Gold and silver have fallen in such a way that investors will rather understand why it is not worth taking a bullish stance on them.

Gold, silver, and mining stocks (major proxies for them) have all moved to new yearly lows during yesterday’s trading, and they are not back up (they’re rather flat) in today’s pre-market trading.

This is a significant bearish development, and it will finally convince many traders and investors that something is wrong with the bullish case for gold and the rest of the sector.

Why on earth would gold move to new yearly lows despite the ongoing war in Europe, the pandemic, and soaring inflation?

Because all of the above was already discounted in price, gold could still not move decisively above the $2,000 level. It failed to stay above its 2011 high, and that’s just gold. Silver and mining stocks were not even close to moving to their analogous price levels.

Gold’s failure to launch a proper rally was a massive indication that it’s not yet ready to move higher—it needs to decline massively first, which is what I’ve been writing for many months. Still, as new black swans kept popping up, gold was unable to complete its regular cyclical decline beforehand. So, it’s going now.

As real interest rates and the US dollar index continue to climb, precious metal prices are likely to continue to decline – at least for several weeks. At some point, I expect gold, silver, and mining stocks to stop reacting to this bearish reality and show strength, thus indicating that the final long-term bottom is in. However, we are not there yet.

Based on analogies to how precious metals and mining stocks declined in the past, we have much lower to go, and we have much more money to make on our short positions.

After this lengthy introduction, let’s take a look at gold.

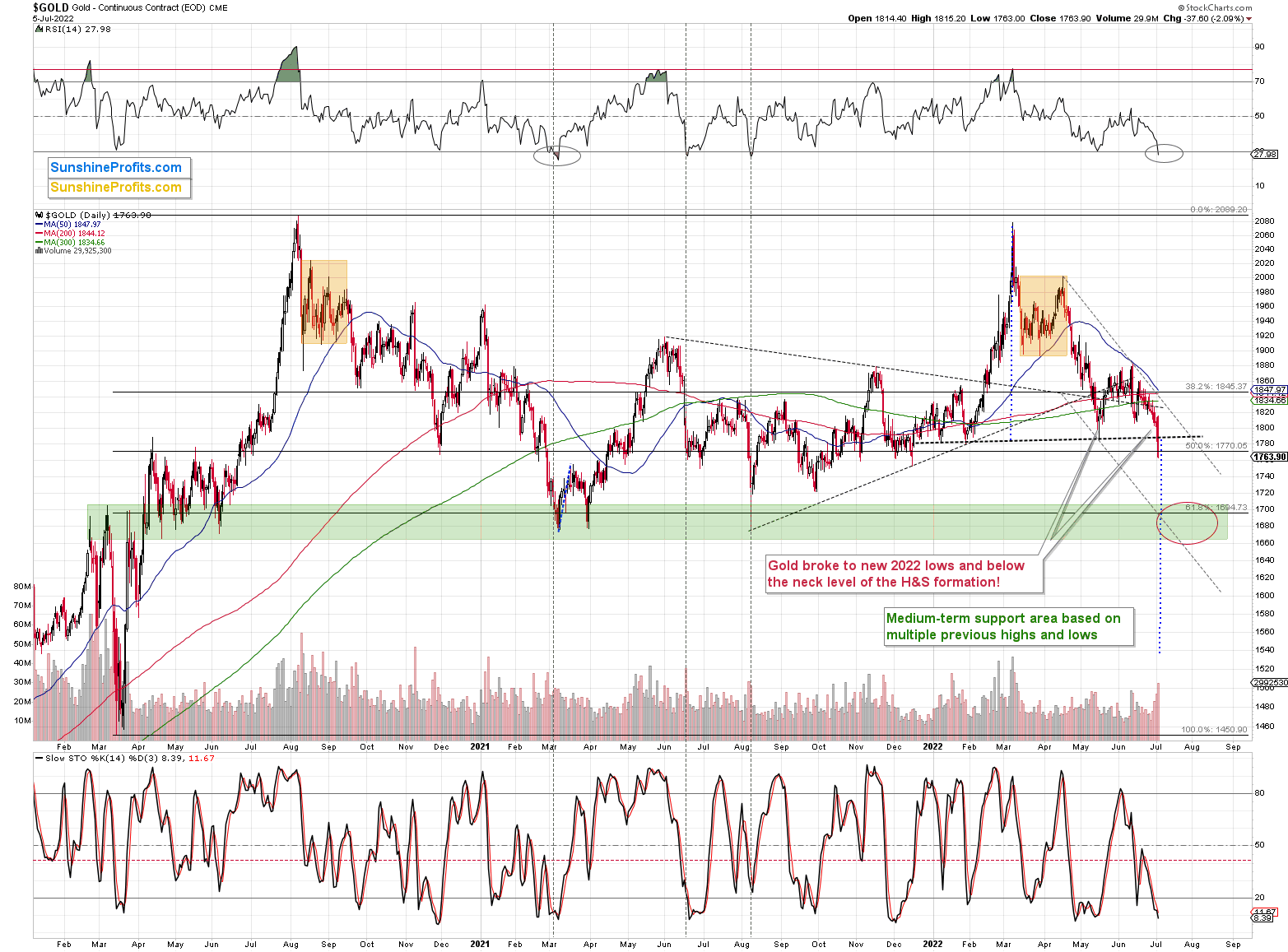

Gold just moved below the neck level of the previous head and shoulders pattern and also to new 2022 lows. The breakdown took place at a high volume, so it appears believable.

However, at the same time, the RSI moved below 30, which is a classic buy signal. I marked the previous similar signals with vertical dashed lines. In all three previous cases, gold was either bottoming or about to bottom.

In particular, the early-2021 situation appears similar because the preceding price action is also similar. The failed attempt to rally above $2,000, the consolidation (marked with orange rectangles) and the subsequent decline that also included a consolidation are all present in both cases.

Back in 2021, gold continued to decline until it moved below $1,700, and while it doesn’t guarantee the same thing right now, the fact that both declines started from highs at very similar price levels makes it quite likely.

So, what’s likely to happen next? Well, I see two likely short-term outcomes:

- Gold corrects a bit, thus verifying the breakdown below the neck level of the H&S formation and the previous 2022 low, and it then continues to decline after the correction.

- Gold slides to or slightly below $1,700 right away - or almost right away, but quite possibly this week.

In the case of scenario 1, junior miners would be likely to correct slightly as well and then slide.

In the case of scenario 2, junior miners would be likely to slide right away, possibly showing some kind of strength right before gold moves to its $1,700 target.

In both cases, I plan to keep the short positions intact until VanEck Junior Gold Miners ETF (NYSE:GDXJ) or gold reaches its targets lower—I don’t plan to trade the rebound from scenario 1. Not all moves are worth trading, just like you’ll probably agree that Friday’s daily rally wasn’t worth trading. Those who attempted to trade it have probably missed or even were hurt by yesterday’s decline instead of profiting on it.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.