I`ve been thinking a lot about the latest oil price as it continue to crater. Are falling prices reflective of oversupply or weak demand? What are the implications for the global growth outlook?

On the one hand, its weakness could be attributable to excess supply due to a Saudi decision to continue producing for economic and political reasons. In that case, falling oil prices are bullish for the global economy as it represents a transfer of wealth from producers to consumers. As consumers spend more, it spurs economic growth.

On the other hand, the prices of other commodities have fallen in lockstep. In that case, a better explanation for commodity price weakness would be falling global demand, which would be bearish for the global growth outlook.

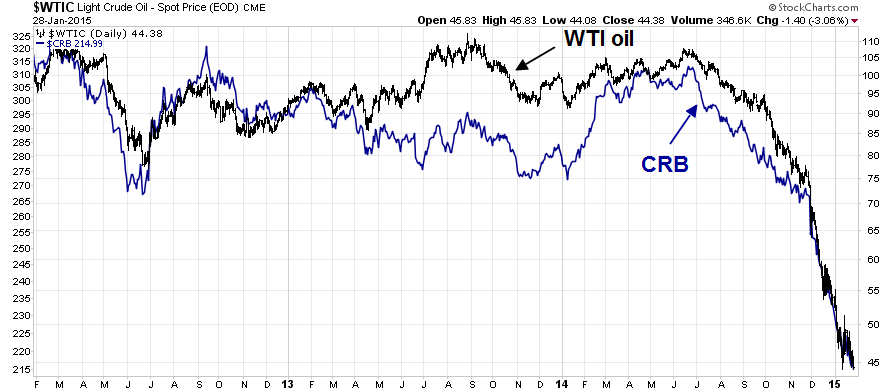

As the above chart shows, both oil prices and commodities, as measured by the CRB Index, have cratered. Is this a warning of sputtering global growth and deflation, a deflationary signal for investors to dive into their bunkers?

Not just falling physical demand

The story isn't as simple as one of declining physical demand. Izabella Kaminska has done a brilliant job of highlighting the process of financialization of commodities, which pushed up their prices. On her personal blog Dizzynomics, she explained the process this way:

Well, 2005 — which marked the real start of the bull run — was the year US interest rates started to be increased. US housing prices peaked the same year, and it was also the year that the issuance of securitised mortgage backed securities was at its record highs.

I postulate that even though interest rates were on the rise there was a type of vicious circle in the investment world. A shortage of high-yielding safe assets and the sudden under performance of the housing market created a real incentive for a new asset class to be created.

One of the key factors behind the housing boom was the idea that house prices could only go up. If you borrowed to invest in a house you were securing your future wealth.

Problem is those rates were not affordable once interest rates started to rise. Rising interest rates not only killed the mortgage security pipeline and impaired existing assets — adding to the collateral/asset shortage — it suspended the securitisation and financialisation of housing. Without new financialised inflow, high house prices could no longer be sustained, and a correction took place. The correction was like a self-enforcing negative spiral, wiping out ever more safe assets from the system.

Which is when the commodity diversification narrative began to be trumpeted in earnest.

This is logical if you consider that a lot of money which wanted a fixed “safe” income was now looking for a new home and looking for another relatively scarce asset to take the place of housing which could only go up.

Commodities were a natural fit.

Fast forward to today, she highlighted the analysis from Richard Yetsenga of ANZ Research at FT Alphaville (emphasis added):

The really important point, according to Yetsenga then, is that even though demand indicators suggest physical oil demand has risen (albeit at lower rates than in recent years) global growth expectations have come down and bonds have rallied.

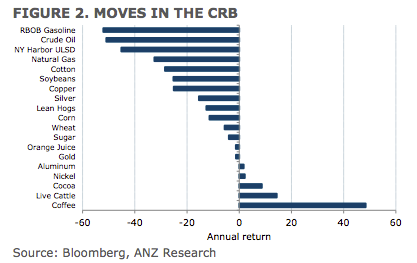

What’s also important to note is that this is not just an oil story. In the CRB index, for instance, only 5 of the 19 components are up over the past year. And of the 14 that fell, only 4 fell less than 10 per cent.

Hurrah! Physical demand is returning, which is bullish for the global growth outlook. Ah, but not so fast:

This suggests to Yetsenga that there is a common factor affecting all of these commodities: financialisation and the emergence of commodities as a financial asset which benefit whenever cheap dollar funding is available, and fall whenever dollars become expensive.

Yetsenga went on to analyze the implications of Fed policy on commodity prices:

In other words, if commodity prices rise purely because of financial flows, then presumably that is akin to an exogenous reduction in physical supply. It is a tax. But consider the broader perspective.

If global financial conditions are loose, and specifically here we are thinking of USD liquidity, then that would actually be boosting financial conditions and hence global growth, at the same time as there was leakage into commodities. Viewed in this context, the rise in commodity prices through the 2000s was actually a positive development in that it reflected the beginning of a secular trend towards USD weakness and plentiful USD liquidity.

On this front recall the hand wringing in the early 2000s when oil (shock horror) rose through USD40 a barrel — a point at which Asia was widely presumed to face rocky times. Of course oil prices ultimately went to four times that level, and any notion that oil was a big issue for Asia at levels that were historically normal was progressively discredited.

Consider now the current cycle. If oil and other commodity prices are falling because global USD liquidity is increasingly restricted, then it seems difficult to interpret that as a growth positive development. In fact, it seems perfectly consistent with growth expectations being under some pressure and global bonds rallying.

In other words, the de-financialization process is putting downward pressure on commodity prices. As the Fed enters a tightening cycle, the withdrawal of USD will depress them further. Kamanska summarized the situation this way:

In short, think of the emerging world in the same position as Greece in the eurozone: dependent on a currency it can’t control access to or supply of. And that’s a problem because, those who have the commodities to sell to emerging countries are obviously still not prepared (as yet) to accept anything other than dollars in exchange.

Which means the only way the problem can be alleviated is if the US continues to subsidise global growth by means of providing it with the cheap liquidity it needs to keep growing. Alternatively, of course, for commodity producers to start accepting a currency that these emerging markets have easy access to.

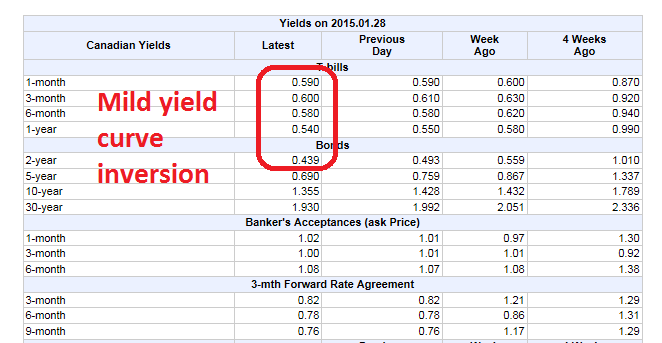

Indeed, strains are starting to show up in commodity producing countries. Here in Canada, not only has the BoC surprised the market with a rate cut, but our yield curve has undergone a minor inversion, with the "elbow" in the curve at 2-years. (Recall that yield curve inversions have been recessionary signals in the past.)

Measuring the de-financialization effect

For momentum oriented investors, these conditions suggest that commodity related investments should be avoided until we see signs of stabilization. As for the concerns about declining demand, there is an indirect and somewhat imperfect way of measuring the effects of commodity de-financialization.

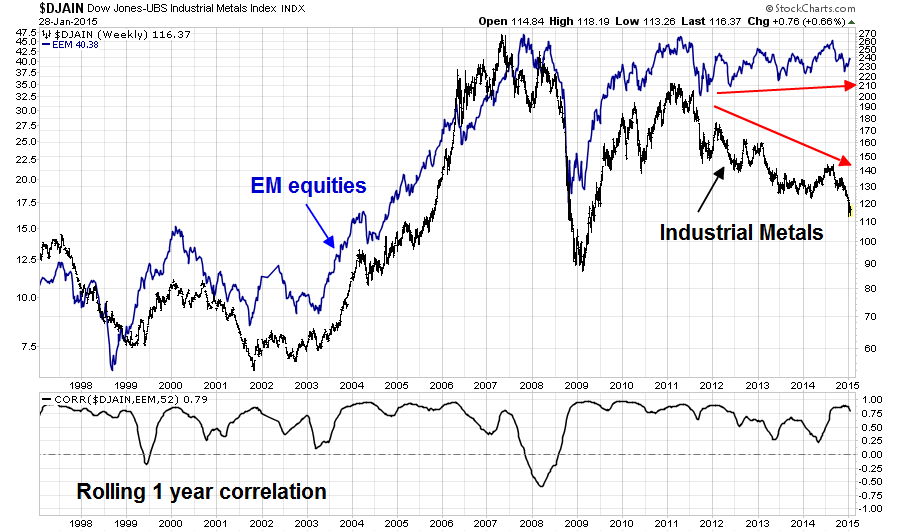

The chart below shows the price of industrial metals, which is highly sensitive to global growth, compared to Emerging Market equities. The bottom panel shows the rolling 52-week correlation between the two price series. The two had been highly correlated, but their paths started to diverge in early 2013. That divergence gives us a clue to the magnitude of the de-financialization effect.

This chart shows the relative performance of EM equities (via iShares MSCI Emerging Markets (ARCA:EEM)) relative to the MSCI All-Country World Index (ACWI). EEM remains in a relative downtrend after having probed the relative support levels seen during the Lehman Crisis lows. It is currently staging a minor relative rally and may be trying to turn up, which is a hopeful signal for global growth.

Another way of analyzing the de-financialization effect is to filter out the effect of USD strength. As commodities are generally priced in USD, a rising USD poses a headwind for commodities. The chart below shows the CRB Index, priced in EUR. As the chart shows, the euro denominated CRB remains in a downtrend, which is a bearish signal.

On the other hand, the cyclically sensitive industrial metals priced in euros have rallied through a downtrend:

In conclusion, my main takeaways from this analysis are:

- Oil price weakness is not just a supply issue, commodities are weak across the board.

- Commodity prices were buoyed by financial demand, but that process is reversing.

- Net of the financial demand, the commodity complex is still signaling global weakness, but the picture is mixed and there are hopeful signs that the growth outlook is bottoming.

I am not panicking just yet, but I am watching these other signals (EEM vs. ACWI, commodities priced in euros) carefully for signs of a global growth upturn (or further weakness).

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.