Gold has shown impressive strength weathering 2024’s summer doldrums. Now through the worst of its weakest seasonals of the year, gold didn’t suffer any prolonged selling. That was despite entering June very overbought, really boosting odds for a sizable selloff. And gold’s usual core constituencies weren’t buying, so unusual significant demand came from elsewhere. This is very bullish for gold’s autumn rally.

Gold’s setup entering this year’s summer doldrums was mixed. On the bearish side, gold had just shot dramatically higher to extremely-overbought levels. From mid-February to mid-May, gold blasted 21.8% higher in just 3.2 months. The stunning 21 new nominal record highs achieved in that span really stoked greedy sentiment. Gold soared so far so fast it stretched as high as 18.8% above its 200dma in mid-April.

That was deep into extremely-overbought territory, which starts at 15% over. Gold hadn’t rallied to such risky levels technically since August 2020 fully 3.7 years earlier. And that extreme was followed by a serious near-bear 18.5% correction over the next 7.0 months. Entering June 2024, gold remained really overbought at 12.2% above its 200dma. So a bigger selloff was fully justified to rebalance technicals and sentiment.

Yet gold’s fundamental outlook was bullish, as I explained in my essay a month ago on 2024’s summer-doldrums setup. I concluded then, “After being extremely overbought in recent months, gold sure could use a healthy pullback to rebalance sentiment. But we might not get one this year, gold also has good odds of surging further.” The reason was the unusual drivers that had just fueled gold’s remarkable breakout.

So I continued then, “Chinese investors and central banks have seized gold’s reins, usurping gold-futures speculators and American stock investors in recent months. The former group may very well continue buying and chasing gold’s strong upside momentum, while the latter group might start returning.” While those gold-futures specs and American investors remain missing in action, someone has been buying.

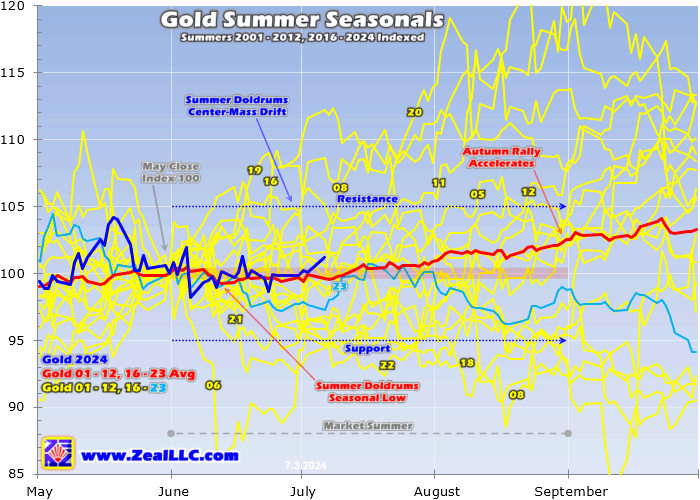

This chart is updated from that latest gold-summer-doldrums essay. It individually indexes all modern gold-bull years’ summers, setting May’s final close to 100. That renders them in perfectly-comparable percentage terms despite very-different gold levels. Then all 20 of these summer gold performances are averaged together in the red line, distilling out summer seasonals. 2024’s action is superimposed in dark blue.

Again technically gold had every right to sell off considerably last month, to work off recent months’ extreme overboughtness and serious greed. Yet instead gold largely drifted sideways on balance, only suffering a single serious down day. This resilient summer action is an impressive show of strength in gold’s weakest time of the year seasonally. That’s a really-bullish omen heading into gold’s autumn rally.

While I’m penning this essay on Wednesday, it won’t be published until early on Jobs Friday the 5th. So I don’t yet know how the latest June US monthly jobs report played out. For long years that headline jobs data has often spawned considerable gold volatility, because it affects traders’ perceptions of the Fed’s rate path. Upside surprises boost rate-hike odds or erode rate-cut odds, often spawning big US dollar buying.

Gold-futures speculators look to the dollar’s fortunes for their primary trading cues, then do the opposite. Case in point was a month ago on Jobs Friday June 7th. On the eve of that report, gold closed up near $2,373 nearing the upper resistance of recent months’ high-consolidation trading range running $2,300 to $2,400. Overbought conditions can also be worked off gradually through sideways drifts rather than fast selloffs.

Overnight gold was slammed down to $2,333 an hour before that jobs data. After 18 months in a row of reporting adding gold reserves, China’s central bank declared it hadn’t done any buying in May. Then in typical Biden Administration fashion, that May US jobs report proved a huge four-standard-deviation beat. The +272k jobs actual trounced the +190k estimates, but that report’s internals were highly suspect like usual.

Those were analyzed in depth in our latest monthly newsletter. For our purposes now, claimed hot jobs growth ignited a big 0.8% rally in the US Dollar Index. That piled on to gold’s overnight selling momentum, and when the dust settled it was slammed a brutal 3.6% lower on June 7th. That was gold’s worst daily loss in 3.6 years, crushing it down to $2,286. Such a blistering plunge worked wonders slaying greed.

Silver and the leading GDX (NYSE:GDX) gold-stock ETF act like gold sentiment gauges, and they collapsed 6.5% and 6.9% that day. Despite such a crushing blow, gold’s total pullback since its recent mid-May high merely grew to 5.7%. And since that freefall started higher in gold’s high consolidation, it didn’t push gold too far under $2,300 support. Indeed gold quickly bounced and continued recovering nicely in subsequent weeks.

Other than that lone serious news-driven plunge, gold’s summer-doldrums performance has been fairly sedate. Without that sharp drop, gold likely would’ve mostly drifted sideways closer to $2,350 to $2,375. Instead gold averaged $2,326 in June, yet still remained slightly above its indexed seasonal average for most of 2024’s doldrums. Again this reveals considerable strength after entering summer very overbought.

Normally the vast majority of gold’s price action is driven by speculators trading hyper-leveraged gold futures and American stock investors buying and selling major-gold-ETF shares. Yet that sure hasn’t explained gold’s unusual strength this summer, remaining in its high consolidation rather than selling off harder from recent extreme overboughtness. The former traders are barely buying, while the latter are selling.

Specs’ gold-futures trading is only reported weekly in the famous Commitments of Traders reports. The four CoT weeks best covering June run from May 28th to June 25th. Throughout that span in total, specs sold a tiny 4.9k long contracts while buying to cover a small 15.5k short ones. Together that netted out to just 10.5k contracts of buying in June, the gold equivalent of only +32.8 metric tons. That’s nothing for futures.

For comparison, in March, April, and May total spec gold-futures buying ran at gold-equivalent levels of +186.6t, +28.5t, and +104.0t. So June’s meager buying was a sharp slowdown from preceding months, yet gold defiantly continued consolidating high. And not only were specs barely buying gold futures, those American stock investors were actively selling shares in the dominant GLD (NYSE:GLD) and iShares Gold Trust (NYSE:IAU) gold ETFs last month.

Their total physical-gold-bullion holdings slumped 0.5% or 5.8t in June. That remained in line with an incredibly-anemic trend, as March, April, and May saw little builds and draws of +5.5t, -1.6t, and -2.2t. Still enamored with the AI stock bubble, American stock investors want nothing to do with gold. In mid-June GLD+IAU holdings fell to 1,204.4t, merely 0.1% above early March’s shocking 4.5-year secular low.

Astoundingly American stock investors have sat out gold’s entire mighty upleg, an extraordinary anomaly. From early October to mid-May, gold powered 33.2% higher. Yet during that span, GLD+IAU holdings still fell 4.5% or 57.4t on differential share selling. Professional money managers are totally ignoring gold, putting all their customers’ eggs into one increasingly-super-risky mega-cap-tech basket. That won’t end well.

Incidentally the fact American stock investors haven’t yet started chasing this gold upleg is probably the single-most-bullish argument for it growing much larger. Today’s gold upleg is the first since a pair both cresting in 2020 where gold achieved new-record-high streaks. Those unleash powerful gold-momentum-chasing dynamics. The higher gold climbs hitting more records, the more the financial media covers it.

That spreads awareness of gold’s mounting gains among a much-broader group of traders, convincing them to buy in. Their capital inflows accelerate gold’s upside to more records, stoking higher-frequency and more-bullish reports in the financial media. That attracts in more traders, fueling a powerful virtuous circle of buying. American stock investors have long been a big part of that before major gold uplegs peak.

Those 2020 gold uplegs proved monsters, soaring 42.7% and 40.0% before giving up their ghosts. Their primary drivers were big capital inflows from American stock investors. GLD+IAU holdings saw massive builds of 30.4% or +314.2t during the first and 35.3% or +460.5t during the second. Today’s upleg can’t be over yet with those same metrics at -4.5% and -57.4t. As this AI stock bubble bursts, gold will be remembered.

Since gold’s summer-doldrums strength this year can’t be explained by speculators’ gold-futures trading or American stock investors’ GLD+IAU capital flows, other demand has to be responsible. Since it was Chinese investment demand and central-bank buying that fueled gold’s remarkable breakout surge leading into this summer, odds are that continued in June. We won’t know for sure for a few more weeks.

The best-available global gold supply-and-demand data is published by the World Gold Council in its outstanding Gold Demand Trends reports. These quarterlies are typically released about a month after quarter-ends, so Q2’s update is likely coming near the end of July. That should illuminate why gold has proven so strong in this year’s doldrums. The earlier Q1 GDT revealed big Chinese and central-bank demand.

In January, February, and March, Chinese bar-and-coin investment demand skyrocketed 67.0% YoY to 113.5t. In stark contrast, that same American category collapsed 43.3% YoY to only 20.7t. Europe’s looked even worse, cratering 53.4% YoY to just 17.9t. Q1’s total known central-bank buying of 289.7t was the fourth-largest on record in data extending back to Q1’10. It also proved a Q1 record in that span.

So gold’s last-available major fundamental data showed gold’s remarkable breakout surge in March was driven by Chinese investment demand and central-bank buying. Anecdotal reports since that Q1 GDT imply that remains relatively robust. And June’s defiant gold strength despite remaining very overbought almost certainly confirms that unusual buying continues. That sure makes for a bullish autumn-rally setup.

Historically gold’s weak summer-doldrums seasonals have tended to bottom in late June to early July. Then gold’s major autumn rally usually gets underway, fueled by outsized gold demand from Asian harvest buying followed by Indian wedding season. On average through all these modern gold-bull years, gold has powered 4.8% higher from mid-June to late September. This year should enjoy big outperformance.

Chinese investors and central banks continuing to buy gold, gold-futures speculators resuming buying, and American stock investors finally starting to buy all stacks on top of usual autumn seasonal demand. In addition the AI stock bubble bursting should really boost Western gold investment demand. And the US dollar’s bear market is likely to resume on mounting Fed-rate-cut odds, stoking gold-futures buying.

Entering this year’s summer doldrums soon after extremely-overbought conditions, gold could’ve easily and justifiably dropped 5%+ in June. Yet at worst on that last Jobs Friday, gold had only retreated 1.8%. Overall last month, gold only drifted a trivial 0.2% lower. Gold remained quite overbought in June, exiting 9.9% above its 200dma after entering 12.2% over. Last week gold slumped as low as 8.8% above that baseline.

So gold has impressively consolidated high in 2024’s summer doldrums, revealing underlying robust demand. That should really pick up as its autumn rally gets underway, driving gold to new record highs in coming months. The biggest beneficiaries of this mighty gold upleg growing further to monster status will be gold stocks. The major gold stocks of the leading GDX gold-stock ETF tend to leverage gold by 2x to 3x.

They are soon going to report their best quarterly results ever, attracting back institutional investors. The gold miners remain deeply undervalued relative to prevailing gold prices, lagging gold’s breakout surge. And the smaller fundamentally-superior mid-tiers and juniors fare even better than their larger peers. They are better able to consistently grow their production, and their lower market caps are easier to bid higher.

So now is a good time to get deployed mid-upleg, with the worst of the summer doldrums passing before gold’s autumn rally really gets motoring. We just finished refilling our newsletter trading books with great mid-tiers and juniors with huge upside potential. Gold-stock gains really accelerate later in major gold uplegs as sentiment grows increasingly bullish. The lion’s share of gold-stock upside in this one is still coming.

The bottom line is gold has shown impressive strength weathering the worst of 2024’s summer doldrums. Gold entered June very overbought, after hitting risky extremely-overbought levels in both mid-April and mid-May. So a sizable June selloff to rebalance very-stretched technicals and greedy sentiment would’ve been fully justified. Yet instead gold managed to consolidate high last month, largely drifting sideways.

That was despite gold-futures speculators doing little buying while American stock investors continued to sell. That implies gold demand remains robust from Chinese investors and central banks, which drove gold’s remarkable breakout surge to many nominal records in recent months. Their buying will likely grow again in gold’s autumn-rally season, and American stock investors should join in when this AI stock bubble bursts.