After blasting higher in a remarkable breakout surge, gold is pulling back. Such mid-upleg selloffs are normal and healthy, rebalancing sentiment to maximize uplegs’ longevity. Gold’s pullback is naturally weighing on gold stocks, fueling some bearishness. But since they didn’t soar to extremely-overbought levels like gold, their downside leverage should prove modest. The gold miners could just consolidate high.

This is definitely atypical, as normally gold stocks amplify their metal. The leading GDX (NYSE:GDX) gold-stock ETF dominated by major gold miners tends to leverage material gold moves by 2x to 3x. During gold’s previous upleg from late September 2022 to early May 2023, it powered 26.3% higher. GDX’s parallel upleg in that span ran 63.9%, making for solid 2.4x upside leverage. This fundamental relationship holds in selloffs too.

Before today’s mighty breakout upleg was born, gold corrected 11.3% into early October 2023. GDX dutifully sold off in sympathy, plunging 27.7% in that span for typical 2.5x downside leverage. Examples of this are legion, ultimately driven by gold-mining earnings amplifying gold price trends. Traders expect the same during gold’s current pullback, as this relationship is thought to be ironclad. But today is rather unique.

A few weeks ago I wrote an essay on the overboughtness in gold and gold stocks. Then gold had just hit $2,374, its ninth nominal record close in just eleven trading days. Euphoria was really mounting then, so my contrarian conclusion wasn’t popular. “...gold is extremely overbought today, warning of high risks for a sharp selloff.” That necessary sentiment-rebalancing process has begun, but is moving in fits and starts.

Gold crested two trading days later at $2,388, and drifted sideways for a few more. Then gold was slammed 2.4% lower on no news on Monday the 22nd, spawning flaring bearishness. Later gold plunged another 1.9% this Tuesday to $2,292. That extended gold’s overall pullback to 4.0% across two weeks, material but not excessive. If gold stocks were behaving normally, GDX should’ve fallen 8% to 12% in sympathy.

Plenty of newsletter subscribers and consulting clients have been writing me worrying gold stocks are due for a sizable selloff. That’s rational based on gold-stock precedent. Yet during those same couple weeks since gold’s last interim high, GDX has actually edged up 0.3%. The gold stocks have been holding their own so far in gold’s pullback, consolidating high. And just one day earlier, they had been looking way better.

During the first nine trading days of gold’s pullback, it fell 2.2%. Amazingly GDX defied that to rally 5.3%. What kind of sorcery is this? Over 2/3rds of GDX’s counter-gold rally came on one trading day, where GDX shot 3.7% higher. That was fueled by the world’s largest gold miner’s Q1 results. Newmont Goldcorp Corp (NYSE:NEM) stock rocketed 12.5% higher that day after reporting its production last quarter soared 32.3% YoY to 1,680k ounces.

Newmont has always been GDX’s largest holding, weighing in at 12.2% midweek. So one could argue GDX has resisted gold’s pullback mostly because of NEM’s output surge. That’s actually pretty bullish for gold stocks though, because for years hardly anyone even paid attention to gold-stock quarterlies. The fact enough investors were watching to catapult NEM sharply higher proves gold-stock awareness is growing.

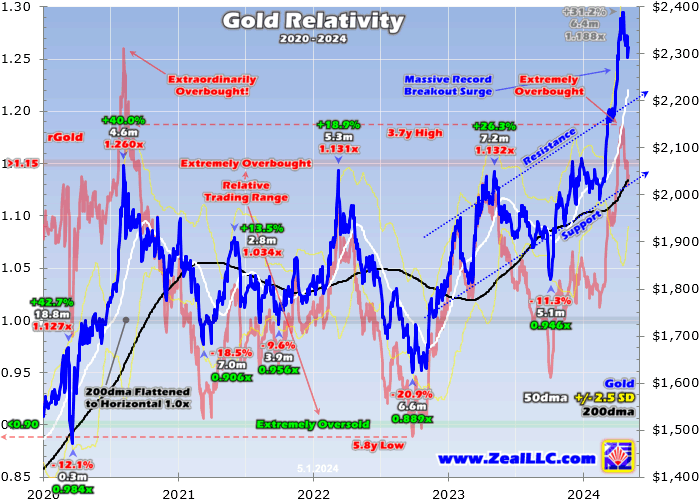

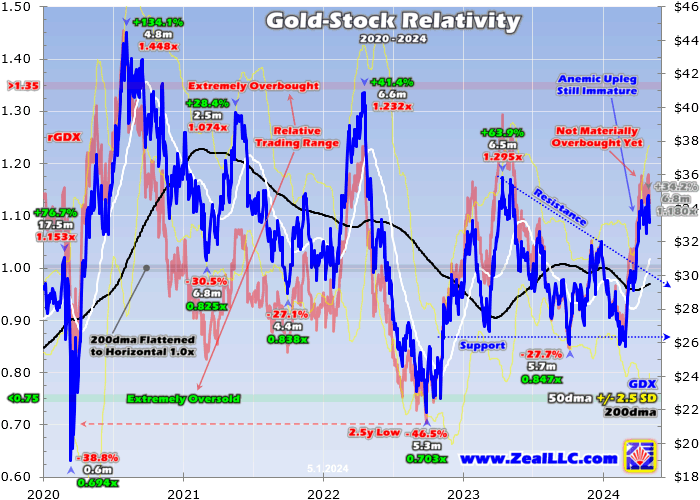

But there’s a more-important reason gold stocks are likely to remain way more resilient in gold’s pullback than normal. I discussed this in depth several weeks ago in that overboughtness essay. That analyzed the following updated gold and GDX charts, which include my bespoke Relativity indicator. That divides prices by their 200-day moving averages, and charts the resulting multiples over time illuminating trading ranges.

Over the past half-year or so, gold rocketed vertical in a massive upleg to extremely-overbought levels. The resulting surging greed is why a rebalancing selloff is essential. But the gold stocks have greatly lagged gold’s advance, their parallel upleg staying anemic leaving GDX far from challenging materially-overbought levels. That left gold-stock sentiment fairly-bearish, so the miners have no need to sell off like gold.

After bottoming near $1,820 in early October, gold mean-reverted sharply higher embarking on a new upleg. That powered higher into early December, with gold achieving its first new nominal record close in 3.3 years. Gold had rallied a normal 13.8% in this upleg then, and subsequently mostly consolidated high into late February. There was a mild pullback from late December to mid-February, which grew to 4.2% at worst.

Throughout that entire early-upleg span, gold was nowhere near overbought. At most it merely stretched 6.6% above its 200dma. Relative to that key baseline, gold’s trading range in recent years ran from 0.90x on the oversold side to 1.15x on the high side. Gold hadn’t yet grown overbought by then simply because it hadn’t surged fast enough. Overboughtness happens when prices rally too far too fast to be sustainable.

But boy as March dawned that dramatically changed. After a top Fed official hinted at monetizing more US Treasuries, gold leapt higher. The resulting upside momentum drove gold’s remarkable breakout surge, which wasn’t fueled by gold’s normal drivers. Speculators weren’t flooding into gold futures, and American stock investors weren’t buying gold ETFs. Instead Chinese investors and central banks rushed in.

During the next six weeks or so, gold rocketed to 19 new nominal record highs. Such a stunning record-achieving streak hadn’t been seen since the summer of 2020. The momentum buying on gold records is powerful. The higher gold surges, the more the financial media covers it, the more bullish traders grow, so the more they buy gold to chase its upside accelerating its gains. This dynamic is a self-feeding virtuous circle.

But gold-futures speculators and American stock investors weren’t driving it like usual, Chinese investors took the helm. They catapulted gold 16.9% higher in just six weeks, condensing 6/10ths of this upleg’s total gains into less than 1/4th of its lifespan. While gold’s upleg rapidly grew to large 31.2% gains over 6.4 months, so much rallying so fast left gold extremely overbought. That’s readily evident in this rGold chart.

At mid-April’s latest interim high, gold was stretched a whopping 18.8% above its 200dma. Gold hadn’t been so overbought in 3.7 years, since its last record-achieving upleg was peaking in August 2020 at monster 40.0% gains. That recent 1.188x rGold read was rarefied territory, guaranteeing an imminent selloff to work off those extreme conditions. That has indeed started since, as gold pulled back in recent weeks.

Writing about this several weeks ago just before this rebalancing selloff began, I even gave a downside target. “Ideally that would be a pullback to gold’s 50dma, which is now running $2,125. 50-day moving averages are the strongest support zone for mid-upleg pullbacks. That is also climbing about $6 per day, so a couple weeks from now gold’s 50dma should be closer to $2,185.” Midweek it had actually shot up to $2,222.

To challenge its 50dma today, gold’s total pullback would need to grow to 6.9%. But with its 50dma now shooting vertical, gold may need to forge lower to better rebalance sentiment. $2,200 is a decent target, which would extend this pullback to 7.9%. Once a selloff from upleg highs exceeds 10%, it is a correction formally slaying that upleg. While a correction-magnitude selloff is possible, a smaller pullback is more likely.

I explained why a couple weeks ago in an essay on gold’s remarkable breakout. Again those Chinese investors and central banks have done most of the heavy lifting driving gold sharply higher. That has left the usual gold-futures speculators and American stock investors with lots of remaining capital firepower for buying. They are going to start chasing gold’s upside momentum soon, their buying accelerating the gains.

So odds are gold’s powerful upleg won’t fail before specs exhaust most of their probable gold-futures buying and American stock investors flood back into GLD (NYSE:GLD) and iShares Gold Trust (NYSE:IAU) shares in a big way. But all uplegs surge two steps forward before retreating one step back in rebalancing selloffs. So gold really does need to pull back farther to work off more of that recent extreme overboughtness. This process is normal and healthy.

But the kicker here is gold stocks don’t need to. If gold’s pullback grows to 8%, GDX certainly doesn’t need to amplify gold’s losses by 2x to 3x like usual plunging 16% to 24%. That’s because gold stocks have greatly lagged gold during this upleg. Their feeble gains barely leveraged their metal’s, and they didn’t get anywhere near extremely-overbought levels. So unlike gold, they don’t need a rebalancing selloff.

Since early October, the major gold stocks of GDX have merely enjoyed a 34.2% upleg at best. That made for terrible 1.1x upside leverage to gold. If gold stocks can’t well outperform their metal, there’s no reason to own them. The miners heap big additional operational, geological, and geopolitical risks on top of gold price trends. So gold stocks must have outsized gains to compensate traders for bearing all these.

GDX’s recent surge was so comparatively small that the most overbought it has grown is only 1.180x its 200dma early this week. The major gold stocks’ Relativity trading range is much wider than gold’s, running from 0.75x on the low side to 1.35x on the high side. Extreme overboughtness for gold stocks doesn’t come until GDX soars 35% over its 200dma. That would be almost $40 midweek, we’re nowhere close.

Since gold stocks didn’t amplify gold’s breakout surge, they have no need to leverage its pullback. They certainly could be sucked in, but they probably won’t be. The gold miners are more likely to consolidate high on balance, mostly drifting sideways while gold works off excess greed and overboughtness. Since traders haven’t rushed into miners to ride gold recently, there should be fewer weak hands to dump them.

This unusual phenomenon is already playing out. Again while gold pulled back 4.0% at worst during the last couple weeks, GDX managed a 0.3% gain. The gold stocks are consolidating high while gold suffers a pullback. And again they were faring much better before Tuesday’s sharp plunge, with GDX rallying 5.3% in nine trading days where gold slumped 2.2%. So this gold-stock disconnect is real and ongoing.

Like always the markets are a probabilities game, nothing is guaranteed. So GDX could plunge 2x to 3x whatever gold’s selloff ends up being. But since gold stocks greatly lagged gold’s upleg and didn’t surge anywhere near extremely-overbought levels, they have little need for a rebalancing selloff. And that massive Newmont spike on better Q1 results proves institutional investors’ interest in gold stocks is mounting.

Incidentally improving gold-stock leverage to gold confirms this. That has been pathetic over this entire gold upleg’s span, that ugly 1.1x. But since gold’s remarkable breakout surge launched in early March, gold has rallied 13.3% as of midweek. GDX has doubled that with 26.6% gains in that span, for better 2.0x upside leverage. While still low in that 2x-to-3x range, gold-stock leverage to gold is improving with sentiment.

So traders probably don’t need to fear gold stocks amplifying gold’s pullback in this unusual situation. Gold-stock trades should still be protected with trailing stop losses, which can be tightened some just in case to lock in more unrealized gains. While capital recovered from any stopped trades doesn’t need to be redeployed until gold’s pullback matures, that is going to prove a great mid-upleg buying opportunity.

Gold stocks still have massive upside from here, especially the smaller mid-tiers and juniors. They have superior fundamentals to the majors dominating GDX, better able to consistently grow their production at lower more-profitable mining costs. Smaller gold miners also have lower market capitalizations, making it easier for capital inflows to bid their stocks much higher. Many could easily still double or triple from here.

The bottom line is gold’s pullback doesn’t need to suck in gold stocks this time around. While gold soared to extremely-overbought levels recently requiring a rebalancing selloff, gold stocks sure didn’t. The gold miners’ upleg has greatly lagged gold’s, with gold-stock prices barely leveraging its gains. Gold stocks were merely moderately overbought at their metal’s recent interim high, with little greed or euphoria evident.

Indeed during the couple weeks since, gold stocks have largely defied gold’s pullback. Rallying through most of it, they are consolidating high even at worst. This outperformance should continue as long as gold’s selloff stays orderly and avoids correction territory. Gold’s pullback maturing will be a great mid-upleg buying opportunity for gold miners, so traders should be watching fundamentally-superior smaller ones.