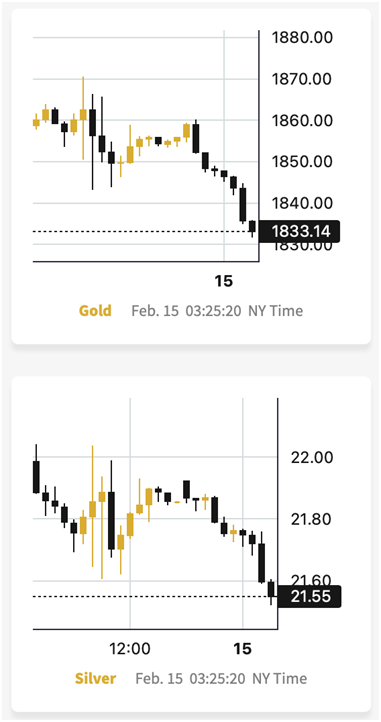

Gold stocks and silver are sliding to new 2023 lows, and gold (after closing 2022 at $1,826.20) is catching up. Will it cancel its entire 2023 rally?

In all likelihood – yes. Then it’s likely to slide more – much more. With this pace (chart courtesy of GoldPriceForecast.com), gold could move below $1,800 in no time.

But why would it decline at all? Isn’t the war in Europe a reason for gold to rally? Isn’t inflation declining so the Fed can lower rates and thus cause gold to rally?

No – it’s not that simple.

First, gold already rallied due to the Russian invasion – whatever was likely to happen based on that news already happened. Interestingly, gold already gave away all those war-tension-based gains and then declined more (in the following months of 2022).

So, no, neither this nor other geopolitical events are likely to make a gold rally in a sustainable manner. In fact, geopolitical events tend to cause only temporary safe-haven rallies in the gold price – which we saw last year.

Second, gold’s link with inflation is not that clear. Gold does rally in hyperinflationary scenarios, and it tends to perform well in stagflation. However, in cases of moderate to low inflation, it doesn’t necessarily rally.

In REALity (pun intended), it’s all about real interest rates, not either inflation on its own or nominal interest rates on their own.

Putting fancy economic terms aside, it all comes down to whether one can easily gain extra income by lending out capital at interest or whether this action would make one lose money anyway.

In other words, will the gains (interest) be bigger than the losses due to the declining value of money (inflation)? If the interest is bigger than inflation, “it’s all good.”

If the inflation is greater than the interest, then people can expect to lose money (its value) even if they are lending it out to someone else. That’s what they want to be protected against, for example, by buying gold, which is known to have served as money for thousands of years.

The difference between nominal interest rates and the (expected) inflation rate is the real interest rate. The higher it is and the higher it moves, the less and less appealing gold ownership becomes.

In contrast, as real interest rates fall, gold ownership becomes increasingly appealing. Does it really work?

You bet!

The United States 10-Year real interest rate had been declining for years, just as gold was soaring. And as the rate bottomed in mid-2012, gold plunged.

Please note that this isn’t a precise technical tool that would allow for making short-term forecasts. The rate bottomed in mid-2012, and that wasn’t the final top in gold.

The final top in gold was formed one year before, but what formed in mid-2012 was the final “good-bye top” before the huge decline started.

When did we see another real-rate bottom and even an attempt to move well below the previous low? In mid-2020. This time, the link was quite precise, as that’s exactly when gold topped, too.

Now, the real rates are up after a sizable rally, and they are at their highest levels in over a decade. Gold didn’t decline to its decade-plus low. Is something wrong with the above line of thought?

Not necessarily. Please note that back in 2011 and 2012, gold had approximately a year-long (!) delay in reacting to the fact that there was a bottom.

Back in 2012, gold still moved higher, but it wasn’t able to show the same kind of strength as before the 2011 top. This is exactly what we saw recently during the short-term corrective upswing.

Gold’s delay is significant, but reality will catch up soon. Probably very soon, because the delay is already huge. The most extreme aspect of the preceding is that real rates are unlikely to have peaked. Far from it.

I don’t want to go into details today, but in essence, to effectively combat inflation, the nominal rates would need to overshoot the CPI year-over-year change. The difference between them is about 2% right now.

Let’s recall real rates – the difference between nominal rates and (expected) inflation. The CPI will serve as a proxy for expected inflation here (it’s not perfect, I know, but it’s good enough).

As a result, if the Fed is serious about combating inflation (and it is, because inflation has become political! ), real interest rates are likely to rise by at least 2% from their current levels.

And it doesn’t really matter if it happens through higher nominal interest rates or through a lower CPI. Both will probably take place.

Consequently, gold is likely to decline profoundly based on its reaction to what has already happened in real interest rates but also to slide because of the upcoming increase in real interest rates.

Yes, the situation really is extremely bearish (and profitable for those who position themselves correctly – all big shifts create big opportunities), and yes, most people choose to ignore it (and most people will not make profits as the situation unfolds).

Why? Because markets (=people) are emotional rather than logical in the short and medium term. That’s one of the reasons why we have those disparities between what should be taking place on the markets and what is really happening.

But as time passes, the reality is likely to kick in. Based on today’s slide, it seems that the “kick” is already working.