Earnings season is in full swing, and on balance, investors are liking what they hear. Tech leaders Google (GOOG) and IBM (IBM) got bought in truckloads after their fine earnings reports, although Apple (AAPL) disappointed after the close on Wednesday. By and large, earnings reports have been positive, including diverse companies like duPont (DD), Johnson & Johnson (JNJ), Verizon (VZ), and Intuitive Surgical (ISRG). You’ll recall that I mentioned GOOG and ISRG two weeks ago as top picks within Tech and Healthcare, and they both came through with flying colors.

Besides record corporate earnings and rising revenues and forward guidance, the good news includes fewer jobless claims, surging housing starts, and modest inflation. Combine this with reasonable stock valuations, high levels of corporate cash, bullish technical conditions (including a “Dow Theory” buy signal from both the Dow Industrials and the Dow Jones Transportation Indexes), and still-reluctant retail investors (who are starting to be lured back in). Also, the House of Representatives passed a bill on Wednesday to raise the debt ceiling to whatever borrowing is required until May 19, which not surprisingly gave the market a jolt of confidence.

Not to be ignored, of course, is the Fed continuing to print QE3 money into a zero-interest rate environment. And because the banks are still mostly reluctant to lend it, much of that cheap liquidity continues to find its way into equities.

The S&P 500 SPDR Trust (SPY) closed Wednesday at 149.37. Bulls made short work of that tough band of resistance between 146 and 148. The 50-day simple moving average is about to cross up bullishly through the 100-day SMA. However, oscillators RSI, MACD, and Slow Stochastic have become extremely overbought as bulls refuse to give up much ground.

I have drawn a possible line of uptrend support starting from the intraday low that filled and tested the morning gap up on November 19 (Thanksgiving week). SPY was only temporarily violated in the final few days of 2012 when the fiscal cliff was still in doubt, but quickly recovered after the deal was done. Perhaps Apple’s disappointing quarterly report will give investors a reason to finally allow a pullback to retest support levels, starting with the convergence of the uptrend line and prior resistance-turned-support at 148, followed by 146, the New Year’s gap from 142, and finally the 200-day SMA around 140. However, I really don’t expect a correction to fall that far or last very long.

Notably, the equal-weighted S&P 500 (RSP) is already well above its all-time high, as is the Russell 2000 Small Cap Index. Now people are actually talking about a new secular bull market taking shape, rather than just another cyclical move.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 12.46 and remains right near its 52-week low. The mixed message remains that fear is low (or conversely, complacency is high), which has been bullish for stocks, although an overdue bounce—perhaps on the heels of the Apple news—would send stocks lower.

I suggested in mid-December that it might be worthwhile to buy some February call options on a market index as a lottery ticket for a bullish surge after a budget deal is inked. I took my own advice as the year came near its close and bought calls on the SPY. I sold half after the fiscal cliff was averted, just to get my original investment back, while letting the balance of the position ride. On Wednesday this week, I closed another quarter position ahead of Apple’s earnings and given the extremely overbought technicals, but I’m holding the remaining quarter position to see if the S&P 500 can make it to 1500 (and beyond) before expiration.

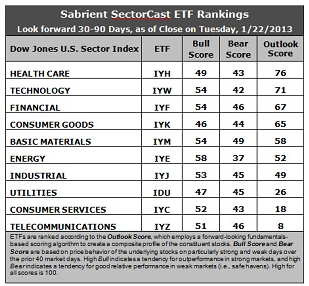

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Healthcare (IYH) again holds the top spot with a score of 76, while Technology (IYW) takes sole possession of second with an Outlook score of 71. IYH shows relatively good support among Wall Street analysts and solid return ratios, while Technology (IYW) shows strong projected growth and a low forward P/E, as well as solid return ratios. Notably, Financial (IYF) took a 25-point jump this week to third place, largely due to a big improvement in Wall Street analyst sentiment.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 8, and is again joined in the bottom two this week by Consumer Services (IYC) with an 18. Stocks within IYZ appear overvalued from the standpoint of the forward P/E and lack analyst support.

3. Overall, this week’s rankings are looking a tiny bit more bullish, given the rise in Financials this week and the fact that six of the sectors are scoring above 50 (and Industrial is close at 49). However, the high scores for defensive sectors Healthcare and Consumer Goods, combined with the low score for Consumer Services, tempers the bullishness of the Outlook rankings somewhat.

4. Looking at the Bull scores, Energy (IYE) is the leader on strong market days, scoring 58, while Consumer Goods (IYK) is the laggard on strong market days, scoring 46. This is only a 12-point range from top to bottom, which indicates high correlation. In other words, Energy stocks have tended to perform the best when the market is rallying, while Consumer Goods stocks have lagged.

5. Looking at the Bear scores, none of the sectors are scoring very high. In fact, none score above 50! Utilities (IDU) is normally the favorite safe haven on weak market days, but it’s only scoring 45, which indicates that most everything has been selling off roughly equally during recent market weakness. Amazingly, Basic Materials (IYM), which is normally among the worst on weak days, is scoring the highest at 49. Energy (IYE) is the worst during market weakness, as reflected in its low Bear score of 37, but there’s still only a 12-point range from top to bottom. Thus, Energy stocks have been selling off the most when the market is pulling back, while Materials stocks have held up the best, relatively speaking.

6. Overall, Technology (IYW) shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 168. Telecom (IYZ) is by far the worst at 105. Looking at just the Bull/Bear combination, Healthcare (IYH), although displaying the best Outlook score, doesn’t look very good at all—with a total score of only 92. Consumer Goods (IYK) is the lowest at 90. Basic Materials (IYM) has the best score at 103.

These scores represent the view that the Healthcare and Technology sectors may be relatively undervalued overall, while Telecom and Consumer Services sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within IYH and IYW include Varian Medical Systems (VAR), The Cooper Companies (COO), F5 Networks (FFIV), and VMware (VMW).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Good News And Earnings Propel Stocks As Fear Abates

Published 01/24/2013, 02:45 AM

Updated 07/09/2023, 06:31 AM

Good News And Earnings Propel Stocks As Fear Abates

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.