Just superb action as the bull market continues.

The metals have been acting pretty strong as well but did show weakness into the end of the week which suggests to me more time and basing action is needed, regardless, there are easier ways to make money, and more of it, than trading metals equities right now.

Gold did close the week out with a 1.24% gain.

I’m not sure if we’re moving lower near $1,200 to put in a lower high, which would be another notch in the trend is up bedpost, or of we will see a longer basing period.

Miners are acting weaker for the most part so it’s really quite a mixed message in the metals for now.

There are many place to find easy money right now and I don’t see the precious metals as that place, for now at least.

Silver gained 2.60% this past week and is now wrestling with the 200 day average.

Let’s see if we can best the $18 area and hold it a few days.

While this isn’t a super bullish breakout type of chart, it is coming off lows quite well.

Platinum rose 0.50% but was rejected hard on its attempt to move above the 200 day moving average.

Is this a prelude to the action coming in silver?

Only time will tell.

For now, under the 21 day moving average is bad while above the 200 day is good.

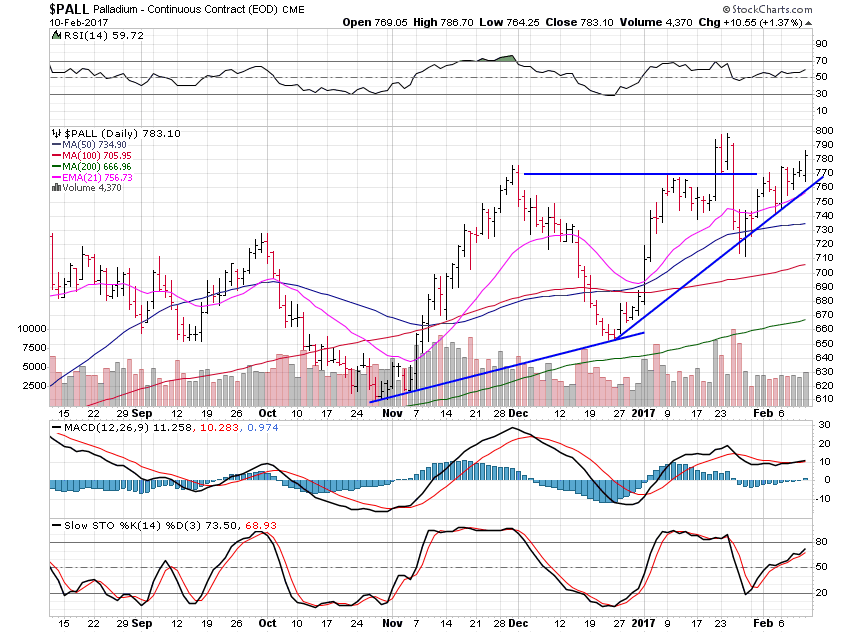

Palladium rose 4.55% and won the week in the metals arena.

Not bad action at all with the next resistance level coming in at $800 and support at $770.

So, staying with the trend in leading sectors and stocks is my mojo now, as always, and metals are not that sector right now.