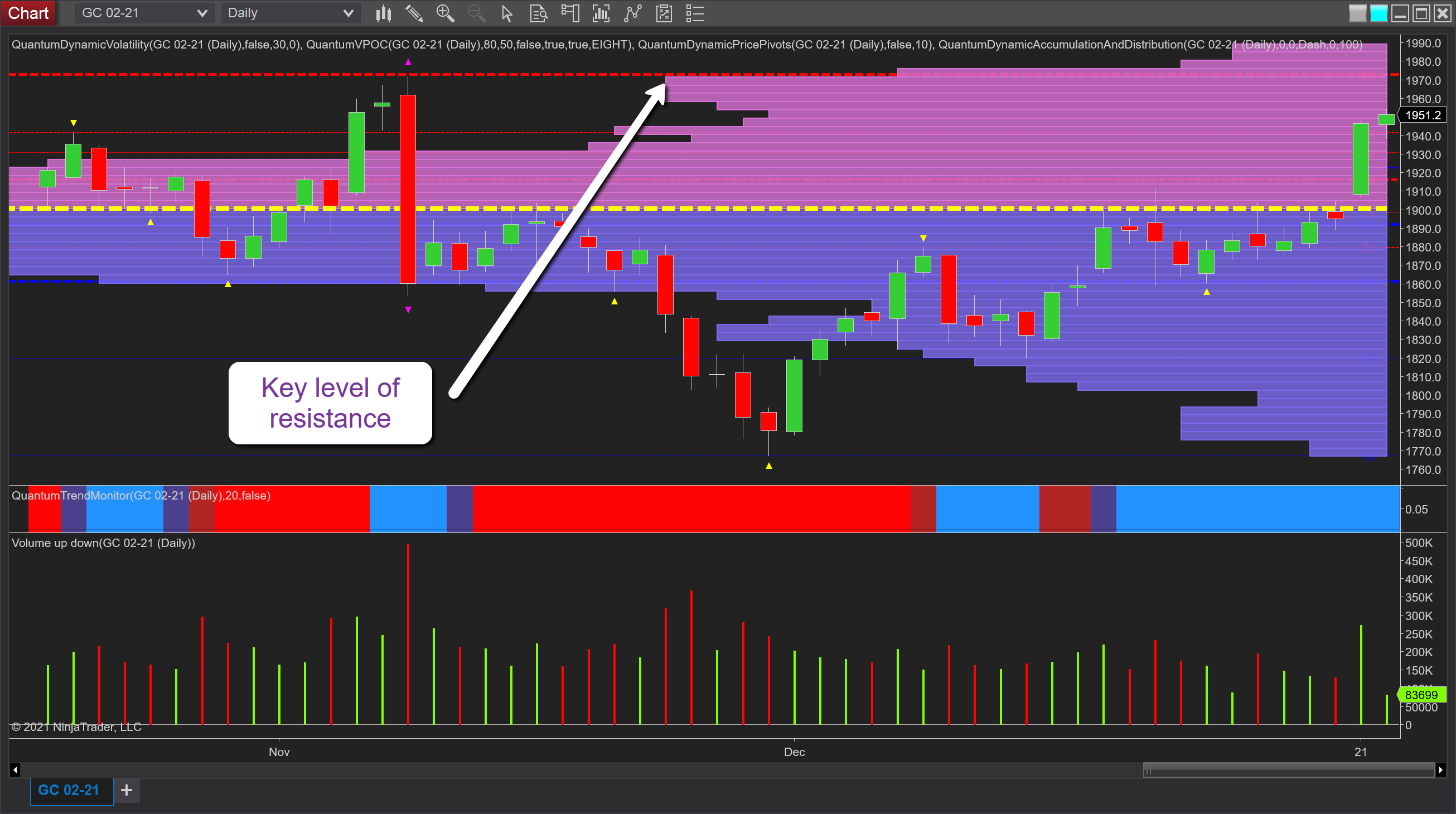

It’s been a lively start to the new trading year, with the battle for the Senate top of the list in the U.S. closely followed by the pandemic, which continues to maintain its iron grip on the headlines and populations, with the UK plunged into a level-five lockdown for several weeks as a new and more pervasive strain takes hold. But as always there are winners and losers, and one such is gold, which has started 2021 in explosive form, and benefitting from yesterday’s plunge in U.S. equities. It closed out the session with a wide spread-up candle on excellent volume and breaking away from the volume point of control, which was approached at the end of last year. Note: the trend monitor indicator for NinjaTrader has maintained its bullish perspective since the buyers arrived at the end of November.

Yesterday’s price action saw the precious metal close at $1,946 per ounce, with early trading today continuing to maintain the bullish tone and trading at $1,952 per ounce at the time of writing as worries over the outcome of the voting in Georgia continues to weigh on risk markets.

Looking ahead, the key level for gold on the horizon is the resistance level at $1,972 per ounce denoted with the red dashed line of the accumulation and distribution indicator and one which capped the rally of early November. But if this is breached, gold looks set to regain the $2,000 per ounce handle and beyond, and from there to move beyond the $2,100 per ounce level, which proved to be a bridge too far in 2020. Will see it breached in 2021?