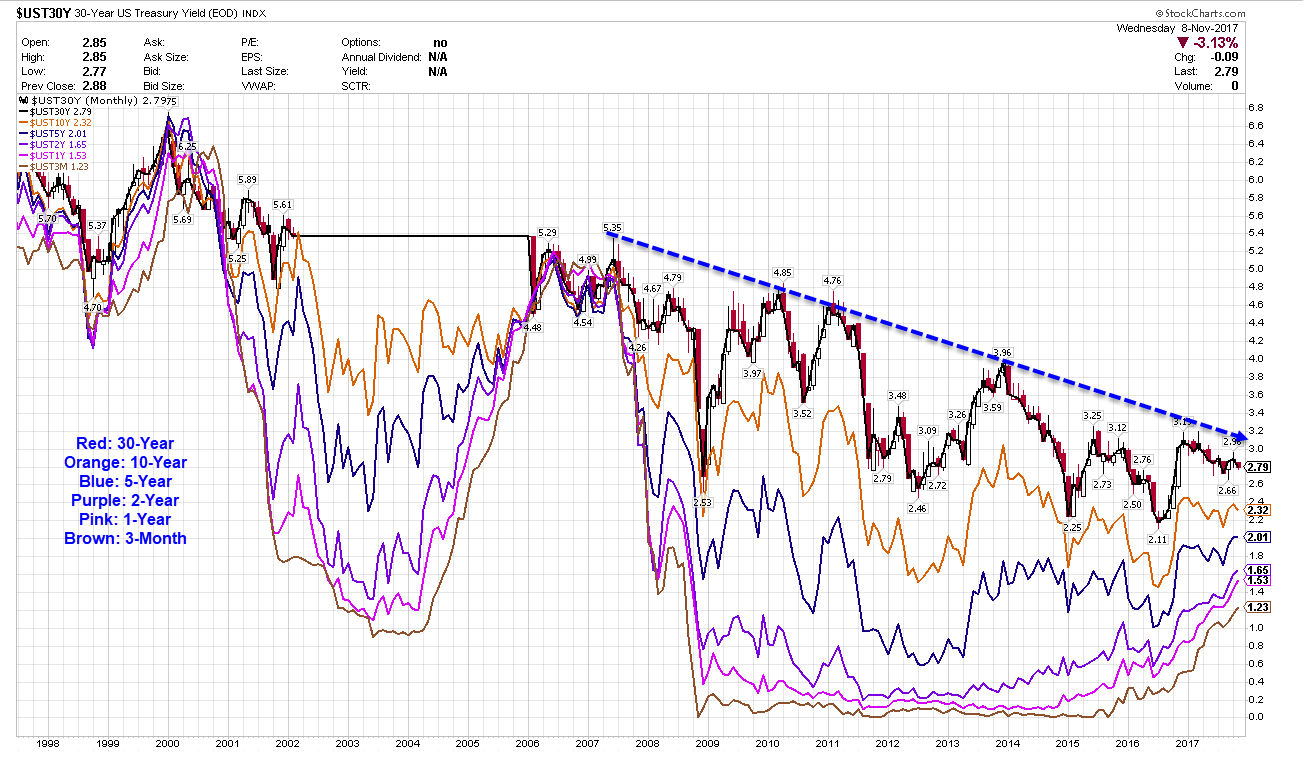

Treasury Yields

There is no reason to believe the long-term treasury bull market is over, either fundamentally or technically. The trend is down, down, down.

Money managers pulling out now will likely chase the rally when it's clear the economy is going nowhere. By then, yields may be much lower.

I stick with my call made two days ago: I Expect New Record Low Long Bond Yield.

Despite all the economic cheerleading about the allegedly strengthening economy, I see things differently. Job growth is shrinking. Average the last two months to smooth out the hurricanes and you get growth job growth of 114,000. For now, it's still positive.

Hooray, autos rebounded. However, 100% of that rebound is due to hurricane replacement. It won't last.

Rental Vacancies Are Rising. What will that do to new apartment construction?

What growth we have is due to a diminishing savings rate. That's another hurricane aspect that won't last.

If the economy was getting stronger, trends in long-term treasury yields would not look like they do.