Gold is finishing one of its most-defiant summers in memory. Gold rallied to new record highs in recent months despite odds stacked against it. Gold was extremely overbought heading into summer 2024, its primary drivers weren’t performing well or really favorable, and the AI stock bubble continued to distract investors. Yet gold defied all that to power higher on balance through June, July, and August, a bullish omen.

Gold’s summer has truly been defiant, boldly resisting opposing forces. Market summers run June, July, and August proper. As of midweek, gold had rallied an excellent 7.7% summer-to-date with just a couple trading days left. Annualize that, and gold has been powering higher at a blistering 30%+ pace in recent months. This proved gold’s fifth-best summer performance in the modern era of the past quarter-century.

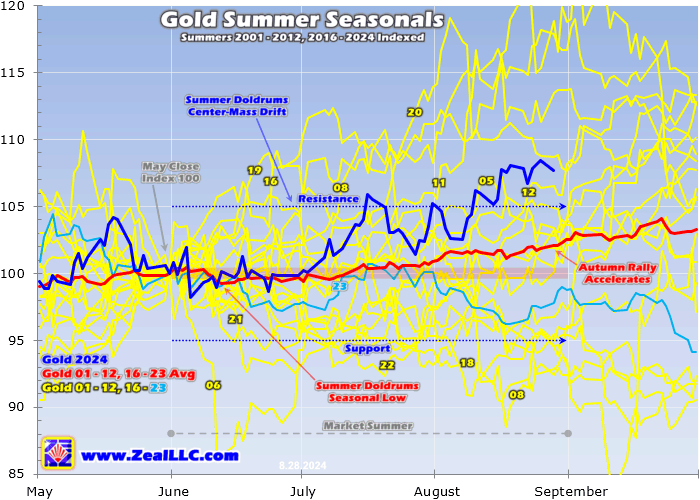

Normally gold mostly drifts sideways to lower in early summers before its autumn rally gets underway in July then accelerates in August. On average during gold’s 20 bull-market years since 2001, it rallied 2.6% through the entire market summer. But during summer 2024 gold tripled this seasonal average. That exceptional strength is evident in this chart updated from my latest gold-summer-doldrums essay.

My first one this summer, it was published in early June. This chart individually indexes each gold-bull summer to 100 as of May’s final close. Then all these summer indexes are averaged together to distill out summer seasonality. This year’s indexed action is rendered in dark blue, last year’s in light blue, previous years’ in yellow, and the pre-2024 average of all of them in red. Gold certainly outperformed this summer.

Normally gold meanders in a summer trading range of +/-5% from May’s final close. That was the case for much of summer 2024, until gold’s upside breakout in recent weeks. Gold poked its head above that resistance briefly in mid-July, surging to a single nominal record before pulling back considerably. That driving big 1.8% up day was defiant, as that morning saw a Fed-hawkish upside surprise in US retail sales.

But gold failed to hold that mid-summer breakout, and fell 4.2% over the next week or so. A few weeks later in early August, gold caught a strong 1.6% bid on festering higher levels of US weekly jobless claims. Then two trading days later it surged another 1.7% to its second summer-2024 nominal record on geopolitical news. Israeli intelligence warned that it believed Iran was preparing a major strike against Israel.

The US responded by ordering a carrier strike group steaming towards the Middle East to “accelerate its transit”, and said a guided-missile submarine was already in that theater. Gold would achieve four more nominal record closes in subsequent weeks, for six total in summer 2024 as of midweek. Those mostly came on mounting Fed-rate-cut odds, which were usually driven by weaker economic data or Fedspeak.

Gold’s primary short-term driver is speculators’ gold-futures trading. That has an outsized impact on gold prices due to the extreme leverage inherent in it. Each contract controls 100 ounces of gold, which at $2,500 are worth $250,000. Yet those traders are only required to keep $10,500 cash margins in their accounts for each contract traded. That enables maximum leverage of 23.8x today, and is often even higher.

That means each dollar deployed in gold futures can have up to 24x the price impact on gold as a dollar invested outright. At maximum leverage, a mere 4.2% gold move against specs’ bets wipes out 100% of their capital risked. That forces these guys to be ultra-myopic, with trading time horizons measured in days or weeks. They watch the US dollar’s fortunes as their main trading cue, which trade on Fed odds.

Exiting May, futures-implied 2024 Fed-rate-cut expectations were merely running 36 basis points. They rose steadily this summer on weaker-than-expected major US economic data, then soared to 140bp at peak fear during early August’s Japanese stock-market crash. This week they are still running 104bp, forecasting fully four 25bp rate cuts at the FOMC’s three remaining 2024 meetings starting mid-September.

A big part of gold’s defiance this summer is rallying on balance despite specs’ gold-futures positioning largely staying bearish. Speculators trade gold futures on both the long and short sides, with each having trading ranges in recent years. Spec longs’ upper resistance runs around 415k contracts, while shorts’ lower support has been near 95k. Entering summer 2024, there was no room for gold buying in the latter.

In May’s final trading week, total spec shorts of 77.3k were well under secular support. So gold wouldn’t see any meaningful gold-futures short-covering buying to buoy it. Meanwhile total spec longs were nearing the higher side at 338.3k contracts. For reference when today’s mighty gold upleg was born back in early October, total spec longs and shorts ran 264.8k and 174.4k for massive room for buying on both sides.

Total spec shorts indeed drifted higher in recent months, renewed shorting pushing them to 94.4k in late July. They remained at 92.0k in the latest weekly CoT report, still under support. But total spec longs did climb considerably in recent months, explaining some of gold’s strong summer advance. They surged to 403.6k in mid-July, retreated, and then soared again to 408.5k as of last Tuesday. That’s getting really high.

While total spec longs can briefly surge above their 415k upper resistance when herd greed gets frenzied, those lofty heights never last long. Despite challenging those top-of-trading-range levels five CoT weeks ago, gold has still carved five new nominal record closes since. This is defiant too, since really-high spec longs usually portend sharp selloffs. Yet gold has soldiered on higher despite increasingly-tapped-out specs.

Especially in the second half of summer 2024, speculators’ overall gold-futures positioning left high odds of fueling a sizable gold selloff. That would’ve been driven by specs dumping longs and adding shorts to start normalizing their lopsided gold-bullish bets. Yet they haven’t done that, perhaps realizing that the imminent Fed-rate-cut cycle is quite bearish for the US dollar’s fortunes and thus similarly bullish for gold.

Gold’s defiance in the face of bearish gold-futures positioning in recent months is more impressive when considering where gold was entering this summer. Gold tends to trade in a range relative to its underlying 200-day moving average. The distance gold stretches above its 200dma reveals overboughtness, when gold has likely rallied too far too fast to be sustainable. Extreme overboughtness was hit in both April and May.

That threshold is crossed when gold soars more than 15% above that key technical baseline. In mid-April when gold first blasted up to $2,388, it was stretched a whopping 18.8% above its 200dma. That was a 3.7-year high in overboughtness, extreme levels last seen in August 2020. That was when a monster gold upleg peaked before rolling over into a major 18.5% correction. Extreme overboughtness is very bearish.

Again later in mid-May heading into this summer, gold surged to another nominal record of $2,424 which was 17.8% above its 200dma. That moderated to a still-very-high 12.2% over on May’s final trading day. But for all intents and purposes gold entered summer 2024 extremely-overbought, screaming for a sizable selloff to rebalance technicals and sentiment. One started growing early on, but proved very-short-lived.

Usually the first Friday every month starts with the most-important economic data to move markets including gold, the monthly US-jobs reports. Back in early June, there was a massive four-standard-deviation beat with the Biden Administration claiming 272k jobs created in May compared to forecasts of +190k. That slammed 2024 expected Fed rate cuts to 37bp, and gold plummeted a whopping 3.6% to $2,286.

That was its worst daily loss in 3.6 years, proving its summer nadir. Yet gold’s total pullback since its latest mid-May record close only ran 5.7%. That was quite mild spawning from record-high extremely-overbought conditions. Given that setup including spec gold-futures positioning, gold could’ve easily neared a 10% correction mid-summer. But it didn’t, quickly bouncing back and recovering in a show of defiance.

Still gold’s most-defiant act of all this summer came on an entirely-different front. Along with specs’ hyper-leveraged gold-futures trading, gold’s other primary driver is American stock investors trading shares of the world-dominant GLD (NYSE:GLD) and IAU gold ETFs. Big differential GLD+IAU share buying has fueled gold’s mightiest uplegs. Without those capital inflows, odds are stacked against gold seeing outsized summer gains.

Yet from the end of May to midweek, GLD+IAU holdings have only edged up 0.7% through summer 2024. That’s next to nothing, a rounding error. Gold managed to rally 7.7% so far this summer, achieving six record highs and its fifth-best summer in modern times, despite American stock investors still ignoring it. They’ve been enamored with the euphoric chronically-overbought dangerously-overvalued AI stock bubble.

Apathetic or oblivious American stock investors have plagued gold’s entire upleg. It has already powered up a massive 38.7% at best since early October, nearing 40%+ monster status. Yet during that exact span, GLD+IAU holdings actually fell 4.4% or 55.8 metric tons. This is wildly unprecedented since gold ETFs grew popular over the last couple decades. Previous similar gold uplegs were driven by big ETF buying.

Gold’s last two record-achieving ones both crested in 2020, at monster 42.7% and 40.0% gains. Those were mostly fueled by utterly-enormous GLD+IAU holdings builds, 30.4% or 314.2t during the first and an epic 460.5t or 35.3% in the second. American stock investors will inevitably start chasing gold’s current record-breaking upleg sooner or later, driving gold way higher as GLD+IAU holdings shift from -50t to +400t.

So gold’s latest summer has proven remarkably defiant, smashing the odds. Gold powered higher on balance despite exiting May after just being extremely-overbought. Gold rallied in June, July, and August despite mostly-bearish spec gold-futures positioning. And gold had one of its best modern summers ever with American stock investors doing no material GLD+IAU-share buying. All of this is darned impressive.

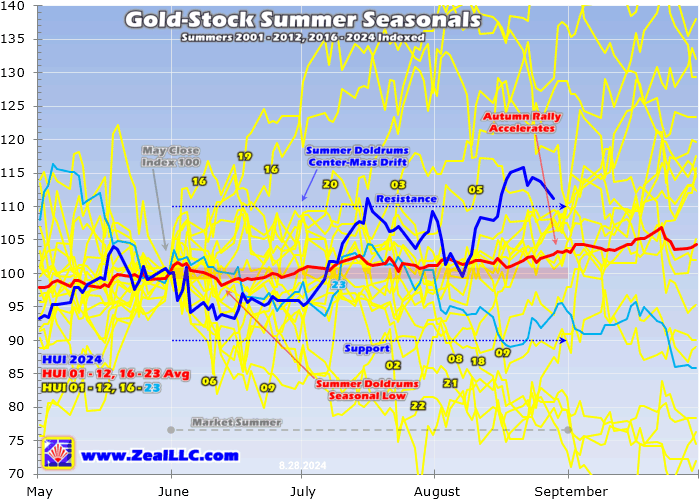

With gold so defiantly strong, its miners’ stocks have fared pretty well too. This chart applies this same summer-seasonals methodology to the classic HUI gold-stock index. Using it is necessary in this research, since the similar GDX (NYSE:GDX) wasn’t birthed until well into this seasonality study. But GDX and the HUI closely track each other, and are functionally interchangeable with most of the same main component stocks.

While not as exceptional as gold’s, the major gold stocks are still enjoying a strong summer. This year has also seen gold stocks’ fifth-best summer performance over the past quarter-century. GDX is up 8.7% summer-to-date, and peaked up 12.7% last week. While solid, those summer-2024 gains only make for 1.5x upside leverage to gold at best. Typically the major gold stocks amplify material gold moves by 2x to 3x.

And that’s where gold’s defiant-summer opportunities still lie. A problem during this entire gold upleg, the miners’ stocks continue to really lag gold. GDX has rallied 53.5% at best since early October, for mere 1.4x upside leverage to gold. During those last two similar monster gold uplegs cresting in 2020, GDX averaged 105.4% gains for 2.5x. So gold stocks have lots of catch-up rallying left to do, which is coming.

Before this near-monster gold upleg gives up its ghost, the major gold stocks will almost certainly amplify it by 2x to 3x. Even if gold didn’t head much higher, that argues for total GDX gains of 77% to 116% for a $46-to-$56 GDX target range. That’s another 20% to 46% higher from mid-week levels, worth riding. And gold’s upleg is likely to power considerably higher, which proportionally boosts gold stocks’ upside potential.

Gold’s remarkable summer defiance was partially fueled by major buying from both Chinese investors and world central banks, which have done much of gold’s heavy lifting for much of this upleg. The latest gold fundamental data as of the end of June shows both groups still buying big. There’s no reason to expect that not to continue, especially as the coming Fed rate cuts further erode the US dollar’s fortunes.

Eventually gold will have finally rallied high enough for long enough to reappear on the radars of American stock investors. They’ll hear about all the records and want to start chasing gold’s upside, rushing in and accelerating it like during past record-breaking monster uplegs. That shift back into gold will be bolstered by the AI stock bubble rolling over and bursting, that euphoric anomaly is really long-in-the-tooth.

With all that coming, gold stocks are nearing a crucial psychological tipping point where traders flock back to them. As this small high-potential sector regains popularity, its gains become self-feeding. And having just reported their fattest earnings on record, gold stocks are incredibly attractive fundamentally. Their latest upleg has likely only seen half its ultimate gains so far, and even less if gold continues climbing on balance.

The bottom line is gold just enjoyed its most-defiant summer in memory. Gold rallied on balance in one of its best summers in the past quarter-century despite odds being stacked against it. Gold was extremely-overbought entering summer 2024, speculators’ gold-futures positioning was mostly bearish during recent months, and American stock investors enthralled by the euphoric AI stock bubble continued to ignore gold.

Gold’s defiance is a bullish omen for more gains in this monster upleg. The Chinese investors and world central banks helping fuel gold’s strong summer are still buying. And they are likely to keep buying with Fed rate cuts further eroding the US dollar. As gold’s gains mount and more nominal records are achieved in coming months, interest in and capital inflows into gold stocks will surge likely doubling their gains.