Gold's recent surge above $1,760 shattered the bearish engulfing candle signal and triggered our buy signal, targeting levels at $1,775/$1,777, $1,785/$1,786, and ultimately $1,789/$1,790. As anticipated, the price reached an all-time high of exactly $1,790 right before the Non-Farm Payroll (NFP) report.

However, the excitement quickly turned into concern as prices unexpectedly plummeted through our buying opportunity at $1,774/$1,771, stopping out long positions below $1,767. In my update yesterday, I noted that gold could face resistance between $1,744/$1,748, suggesting that shorts should set their stops above $1,754. A breakout above $1,754 could target $1,760 and possibly push as high as strong resistance at $1,765/$1,770, while shorts here should have stops above $1,775.

On the downside, a drop below $1,730 meets support at $1,718/$1,714, where long positions need to set stops below $1,708. If we see a break below $1,708, the next targets will be $1,698/$1,695 and then $1,685/$1,680.

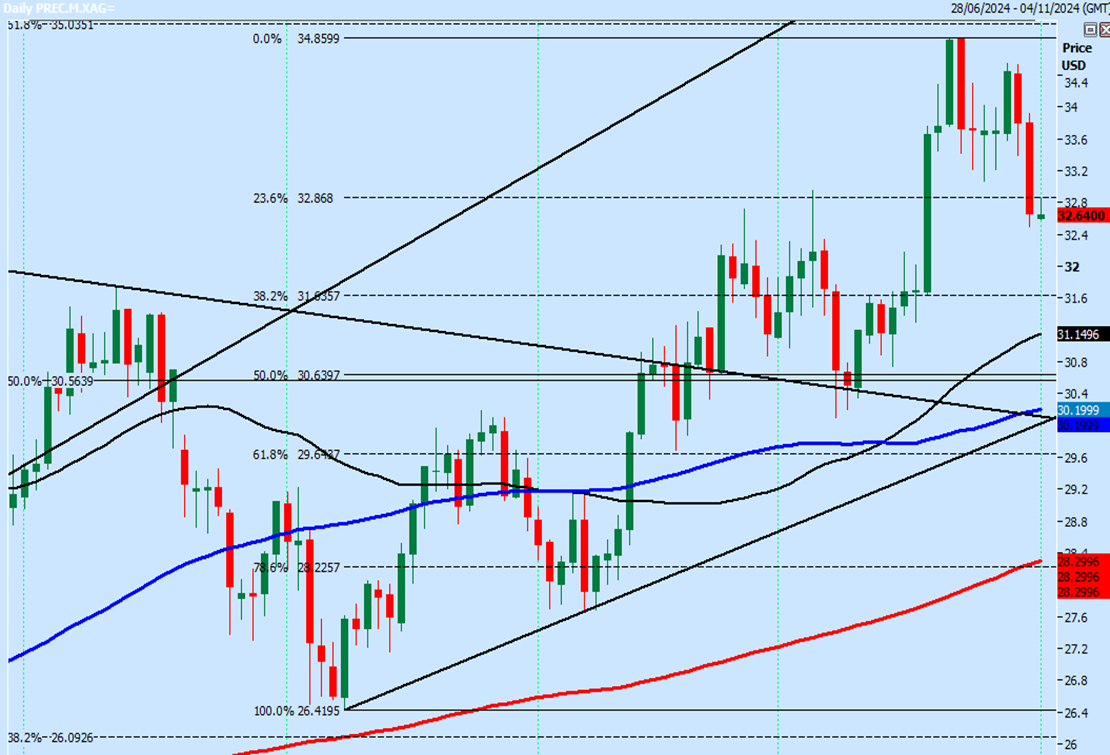

Silver's Struggles Continue

Silver (XAG/USD) recently broke through its first support level at $3,380/$3,370, with long positions stopping out below $3,355. Traders should target levels at $3,233/$3,238 and potentially down to $3,180/$3,160. Resistance now lies between $3,280/$3,300, with shorts needing stops above $3,310. If the market breaks above $3,310, we could see a move targeting $3,050/$3,070.

WTI Crude Sees Gap Close and Potential Resistance Ahead

In the last session, WTI crude for the December contract posted a low of $68.30 and a high of $70.80. WTI crude broke above $69.25 yesterday, triggering a gap close and targeting $69.90 and then $70.80, as we predicted.

Strong resistance now sits at $70.80/$71.10, where traders may find a selling opportunity. However, shorts should protect against upward movements with stops above $71.50. Targets for this trade include $70.10, $69.50, and potentially as low as $68.90/$68.80. If the price continues to decline, keep an eye on $68.20/$68.10.

Finally, be aware that a break above $71.50 could push prices toward $71.90/$72.20.